Question: Net present value Quark Industries has a project with the following projected cash flows a. Using a discount rate of 9% for this project and

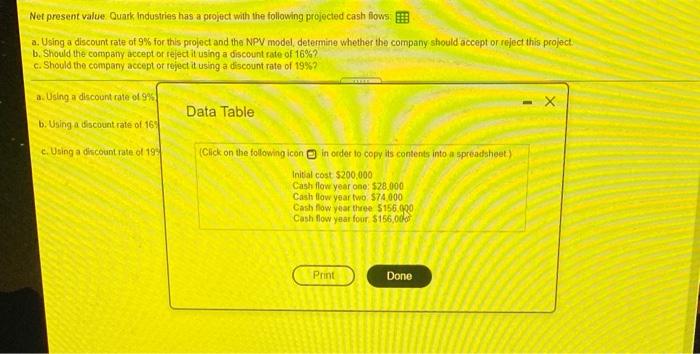

Net present value Quark Industries has a project with the following projected cash flows a. Using a discount rate of 9% for this project and the NPV model determine whether the company should accept or reject this project b. Should the company accept or reject it using a discount rate of 16%? c. Should the company accept or reject it using a discount rate of 19%? a. Using a discount rate of 9% this project should be (Select from the drop-down menu.) b. Using a discount rate of 16%, this project should be V (Select from the drop-down menu) c. Uning a discount rate of 19%, this project should be (Select from the drop-down menu) Net present value Guark Industries has a project with the following projected cash flows a. Using a discount rate of 9% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 16%? c. Should the company accept or reject it using a discount rate of 19%? Data Table Using a discount rate of 9 b. Using a discount rate of 16 c. Using a discount rate of 199 (Click on the following icon in order to copy its contents into a spreadsheet) Initial cost $200,000 Cash flow year one: 528,000 Cash flow year two $74.000 Cash flow year three 5156.900 Cash flow year four $156,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts