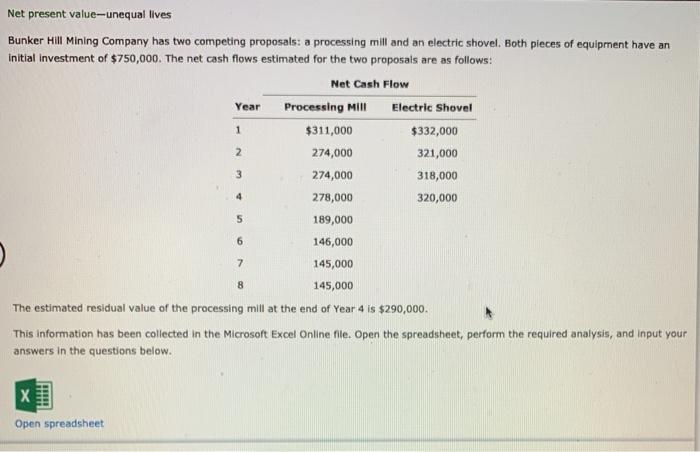

Question: Net present value - unequal lives 1 3 Net present value-unequal lives Bunker Hill Mining Company has two competing proposals: a processing mill and an

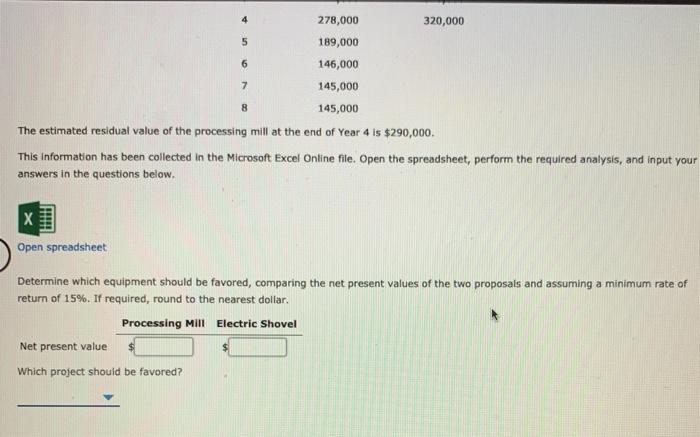

1 3 Net present value-unequal lives Bunker Hill Mining Company has two competing proposals: a processing mill and an electric shovel. Both pieces of equipment have an Initial Investment of $750,000. The net cash flows estimated for the two proposals are as follows: Net Cash Flow Year Processing MIHI Electric Shovel $311,000 $332,000 2 274,000 321,000 274,000 318,000 278,000 320,000 189,000 146,000 145,000 145,000 The estimated residual value of the processing mill at the end of Year 4 is $290,000 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. 4 5 6 7 8 Open spreadsheet 5 6 7 278,000 320,000 189,000 146,000 145,000 145,000 The estimated residual value of the processing mill at the end of Year 4 is $290,000 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. 8 HH Open spreadsheet Determine which equipment should be favored, comparing the net present values of the two proposals and assuming a minimum rate of return of 15%. If required, round to the nearest dollar. Processing Mill Electric Shovel Net present value Which project should be favored

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts