Question: Net present value. Quark Industries has a project with the following projected cash flows a. Using a discount rate of 9% for this project and

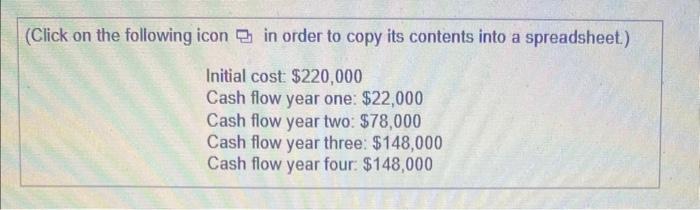

Net present value. Quark Industries has a project with the following projected cash flows a. Using a discount rate of 9% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 17% ? c. Should the company accept or reject it using a discount rate of 21% ? (Click on the following icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts