Question: Net present value. Quark Industries has a project with the following projected cash flows: a. Using a discount rate of 10% for this project and

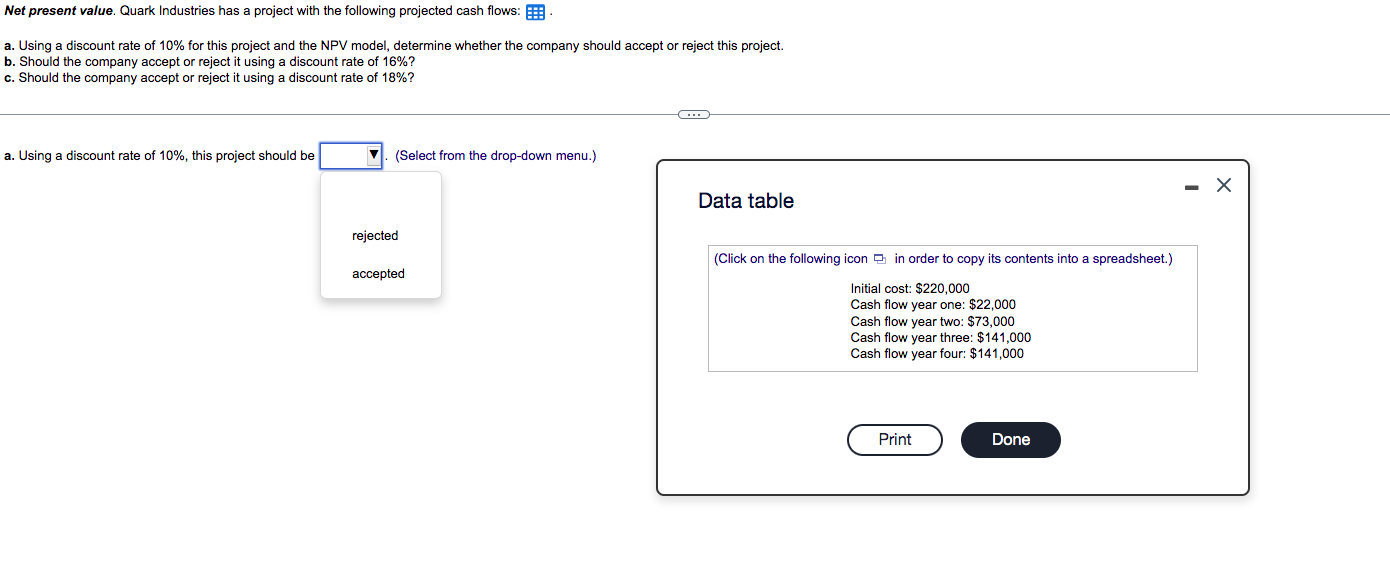

Net present value. Quark Industries has a project with the following projected cash flows: a. Using a discount rate of 10% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 16%? c. Should the company accept or reject it using a discount rate of 18%? ... a. Using a discount rate of 10%, this project should be (Select from the drop-down menu.) Data table rejected (Click on the following icon in order to copy its contents into a spreadsheet.) accepted Initial cost: $220,000 Cash flow year one: $22,000 Cash flow year two: $73,000 Cash flow year three: $141,000 Cash flow year four: $141,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts