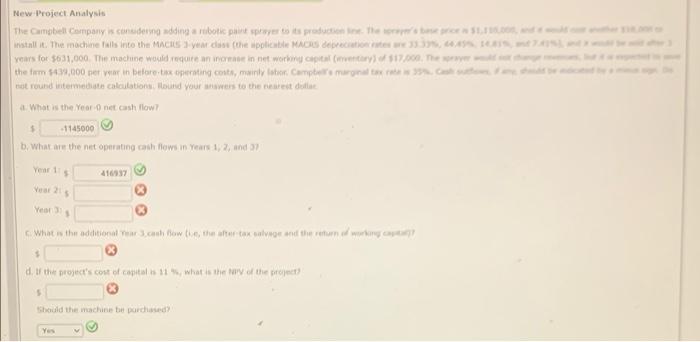

Question: New Project Analysis The Campbell Company is considering adding a mibotic paint sprayer its production. The rest install it. The machine alls into the MACBS

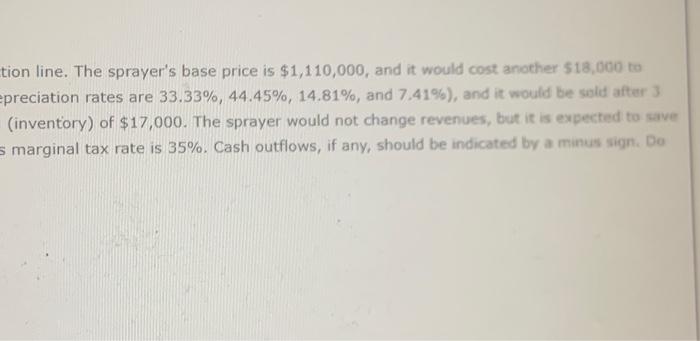

New Project Analysis The Campbell Company is considering adding a mibotic paint sprayer its production. The rest install it. The machine alls into the MACBS years the police MARS Berechos 33.44 TL years for $631,000. The machine would requireann in networking capital (517.000. The the form 4.000 per var in before the operating costs, mainly shor Camper not round intermediate calculation und your answers to the nearest della What is the Year net cash flow? $ -1145000 b. What are the net operating canh Bows.in. Years 132, and 12 416937 Year 2 Yeon What is the additional archdow that the after tax color and the returned working $ the project's cost of capital is 11 , what is the way of the projects Should the machine bir parchased? Yes tion line. The sprayer's base price is $1,110,000, and it would cost another 518,000 to epreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after 3 (inventory) of $17,000. The sprayer would not change revenues, but it is expected to save s marginal tax rate is 35%. Cash outflows, if any, should be indicated by a minus sign. Do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts