Question: New Microsoft Word Document (2) View Help Search AaBboedd AoBbceDd AaBb 1 Normal No Spac... Heading 1 AaBbc AaB AaBb CD ABW Abbo Heading 2

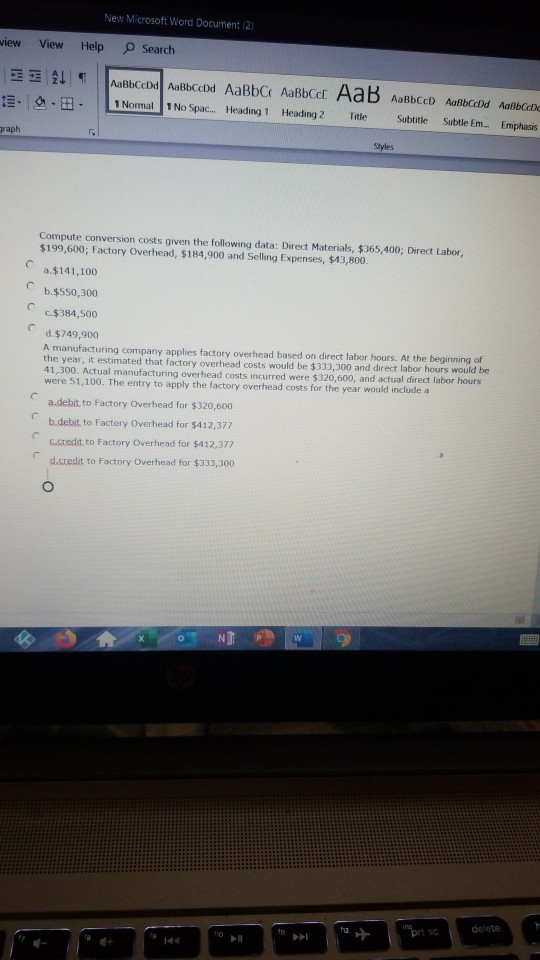

New Microsoft Word Document (2) View Help Search AaBboedd AoBbceDd AaBb 1 Normal No Spac... Heading 1 AaBbc AaB AaBb CD ABW Abbo Heading 2 Title Subtitle Subtle Em... Emphasis Styles C Compute conversion costs given the following data: Direct Materials, $365,400; Direct Labor, $199,600; Factory Overhead, $184,900 and Selling Expenses, $43,800 a $141,100 b.$550,300 $384,500 d $749,900 A manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $333,300 and direct labor hours would be 41,300. Actual manufacturing overhead costs incurred were $320,600, and actual direct labor hours were 51,100. The entry to apply the factory overhead costs for the year would include a adebit to Factory Overhead for $320,600 b.debit to Factory Overhead for $412,377 credit to Factory Overhead for $412,377 d.credit to Factory Overhead for $333,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts