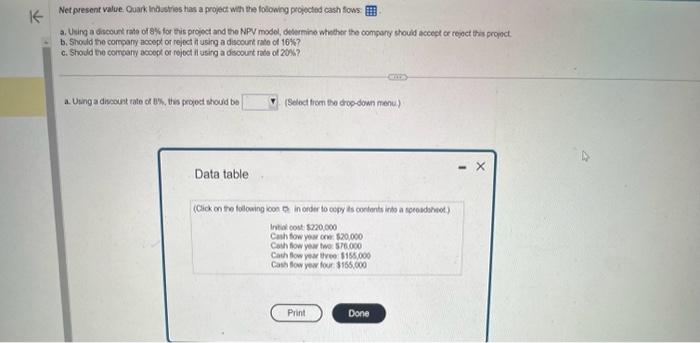

Question: Net present value, Quark Indistries has a project with the folowng projoctod cash fous: b. Should the corngary ncoept of reject it using a discourt

Net present value, Quark Indistries has a project with the folowng projoctod cash fous: b. Should the corngary ncoept of reject it using a discourt rabe of 16 \%,? c. Should the compary acoept of rojoct if using a discourt rads of 2 Wh? a. Using a dipount tate of B\%, this projot shouid be (Seloct ficen the droo-down menu) Data table (Cick on tre folowing kos D in onder to oopy is contents ints a socodohed) Intivi cost sin000 Cahisow you core 820000 Cah fow year two 576000 Cah fow year tree $155000 Cash Bow yew four $165,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts