Question: newconnect. meducaron.com ter 8 Problems Help Save & Chol A machine costing $209,000 with a four year life and an estimated $19,000 salvage value is

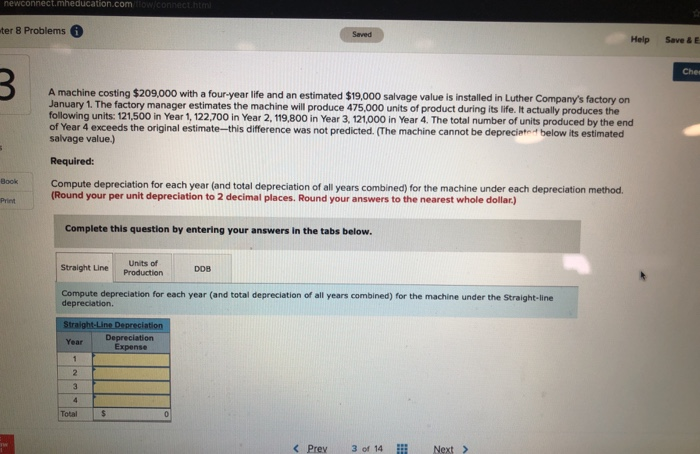

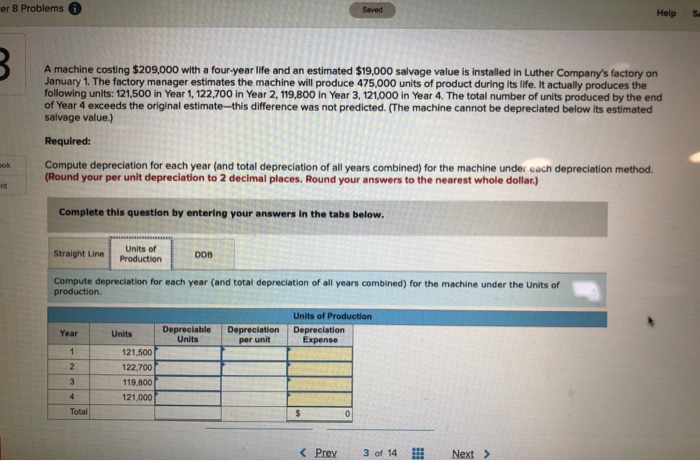

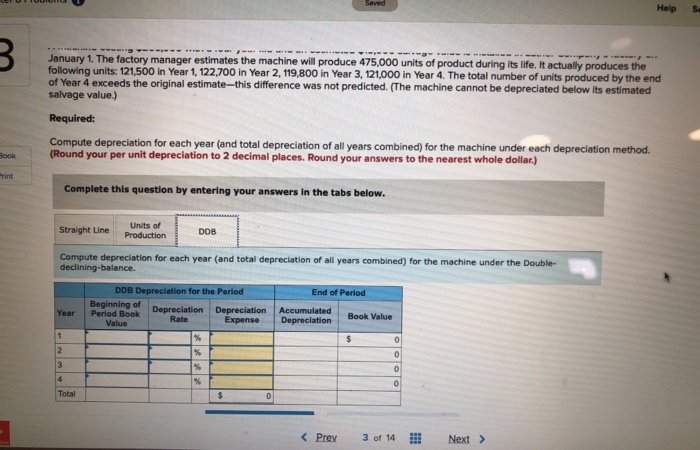

newconnect. meducaron.com ter 8 Problems Help Save & Chol A machine costing $209,000 with a four year life and an estimated $19,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 475,000 units of product during its life. It actually produces the following units: 121,500 in Year 1, 122,700 in Year 2. 119,800 in Year 3, 121,000 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate--this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) Complete this question by entering your answers in the tabs below. Straight Line Units of Production DOB Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Straight-line depreciation. Straight-Line Depreciation Year Depreciation Expense er 8 Problems 0 Help A machine costing $209,000 with a four year life and an estimated $19,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 475,000 units of product during its life. It actually produces the following units: 121,500 in Year 1, 122,700 in Year 2, 119,800 in Year 3, 121,000 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) Complete this question by entering your answers in the tabs below. Straine Straight Line Units of Production DOB Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Units of production Year Units of Production Depreciation Expense Units Depreciable Units Depreciation per unit 121,500 122,700 119,800 121,000 Help January 1. The factory manager estimates the machine will produce 475,000 units of product during its life. It actually produces the following units: 121,500 in Year 1, 122,700 in Year 2, 119,800 in Year 3, 121,000 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate--this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Units of Straight Line Production DOB Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Double- declining-balance. End of Period DDB Depreciation for the Period Beginning of Period Depreciation Depreciation Rate Expense Year Accumulated Depreciation Book Value Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts