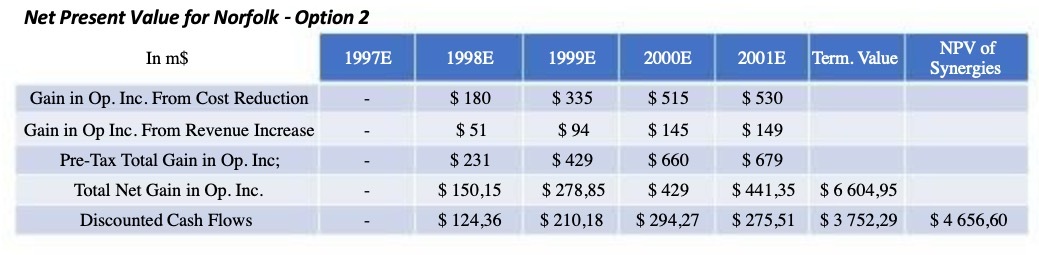

Question: Net Present Value for Norfolk - Option 2 In m$ 1997E 1998E 1999E 2000E 2001E Term. Value NPV of Synergies Gain in Op. Inc. From

Net Present Value for Norfolk - Option 2 In m$ 1997E 1998E 1999E 2000E 2001E Term.

Value NPV of Synergies Gain in Op. Inc.

From Cost Reduction $ 180 $ 335 $ 515 $ 530 Gain in Op Inc.

From Revenue Increase $ 51 $ 94 $ 145 $ 149

Pre-Tax Total Gain in Op. Inc; $ 231 $ 429 $ 660 $ 679

Total Net Gain in Op. Inc. $ 150,15 $ 278,85 $ 429 $ 441,35 $ 6 604,95

Discounted Cash Flows $ 124,36 $ 210,18 $ 294,27 $ 275,51 $ 3 752,29 $ 4 656,60

Additional comments: How did you get the values for Total Net Gain in Op. Inc?

Net Present Value for Norfolk - Option 2 In m$ Gain in Op. Inc. From Cost Reduction Gain in Op Inc. From Revenue Increase Pre-Tax Total Gain in Op. Inc; Total Net Gain in Op. Inc. Discounted Cash Flows 1997E 1998E 1999E 2000E 2001E Term. Value NPV of Synergies $ 180 $335 $515 $530 $ 51 $94 $ 145 $ 149 $231 $429 $ 660 $ 679 $ 150,15 $ 278,85 $429 $ 441,35 $6604,95 $ 124,36 $210,18 $294,27 $275,51 $3 752,29 $4656,60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts