Question: Never round intermediary steps (or keep at least 4 decimal places), SHOW ALL WORK, and LABEL your answers. Problem #1: Evaluating Relevant Cash Flows (Initial

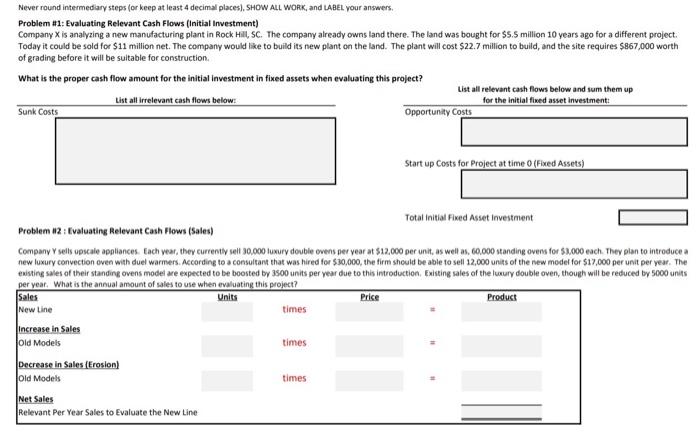

Never round intermediary steps (or keep at least 4 decimal places), SHOW ALL WORK, and LABEL your answers. Problem #1: Evaluating Relevant Cash Flows (Initial Investment) Company is analyzing a new manufacturing plant in Rock Hill, SC. The company already owns land there. The land was bought for $5.5 million 10 years ago for a different project. Today it could be sold for $11 million net. The company would like to build its new plant on the land. The plant will cost $22.7 million to build, and the site requires $867,000 worth of grading before it will be suitable for construction. What is the proper cash flow amount for the initial investment in fixed assets when evaluating this project? List all relevant cash flows below and sum them up List all irrelevant cash flows below: for the initial fixed asset investment: Sunk Costs Opportunity Costs Start up Costs for Project at time (Fixed Assets) Total initial Fixed Asset Investment Problem #2 : Kvaluating Relevant Cash Flows (Sales) Company sells upscale appliances. Each year, the currently sell 30,000 luxury double ovens per year at $12.000 per unit, as well as. 60.000 standing overs for 2.000 each. They plan to introduce a new luxury convection oven with duel warmers. According to a consultant that was hired for $30,000, the firm should be able to sell 12.000 units of the new model for $17,000 per unit per year. The existing sales of their standing ovens model are expected to be boosted by 3500 units per year due to this introduction. Existing sales of the luxury double oven, though will be reduced by 5000 units per year. What is the annual amount of sales to use when evaluating this project? Sales Units Price Product New Line times Increase in Sales Old Models times Decrease in Sales (Erosion) Old Models times Net Sales Relevant Per Year Sales to evaluate the New Line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts