Question: Net Present Value / Worth. Recall from our last lecture that if the Net Present Value of a stream of cash flows (Present Value of

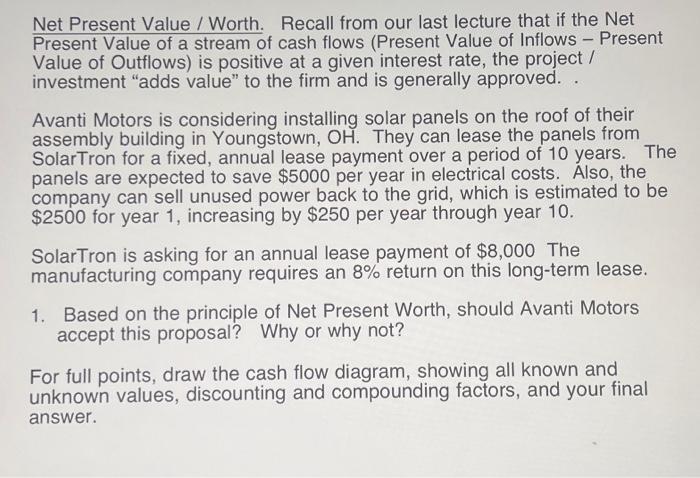

Net Present Value / Worth. Recall from our last lecture that if the Net Present Value of a stream of cash flows (Present Value of Inflows - Present Value of Outflows) is positive at a given interest rate, the project / investment "adds value" to the firm and is generally approved. . Avanti Motors is considering installing solar panels on the roof of their assembly building in Youngstown, OH. They can lease the panels from SolarTron for a fixed, annual lease payment over a period of 10 years. The panels are expected to save $5000 per year in electrical costs. Also, the company can sell unused power back to the grid, which is estimated to be $2500 for year 1 , increasing by $250 per year through year 10 . SolarTron is asking for an annual lease payment of $8,000 The manufacturing company requires an 8% return on this long-term lease. 1. Based on the principle of Net Present Worth, should Avanti Motors accept this proposal? Why or why not? For full points, draw the cash flow diagram, showing all known and unknown values, discounting and compounding factors, and your final

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts