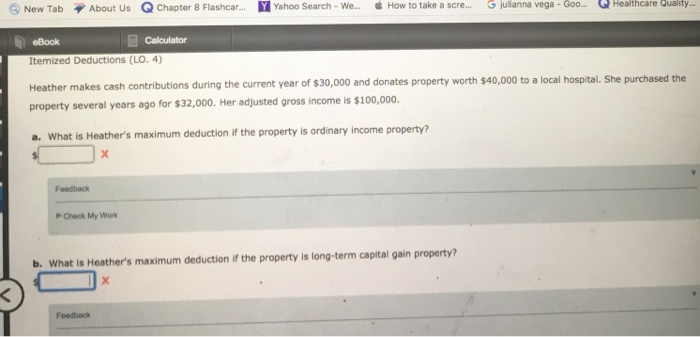

Question: New TabAbout Us QChapter 8 Flashcar. Yahoo Search - We. How to take a scre.. G julianna vega- Healthcare Bay eBook Itemized Deductions (LO. 4)

New TabAbout Us QChapter 8 Flashcar. Yahoo Search - We. How to take a scre.. G julianna vega- Healthcare Bay eBook Itemized Deductions (LO. 4) Heather makes cash contributions during the current year of $30,000 and donates property worth $40,000 to a local hospital. She purchased the property several years ago for $32,000. Her adjusted gross income is $100,000. a. What is Heather's maximum deduction if the property is ordinary income property? Calculator Feedback Check My Work b. What is Heather's maximum deduction if the property is long-term capital gain property? Feedback

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock