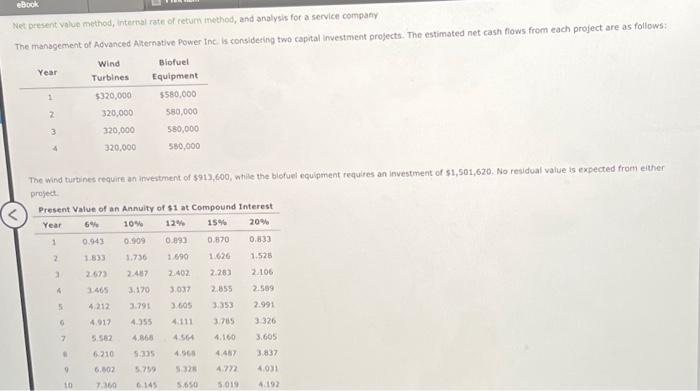

Question: Net present value method, internal rate of return inethod, and analysis for a service company. The managemient of Acvanced Alternative Power inc. is conslidering two

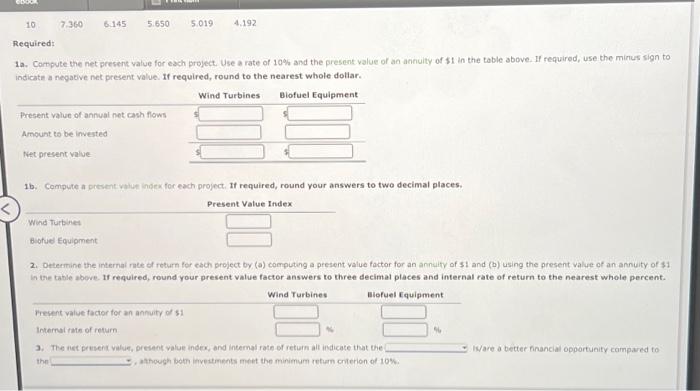

Net present value method, internal rate of return inethod, and analysis for a service company. The managemient of Acvanced Alternative Power inc. is conslidering two capital investment orojects. The estimated net cash flows from each project are as follows: The wind turtines require an invectment of $913,600, while the blofuel equipment requires an investment of 51,501,620. No residual value is expected from either project. 1a. Campute the net present value for each project. Use a rate of 10% and the present value of an annulty of $1 in the table above. If required, use the mirtus sign to indicate a negative net present value. If required, round to the nearest whole dollar. 1b. Compute an present vaiut ingex foc each project. If required, round your answers to two decimal places. 2. Determine the internai rate of return for each project by (a) computing a present value foctor for an annuity of s1 and (b) using the present value of an annuity of 31 in the table above. If required, round your present value factor answers to three decimal places and internal rate of return to the nearest whole percent. 3. The net present vilue, present value inder, ond internal rate of return alt indicate that the Isare a better financial opportunify compared to the , athough both inveitments met the minimum refum coterion of 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts