Question: New Portfolio Creation Based on instructor feedback from Milestones One, Two, and Three, you will now make a new recommended portfolio that highlights your recommendations

New Portfolio Creation Based on instructor feedback from Milestones One, Two, and Three, you will now make a new recommended portfolio that highlights your recommendations based on your previous findings.

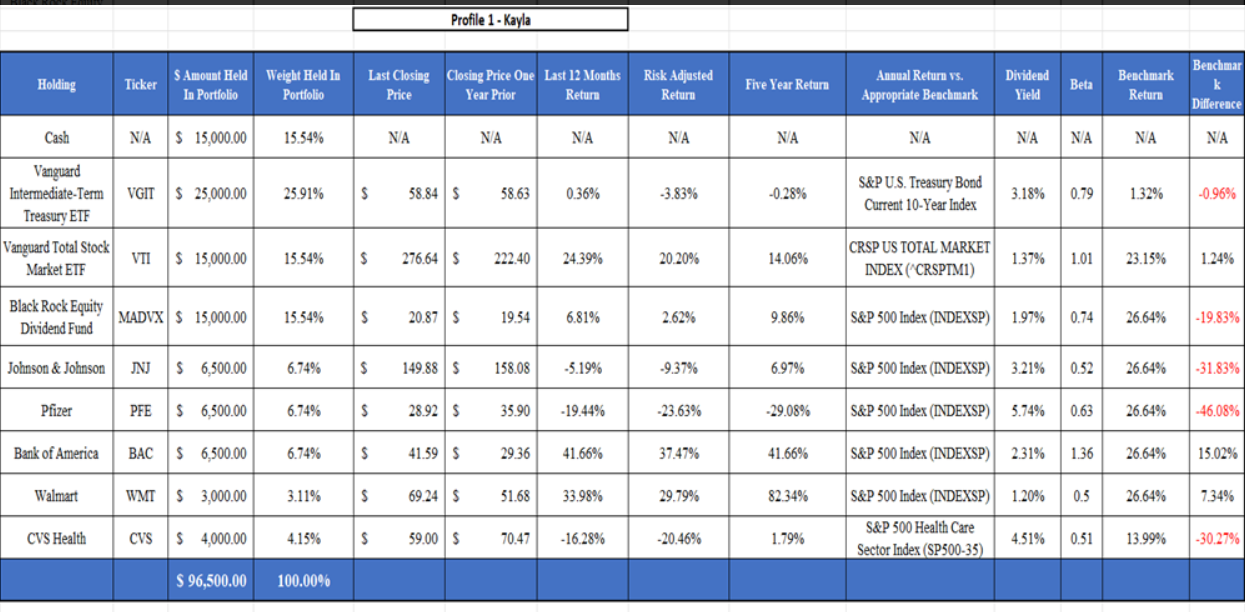

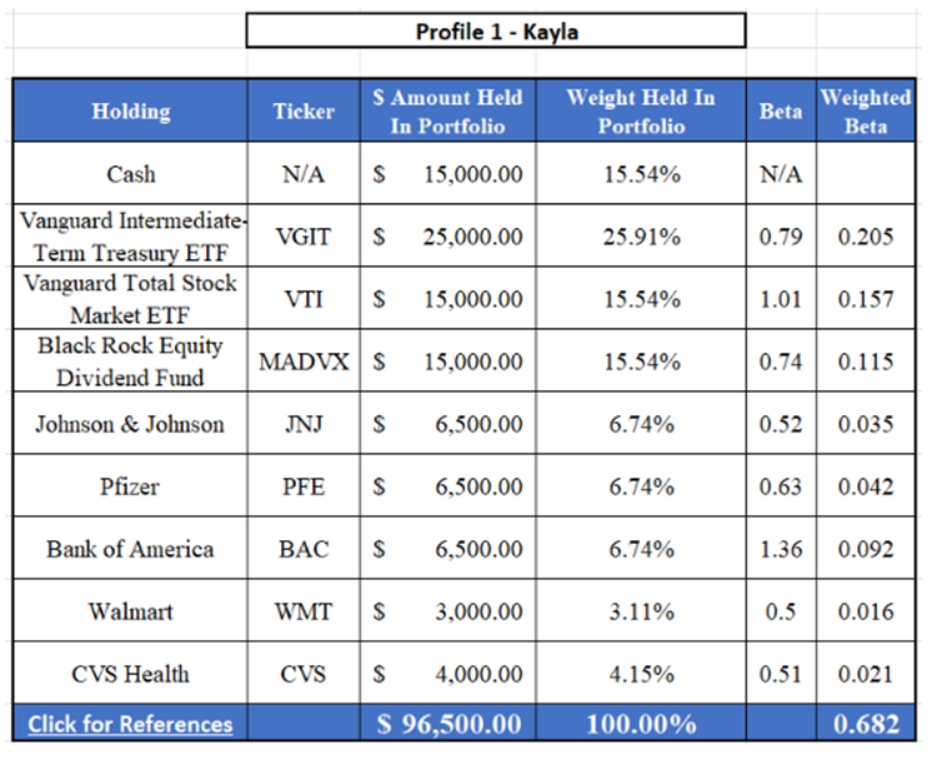

The client's life stage and time horizon for reaching their goals have an impact on the risk and return profile. Kayla is 29 years old, with at least 35 years till retirement. She must take onriskier investments now to accelerate her growth and be comfortable enough to retire when she reaches the appropriate age. She wants to pay off her student loans and save to fund to open her medical practice, but other major future financial milestones, like marriage, purchasing a home, and sending children to college, in addition to retiring, should be considered. The time range and milestones should be properly related to the risk and return objectives. For example, when the customer approaches a milestone, she may want to reduce risk to ensure the necessary funds are available. Aligning the portfolio with these milestones involves balancing growth and risk to ensure financial objectives are met. This might entail shifting funds from high-risk to low-risk assets or vice versa, depending on the client's risk tolerance. It may also imply investing more in successful assets or sectors to capitalize on trends. Rebalancing is done to ensure that the portfolio has the optimal balance of risk and return, allowing the customer to meet their financial goals within the time frame they specify

- Recommend an asset allocation strategy that best fits the client's needs in the form of actual investments that the client should hold in the portfolio. Address the following in your recommendation on why that asset allocation strategy is the best fit:

- Viability and stability: Does the recommended asset allocation strategy add required long-term stability to the portfolio?

- Tax efficiency: What are some tax considerations to keep in mind, including deferring tax liabilities through retirement accounts?

- Level of risk and alignment with client's risk tolerance

- Alignment with client's goals

- Expected return and client's needs

- Withdrawal requirements: At what stages will the assets be liquidated and what are some considerations for early withdrawals and other liquidity concerns?

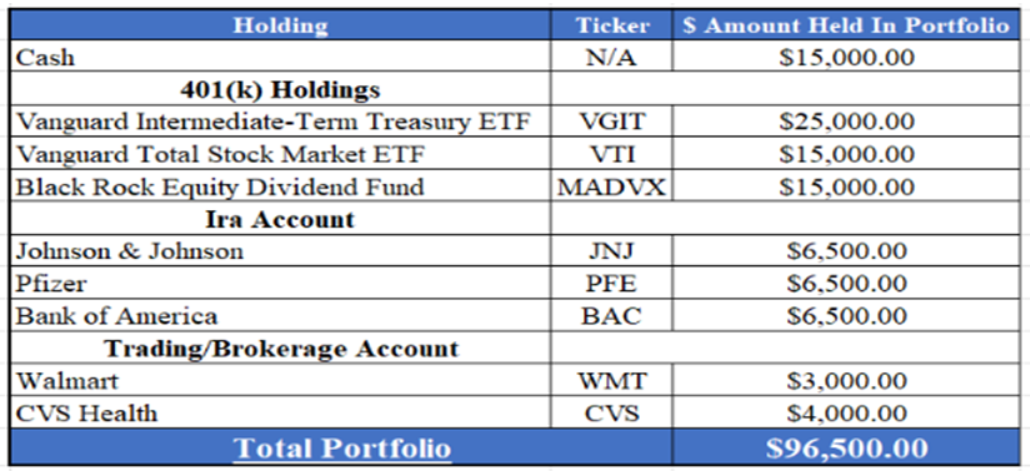

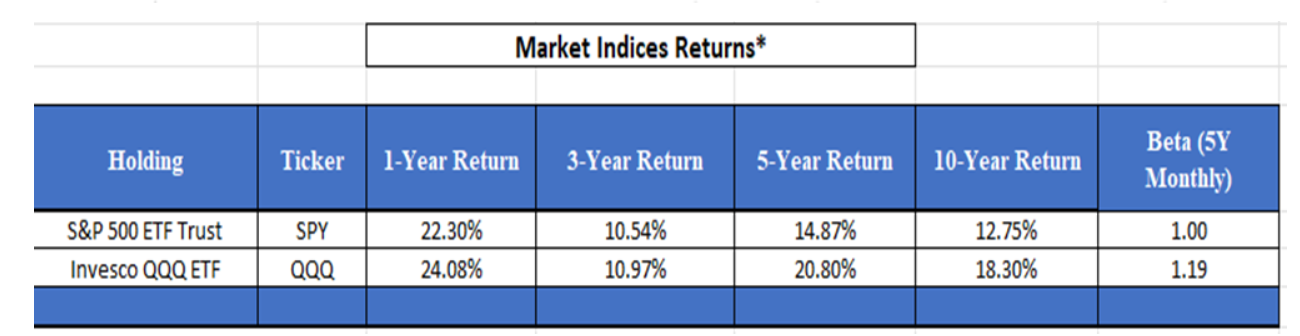

Kayla is a 29-year-old single female who just graduated from medical school and is starting her career as a doctor. Her annual salary is $150,000. She wants to pay off her $100,000 student loan debt (average debt rate 6%) quicker, so she reduced her cash savings. She contributes to her employer-provided 401(k) plan at a 6% contribution rate. The employer provides a match on the initial 6% contribution. She knows that the IRS 401(k) maximum contribution of $22,500 in 2023 is expected to rise to $23,000 in 2024. She understands that she is not taking full advantage of the 401(k) contribution tax deferral opportunity since her 6% contribution of $150,000 is roughly $9,000 annually. (For most individuals, every dollar invested in their 401(k) now means a dollar of income not taxed now and instead taxed later, preferably in retirement when personal taxes are generally lower than the rate in working years.) However, she has contributed to an IRA account annually for a few years, including $6,500 in 2023. She anticipates contributing the 2024 limit of $7,000. Kayla earns too much income to use the IRA contributions as tax deductions, but she does live in Floridaa state with no income taxes. Kayla's reasoning behind her decision to contribute to an IRA account instead of contributing the maximum possible annual contribution to her 401(k) is that her IRA account, which is provided by a national bank, allows her to invest in individual stocks, similar to a traditional brokerage account, while the 401(k) plan allows only for investments in mutual funds, exchange-traded funds, and diversified baskets of stocks and bonds. She also has a trading account with the same bank where she maintains the IRA account. All assets held in the three accounts are listed below. While she is generally conservative when it comes to making risky investments, she has a newfound understanding that growth requires taking risk, and that she can raise her risk profile because of her age and what is expected to be rapidly increasing income throughout her career. Now that she has a full-time job, she plans to increase her retirement savings while maintaining contributions to the IRA and investing in her trading account. She has tried to become more educated about the markets and understands that while prior return does not guarantee future performance, she would like to generate the same annual return as S&P 500 during the last 10 years. Because her expenses are modest, her student loans should be paid off in 10 years. She also hopes to open her own practice once her student loans are paid off and would like to build up enough assets, some in more liquid assets, to fund the start-up costs. Another reason for paying down debt and getting her finances in order is to improve her credit score, so she can access business debt funding for her future practice.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts