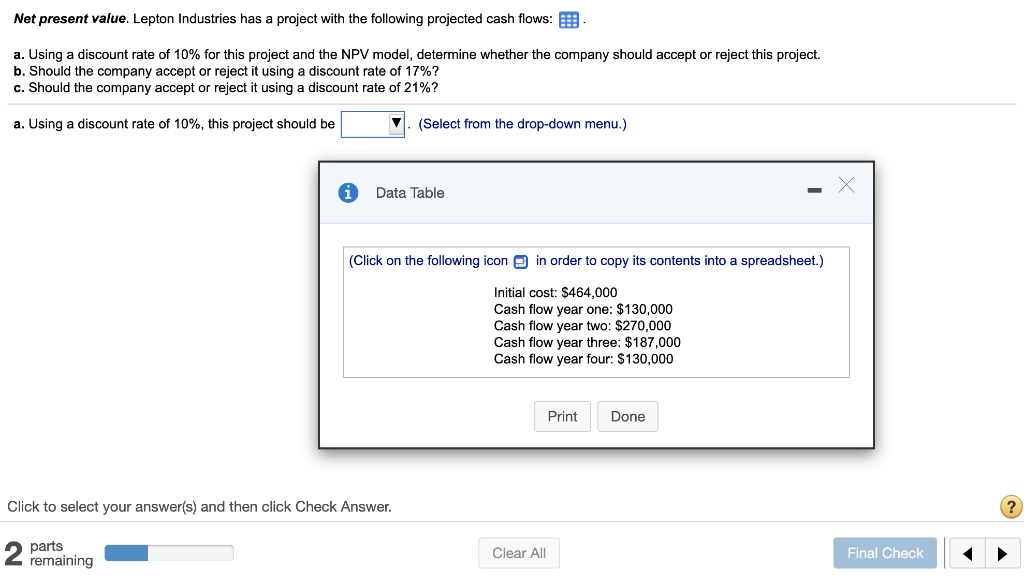

Question: Net present value. Lepton Industries has a project with the following projected cash flows: a. Using a discount rate of 10% for this project and

Net present value. Lepton Industries has a project with the following projected cash flows: a. Using a discount rate of 10% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 17%? c. Should the company accept or reject it using a discount rate of 21%? a. Using a discount rate of 10%, this project should be (Select from the drop-down menu.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Initial cost: $464,000 Cash flow year one: $130,000 Cash flow year two: $270,000 Cash flow year three: $187,000 Cash flow year four: $130,000 Print Done Click to select your answer(s) and then click Check Answer. ? 2 parts remaining Clear All Final Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts