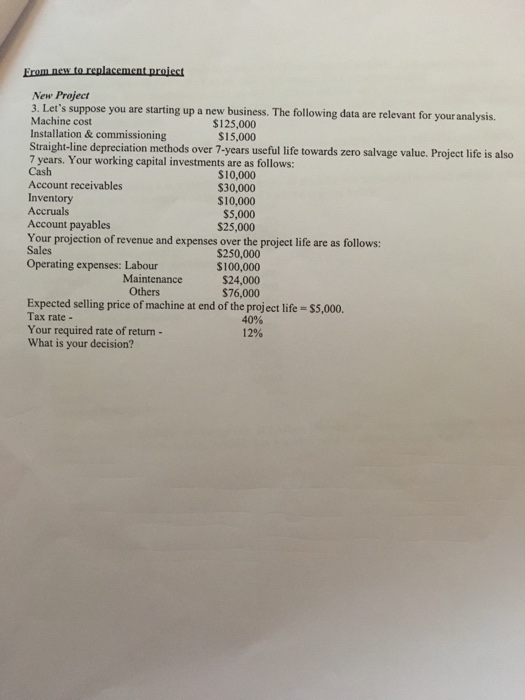

Question: New Project 3. Let's suppose you are starting up a new business. The following data are relevant for your analysis. Machine cost $125,000 $15,000 Installation&

New Project 3. Let's suppose you are starting up a new business. The following data are relevant for your analysis. Machine cost $125,000 $15,000 Installation& commissioning Straight-line depreciation methods over 7-years useful life towards zero salvage value. Project life is also 7 years. Your working capital investments are as follows: Cash Account receivables $10,000 $30,000 $10,000 $5,000 $25,000 Inventory Accruals Account payables Your projection of revenue and expenses over the project life are as follows: Sales S250,000 $100,000 $24,000 $76,000 Operating expenses: Labour Maintenance Others Expected selling price of machine at end of the project life-$5,000. Tax rate - 40% 12% Your required rate of return - What is your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts