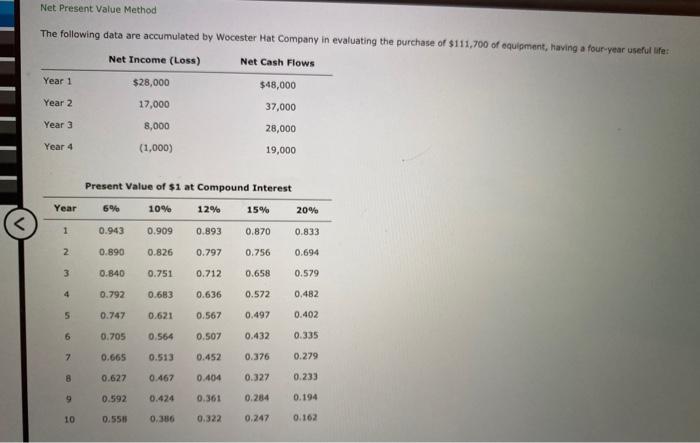

Question: Net Present Value Method The following data are accumulated by Wocester Hat Company in evaluating the purchase of $111,700 of equipment, having a four-year useful

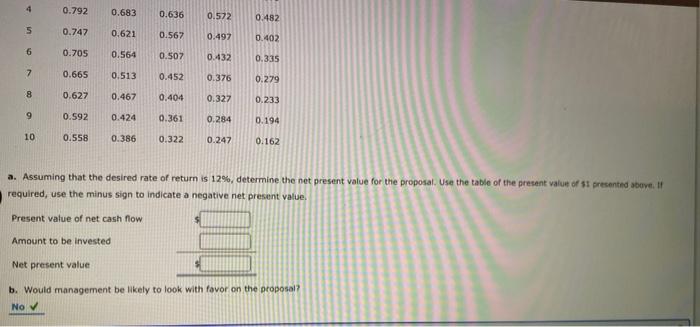

Net Present Value Method The following data are accumulated by Wocester Hat Company in evaluating the purchase of $111,700 of equipment, having a four-year useful life: Net Income (Loss) Net Cash Flows Year 1 $28,000 $48,000 17,000 37,000 Year 3 8,000 28,000 (1,000) 19,000 Year 2 Year 4 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.550 0.386 0.322 0.247 0.162 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 a. Assuming that the desired rate of return is 12%, determine the net present value for the proposal. Use the table of the present value of si presented above. If required, use the minus sign to indicate a negative net present value Present value of net cash flow Amount to be invested Net present value b. Would management be likely to look with favor on the proposal? No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts