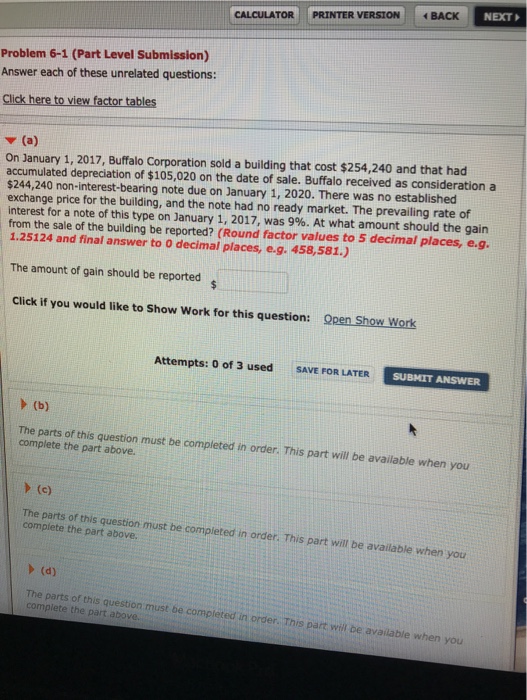

Question: NEXT CALCULATOR PRINTER VERSION BACK Problem 6-1 (Part Level Submission) Answer each of these unrelated questions: Click here to view factor tables On January 1,

NEXT CALCULATOR PRINTER VERSION BACK Problem 6-1 (Part Level Submission) Answer each of these unrelated questions: Click here to view factor tables On January 1, 2017, Buffalo Corporation sold a building that cost $254,240 and that had accumulated depreciation of $105,020 on the date of sale. Buffalo received as consideration a $244,240 non-interest-bearing note due on January 1, 2020. There was no established exchange price for the building, and the note had no ready market. The prevailing rate of interest for a note of this type on January 1, 2017, was 9%. At what amount should the gain from the sale of the building be reported? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to o decimal places, e.g. 458,581.) The amount of gain should be reported s Click if you would like to show Work for this question: Open Show Work Attempts: 0 of 3 used SAVE FOR LATER SURMIT ANSWE The parts of this question must be completed in order. This part will be available when you complete the part above. The parts of this question must be completed in order. This part will be available when you complete the part above. The parts of this question must be completed in order. This part wil be available wher complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts