Question: Exercise 24-9 Computing net present value LO P3 B2B Co. is considering the purchase of equipment that would allow the company to add a new

Exercise 24-9 Computing net present value LO P3 B2B Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $368,000 with a 12-year life and no salvage value. It will be depreciated on a straight-line basis. The company expects to sell 147,200 units of the equipments product each year. The expected annual income related to this equipment follows. Sales $ 230,000 Costs Materials, labor, and overhead (except depreciation on new equipment) 81,000 Depreciation on new equipment 30,667 Selling and administrative expenses 23,000 Total costs and expenses 134,667 Pretax income 95,333 Income taxes (30%) 28,600 Net income $ 66,733 If at least an 10% return on this investment must be earned, compute the net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

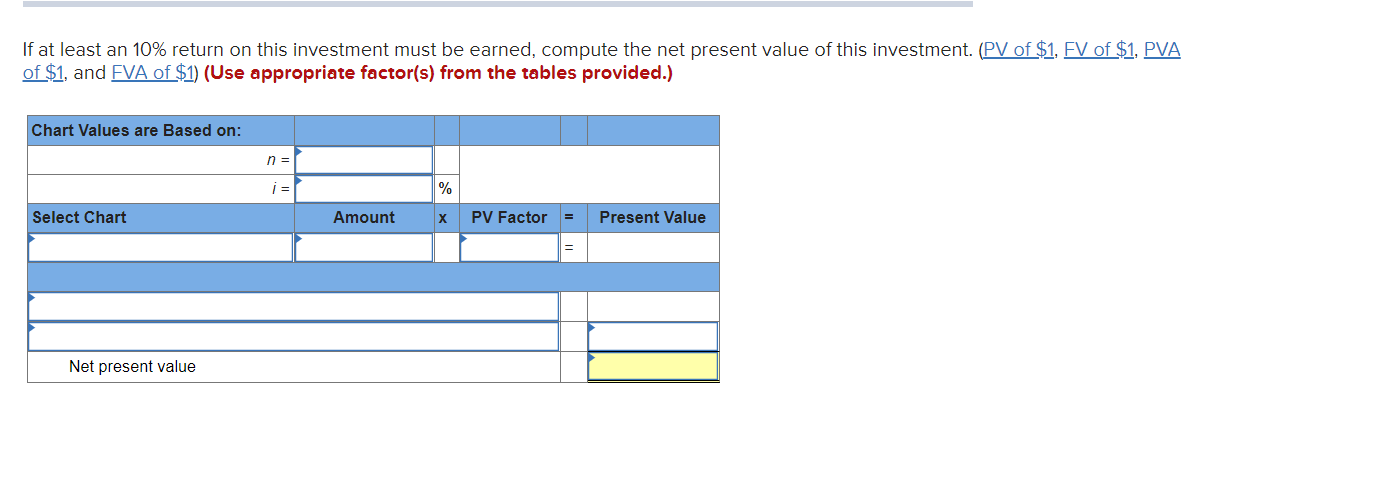

If at least an 10% return on this investment must be earned, compute the net present value of this investment (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Chart Values are Based on: n= i = % Select Chart Amount PV Factor = Present Value - Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts