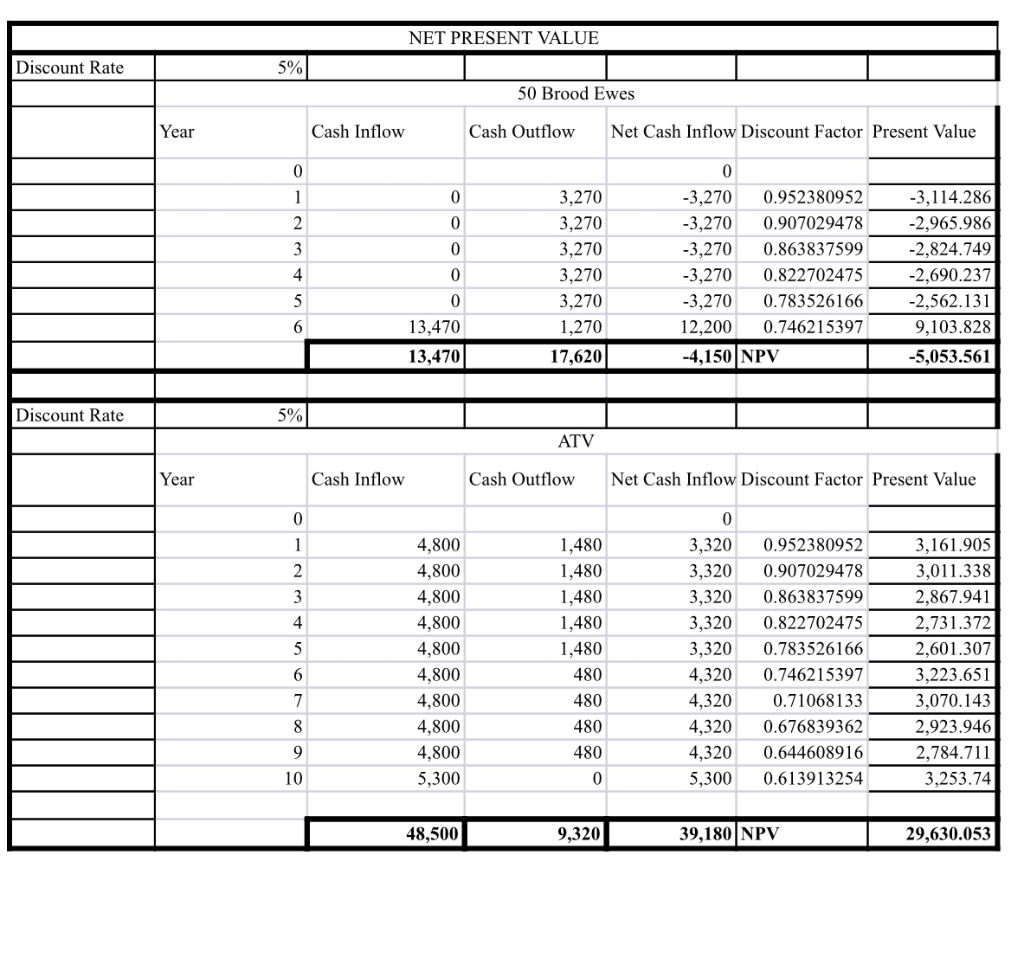

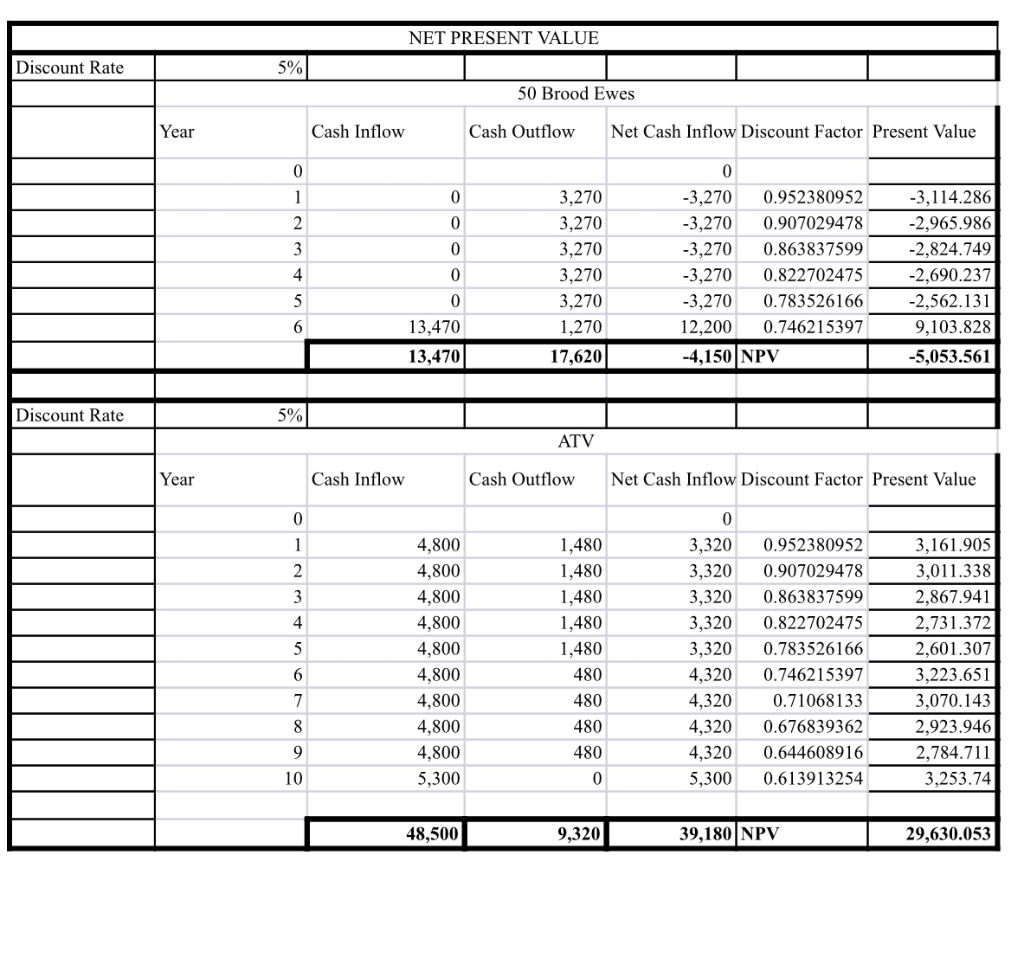

Question: NET PRESENT VALUE Discount Rate 5% 50 Brood Ewes Year Cash Inflow Cash Outflow Net Cash Inflow Discount Factor Present Value 0 0 1 2

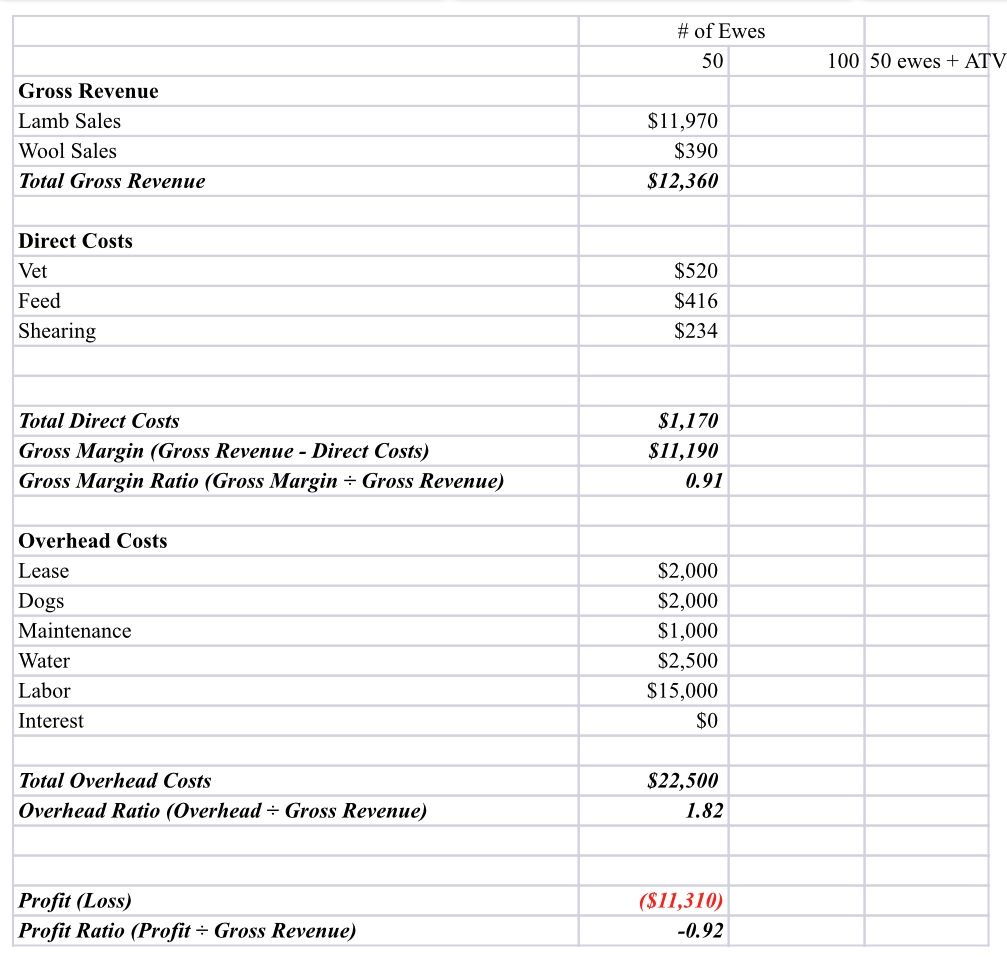

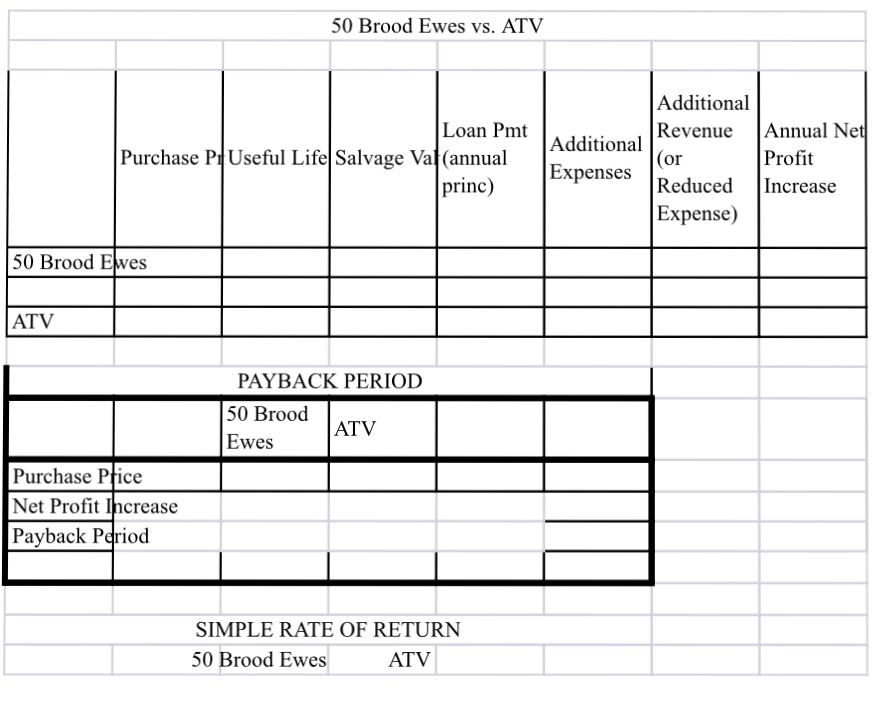

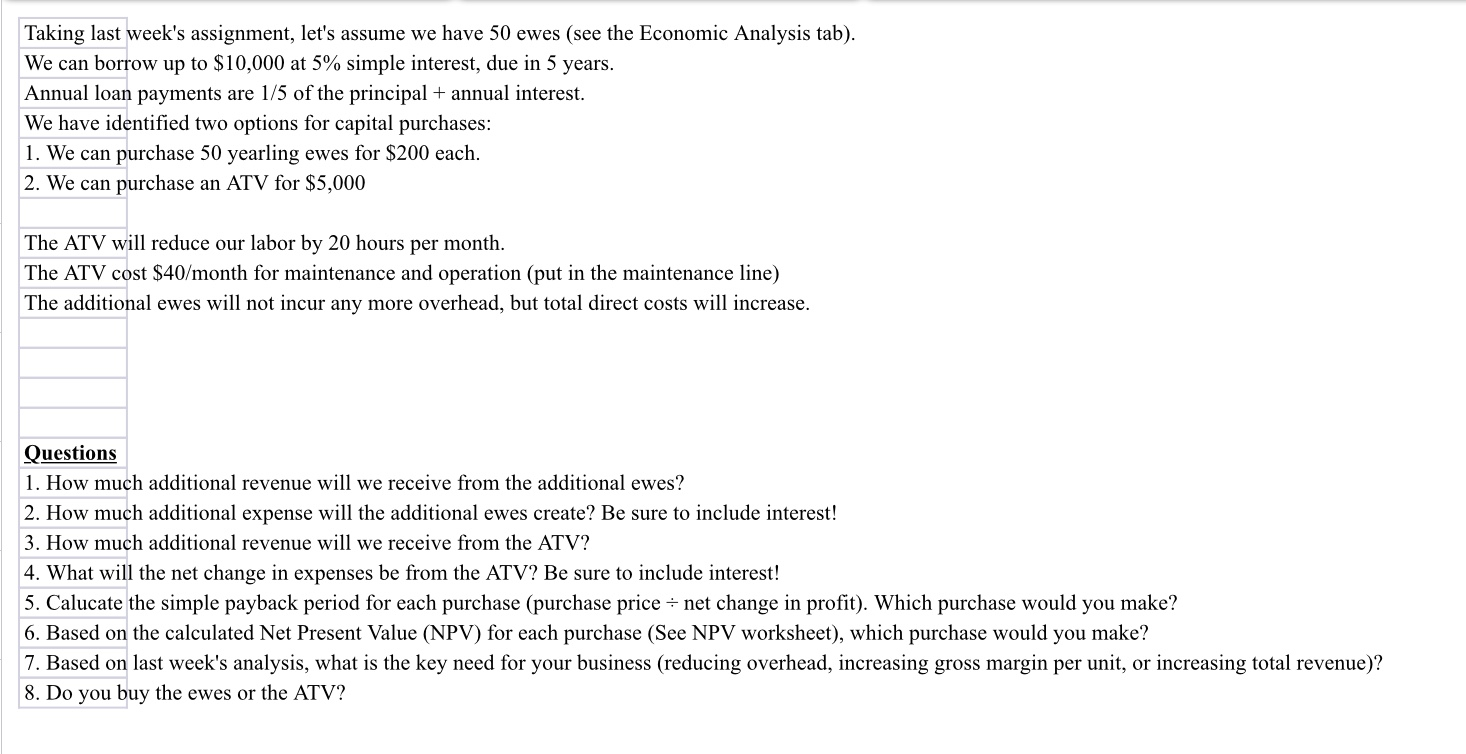

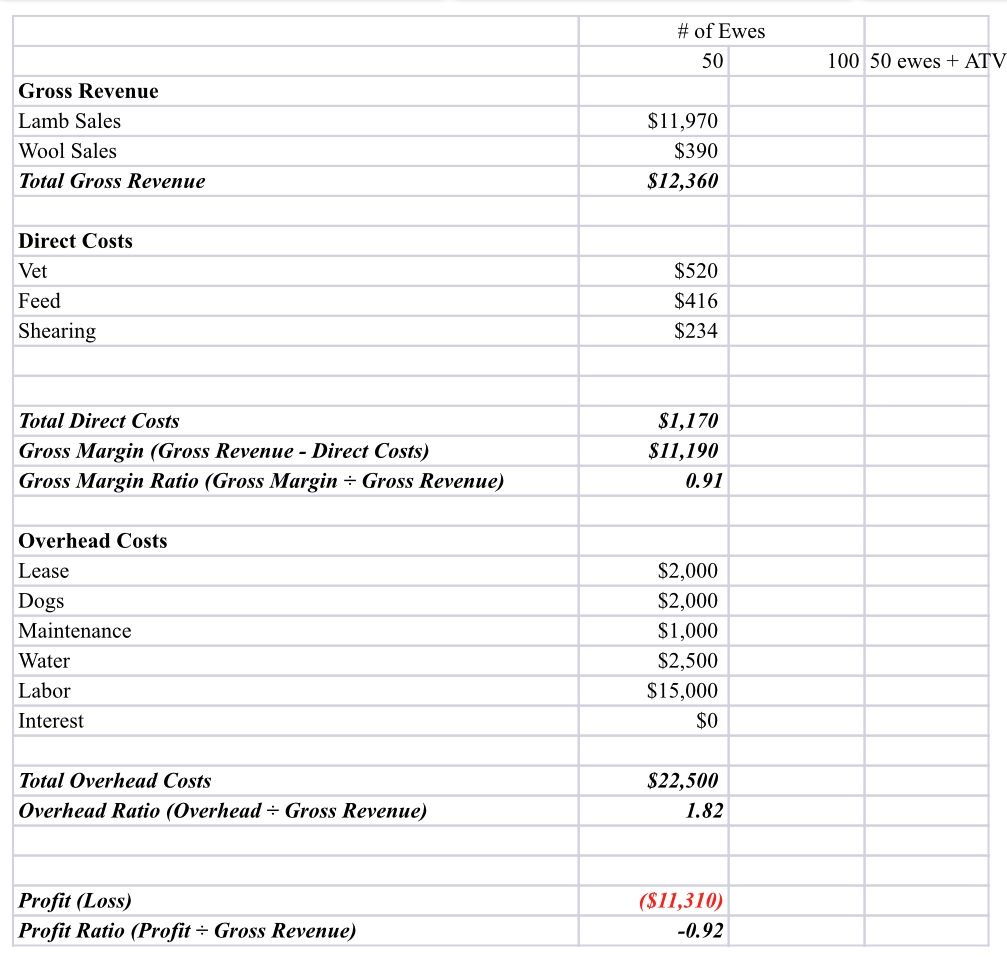

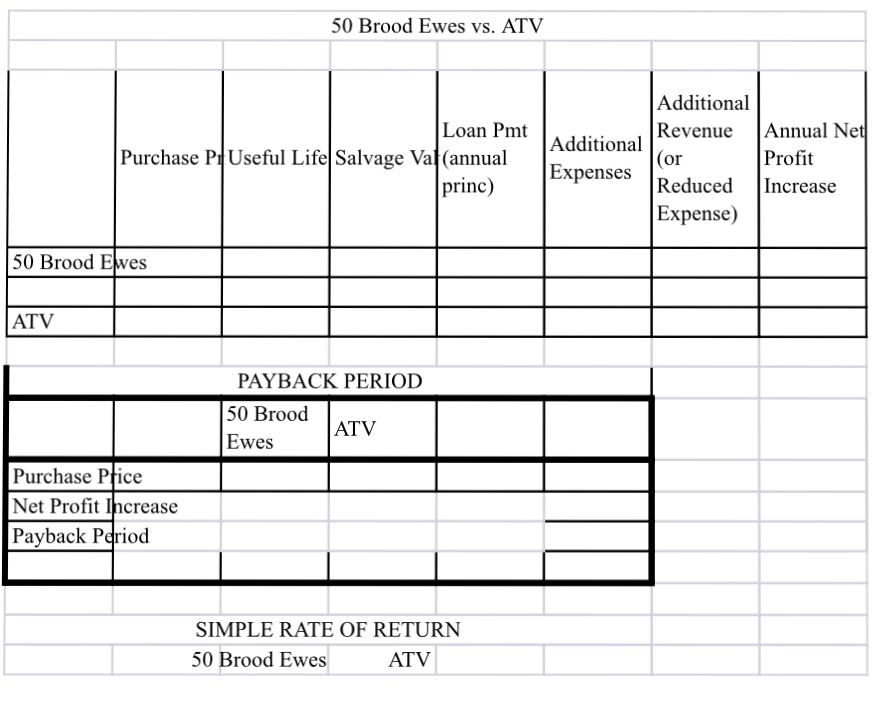

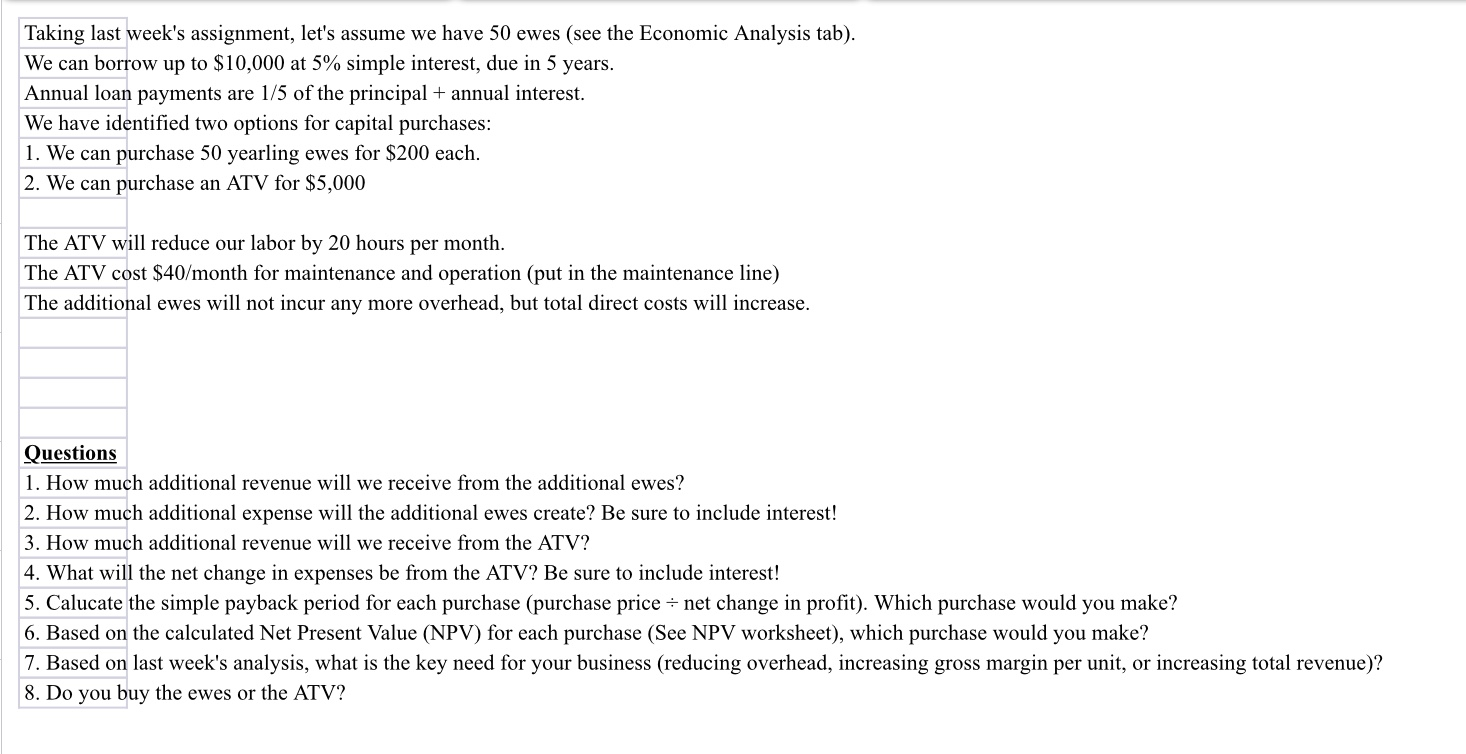

NET PRESENT VALUE Discount Rate 5% 50 Brood Ewes Year Cash Inflow Cash Outflow Net Cash Inflow Discount Factor Present Value 0 0 1 2 3 0 0 0 -3,270 0.952380952 -3,270 0.907029478 -3,270 0.863837599 -3,270 0.822702475 -3,270 0.783526166 12,200 0.746215397 -4,150 NPV 4 3,270 3,270 3,270 3,270 3,270 1,270 17,620 0 -3,114.286 -2,965.986 -2,824.749 -2,690.237 -2,562.131 9,103.828 -5,053.561 5 0 6 13,470 13,470 Discount Rate 5% ATV Year Cash Inflow Cash Outflow Net Cash Inflow Discount Factor Present Value 0 1 2 3 1,480 1,480 1,480 1,480 1,480 480 4 4,800 4,800 4,800 4,800 4,800 4,800 4,800 4,800 4,800 5,300 5 0 3,320 3,320 3,320 3,320 3,320 4,320 4,320 4,320 4,320 5,300 0.952380952 0.907029478 0.863837599 0.822702475 0.783526166 0.746215397 0.71068133 0.676839362 0.644608916 0.613913254 3,161.905 3,011.338 2,867.941 2,731.372 2,601.307 3,223.651 3,070.143 2,923.946 2,784.711 3,253.74 6 7 8 480 480 480 9 10 0 48,500 9,320 39,180 NPV 29,630.053 # of Ewes 50 100 50 ewes + ATV Gross Revenue Lamb Sales Wool Sales Total Gross Revenue $11,970 $390 $12,360 $520 Direct Costs Vet Feed Shearing $416 $234 Total Direct Costs Gross Margin (Gross Revenue - Direct Costs) Gross Margin Ratio (Gross Margin = Gross Revenue) $1,170 $11,190 0.91 Overhead Costs Lease Dogs Maintenance Water Labor Interest $2,000 $2,000 $1,000 $2,500 $15,000 $0 Total Overhead Costs Overhead Ratio (Overhead = Gross Revenue) $22,500 1.82 Profit (Loss) Profit Ratio (Profit - Gross Revenue) ($11,310) -0.92 50 Brood Ewes vs. ATV Loan Pmt Purchase P.Useful Life Salvage Val(annual princ) Additional Revenue Additional (or Expenses Reduced Expense) Annual Net Profit Increase 50 Brood Ewes ATV PAYBACK PERIOD 50 Brood ATV Ewes Purchase Pfice Net Profit Increase Payback Period SIMPLE RATE OF RETURN 50 Brood Ewes ATV Taking last week's assignment, let's assume we have 50 ewes (see the Economic Analysis tab). We can borrow up to $10,000 at 5% simple interest, due in 5 years. Annual loan payments are 1/5 of the principal + annual interest. We have identified two options for capital purchases: 1. We can purchase 50 yearling ewes for $200 each. 2. We can purchase an ATV for $5,000 The ATV will reduce our labor by 20 hours per month. The ATV cost $40/month for maintenance and operation (put in the maintenance line) The additional ewes will not incur any more overhead, but total direct costs will increase. Questions 1. How much additional revenue will we receive from the additional ewes? 2. How much additional expense will the additional ewes create? Be sure to include interest! 3. How much additional revenue will we receive from the ATV? 4. What will the net change in expenses be from the ATV? Be sure to include interest! 5. Calucate the simple payback period for each purchase (purchase price = net change in profit). Which purchase would you make? 6. Based on the calculated Net Present Value (NPV) for each purchase (See NPV worksheet), which purchase would you make? 7. Based on last week's analysis, what is the key need for your business (reducing overhead, increasing gross margin per unit, or increasing total revenue)? 8. Do you buy the ewes or the ATV? NET PRESENT VALUE Discount Rate 5% 50 Brood Ewes Year Cash Inflow Cash Outflow Net Cash Inflow Discount Factor Present Value 0 0 1 2 3 0 0 0 -3,270 0.952380952 -3,270 0.907029478 -3,270 0.863837599 -3,270 0.822702475 -3,270 0.783526166 12,200 0.746215397 -4,150 NPV 4 3,270 3,270 3,270 3,270 3,270 1,270 17,620 0 -3,114.286 -2,965.986 -2,824.749 -2,690.237 -2,562.131 9,103.828 -5,053.561 5 0 6 13,470 13,470 Discount Rate 5% ATV Year Cash Inflow Cash Outflow Net Cash Inflow Discount Factor Present Value 0 1 2 3 1,480 1,480 1,480 1,480 1,480 480 4 4,800 4,800 4,800 4,800 4,800 4,800 4,800 4,800 4,800 5,300 5 0 3,320 3,320 3,320 3,320 3,320 4,320 4,320 4,320 4,320 5,300 0.952380952 0.907029478 0.863837599 0.822702475 0.783526166 0.746215397 0.71068133 0.676839362 0.644608916 0.613913254 3,161.905 3,011.338 2,867.941 2,731.372 2,601.307 3,223.651 3,070.143 2,923.946 2,784.711 3,253.74 6 7 8 480 480 480 9 10 0 48,500 9,320 39,180 NPV 29,630.053 # of Ewes 50 100 50 ewes + ATV Gross Revenue Lamb Sales Wool Sales Total Gross Revenue $11,970 $390 $12,360 $520 Direct Costs Vet Feed Shearing $416 $234 Total Direct Costs Gross Margin (Gross Revenue - Direct Costs) Gross Margin Ratio (Gross Margin = Gross Revenue) $1,170 $11,190 0.91 Overhead Costs Lease Dogs Maintenance Water Labor Interest $2,000 $2,000 $1,000 $2,500 $15,000 $0 Total Overhead Costs Overhead Ratio (Overhead = Gross Revenue) $22,500 1.82 Profit (Loss) Profit Ratio (Profit - Gross Revenue) ($11,310) -0.92 50 Brood Ewes vs. ATV Loan Pmt Purchase P.Useful Life Salvage Val(annual princ) Additional Revenue Additional (or Expenses Reduced Expense) Annual Net Profit Increase 50 Brood Ewes ATV PAYBACK PERIOD 50 Brood ATV Ewes Purchase Pfice Net Profit Increase Payback Period SIMPLE RATE OF RETURN 50 Brood Ewes ATV Taking last week's assignment, let's assume we have 50 ewes (see the Economic Analysis tab). We can borrow up to $10,000 at 5% simple interest, due in 5 years. Annual loan payments are 1/5 of the principal + annual interest. We have identified two options for capital purchases: 1. We can purchase 50 yearling ewes for $200 each. 2. We can purchase an ATV for $5,000 The ATV will reduce our labor by 20 hours per month. The ATV cost $40/month for maintenance and operation (put in the maintenance line) The additional ewes will not incur any more overhead, but total direct costs will increase. Questions 1. How much additional revenue will we receive from the additional ewes? 2. How much additional expense will the additional ewes create? Be sure to include interest! 3. How much additional revenue will we receive from the ATV? 4. What will the net change in expenses be from the ATV? Be sure to include interest! 5. Calucate the simple payback period for each purchase (purchase price = net change in profit). Which purchase would you make? 6. Based on the calculated Net Present Value (NPV) for each purchase (See NPV worksheet), which purchase would you make? 7. Based on last week's analysis, what is the key need for your business (reducing overhead, increasing gross margin per unit, or increasing total revenue)? 8. Do you buy the ewes or the ATV