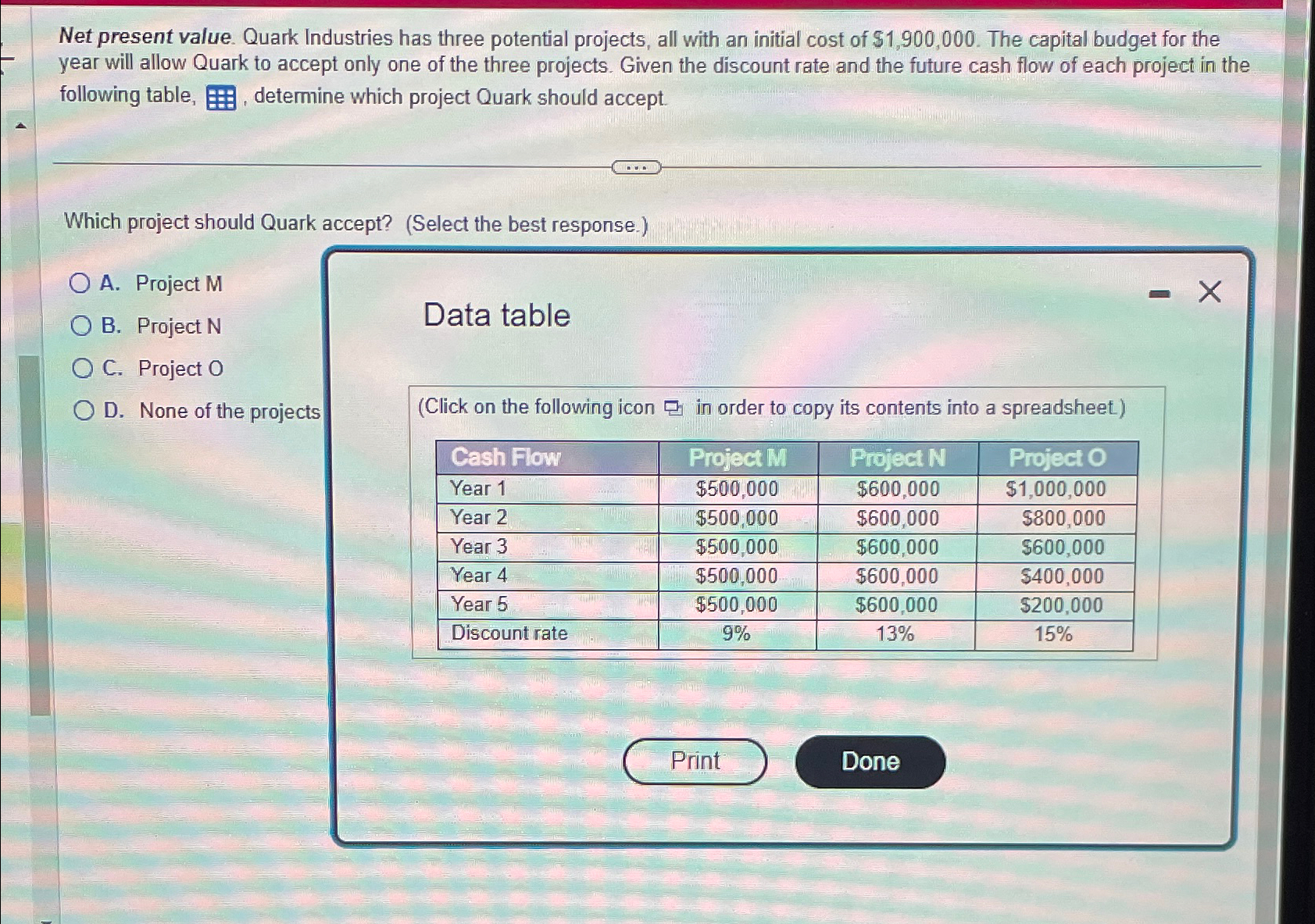

Question: Net present value. Quark Industries has three potential projects, all with an initial cost of $1,900,000. The capital budget for the year will allow

Net present value. Quark Industries has three potential projects, all with an initial cost of $1,900,000. The capital budget for the year will allow Quark to accept only one of the three projects. Given the discount rate and the future cash flow of each project in the following table, determine which project Quark should accept Which project should Quark accept? (Select the best response.) O A. Project M OB. Project N OC. Project O OD. None of the projects Data table (Click on the following icon in order to copy its contents into a spreadsheet) Cash Flow Project M Project N Year 1 $500,000 $600,000 Project O $1,000,000 Year 2 $500,000 $600,000 $800,000 Year 3 $500,000 $600,000 $600,000 Year 4 $500,000 $600,000 $400,000 Year 5 $500,000 $600,000 $200,000 Discount rate 9% 13% 15% Print Done - X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts