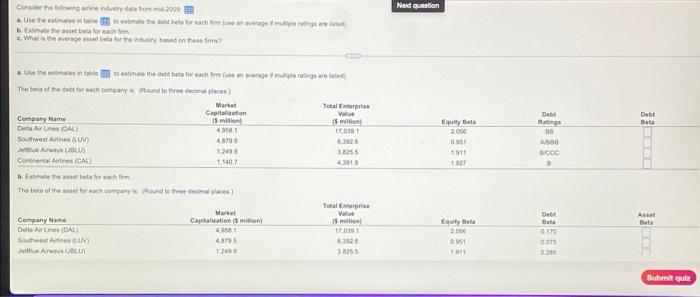

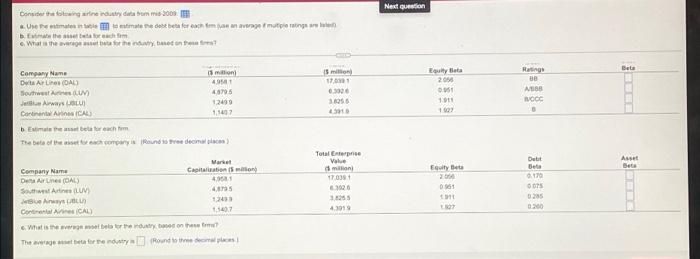

Question: Next Gestion Consider the beginntry data from 2009 Uw he wants to the two teach from the stars are Estebet for each um . What

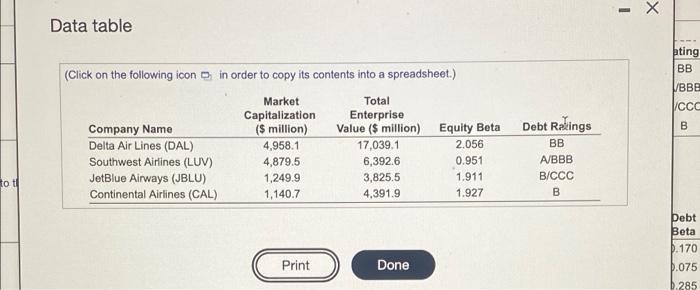

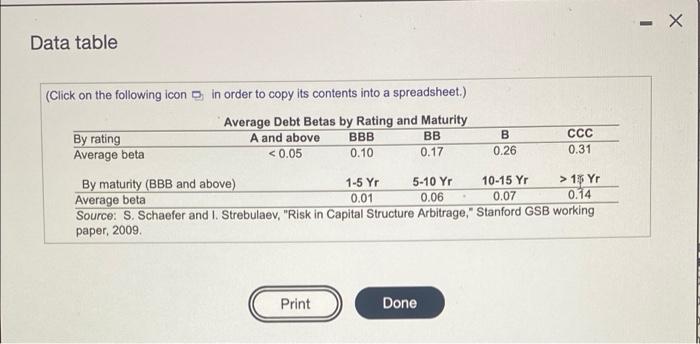

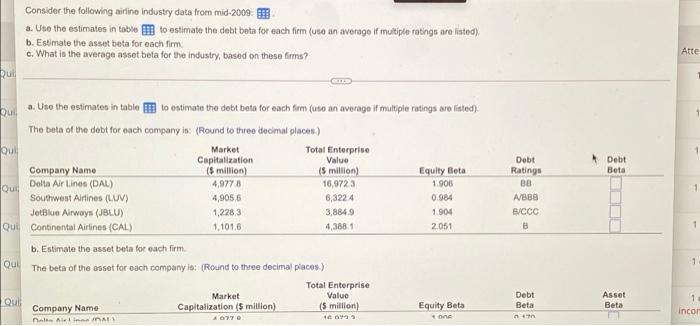

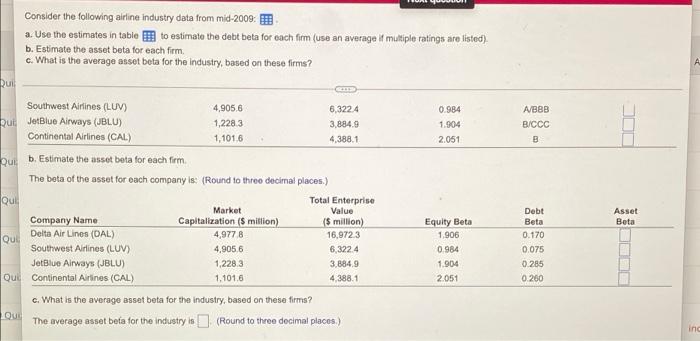

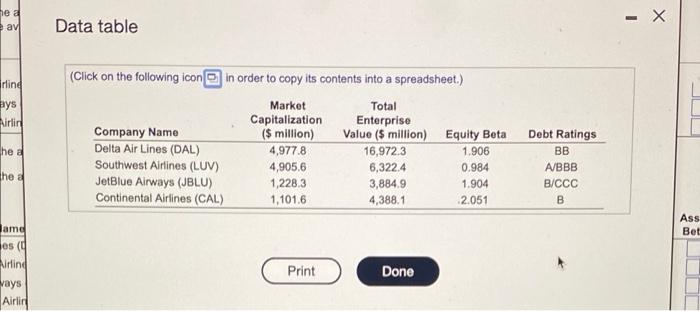

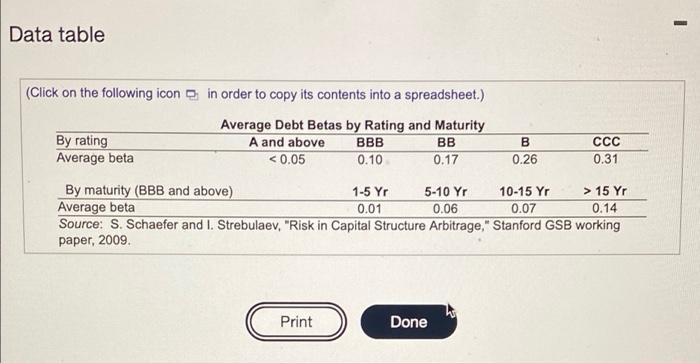

Next Gestion Consider the beginntry data from 2009 Uw he wants to the two teach from the stars are Estebet for each um . What the very best Market Bet Debt Beta as the state omare the debutat each innen relevage are The bota do reach Rund to three decontact Total Enterprise Capitalisation Company Name mo Deta Ares (DAL 4058 17.030+ Southwest 48705 26 JA BLU 12400 3.255 Continental Arts CALI 1407 4.2013 Estimate the strachom The best of the forcond to com Toral Maria Value Company Name Capitalization 3 milion 15 min Date ALDAL $7,0391 SAM 925 A BLU 12490 38255 Equity Bata 2004 095 1911 1921 38 ABO CCC Acer Equity 2008 951 1991 Debt Bata 0.179 0.07 Submit quite Next question Consider the funge data 2001 Usmas edebt betaler mv matplating the form What is the other on the Beta Ratings BB 15 min 4. 48705 12499 1.14 millow 17.01 0.020 30055 Company Name Duta Arins (DAL Sos. Un Jei Airways Continent ICAL Estimate betreach tom The bel of company is und dem Equity Bata 20 0.50 1.971 1902 ASS OC Aset be Euty Bee Total Enterprise Value mi 17.00 1020 25 43019 Maret Company Name Capitation Derne (DAL) 4.9521 South Artin Luv 4. Anes 1241 Contral ACAL . What is the better then the There Round to Dett Det 170 OOTS 025 200 0961 9 1 Data table ating BB BBB /CCC B B (Click on the following icon in order to copy its contents into a spreadsheet.) Market Total Capitalization Enterprise Company Name ($ million) Value ($ million) Equity Beta Delta Air Lines (DAL) 4,958.1 17,039.1 2.056 Southwest Airlines (LUV) 4,879.5 6,392.6 0.951 JetBlue Airways (JBLU) 1,249.9 3,825.5 1.911 Continental Airlines (CAL) 1,140.7 4,391.9 1.927 Debt Ratings BB A/BBB B/CCC B to ti Debt Beta D. 170 Print Done D.075 285 - - X Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Average Debt Betas by Rating and Maturity By rating A and above BBB BB B CCC Average beta 15 YT Average beta 0.01 0.06 0.07 0.14 Source: S. Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage," Stanford GSB working paper, 2009 Print Done Consider the following airlino Industry data from mid-2009 a. Use the estimates in table to estimate the debt beta for each firm (uso an average If multiple ratings are listed) b. Estimate the asset beta for each firm. c. What is the average asset bota for the industry, based on those firma? Atte Du Debt Beta Dul a. Use the estimates in table to estimate the debt bata for each firm (uso an average if multiple ratings are listed) The beta of the debt for each company is: (Round to three decimal places) Qui Market Total Enterprise Capitalization Value Company Name ($ million) (5 million) Equity Beta QUE Delta Air Lines (DAL) 4,9778 16,9723 1 908 Southwest Airlines (LUV) 4,905,6 6,3224 0.984 JetBlue Airways (JBLU) 1,2283 3,8849 1.904 Qui Continental Airlines (CAL) 1,101.6 4,388.1 2.051 b. Estimate the asset beta for each firm Que The beta of the asset for each company lo: (Round to three decimal places) Total Enterprise Market Value QUE Company Name Capitalization (5 million) (5 million) Equity Beta AirlinA Debt Ratings BB ABBB B/CCC B 1 Debt Beta Asset Beta 1 incor ON Consider the following airline industry data from mid-2009 a. Use the estimates in table to estimate the debt beta for each firm (use an average it multiple ratings are listed) b. Estimate the asset beta for each firm, c. What is the average asset bota for the industry, based on these firms? Ruiz 0.984 1.904 A/BBB B/CCC B 2.051 Southwest Airlines (LUV) 4,905.6 6,3224 put JetBlue Airways (JBLU) 1,2283 3,884.9 Continental Airlines (CAL 1,1016 4,388.1 but b. Estimate the asset bota for each firm The beta of the asset for each company is: (Round to threo decimal places) Qui Total Enterprise Market Value Company Name Capitalization (5 million) ($ million) Delta Air Lines (DAL) 4,9778 Que 16.9723 Southwest Airlines (LUV) 4,9056 6,3224 JetBlue Airways (JBLU) 1,2283 3,884,9 Qui Continental Airlines (CAL) 1.101.6 4,388.1 c. What is the average asset beta for the industry, based on these firms? QUE The average asset beta for the Industry is (Round to three decimal places.) Asset Beta Equity Beta 1,906 0.984 1.904 2.051 Debt Beta 0.170 0.075 0.285 0.260 inc ne a av Data table Erlind ays Airlin (Click on the following icon in order to copy its contents into a spreadsheet.) Market Total Capitalization Enterprise Company Name ($ million) Value (s million) Equity Beta Delta Air Lines (DAL) 4,977.8 16,9723 1.906 Southwest Airlines (LUV) 4,905.6 6,322.4 0.984 JetBlue Airways (JBLU) 1,228.3 3,884.9 1.904 Continental Airlines (CAL) 1,101.6 4,388.1 2.051 The & Debt Ratings BB A/BBB B/CCC B the a Ass Bet Jamd os Mirlind Vays Airlid Print Done 1 Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Average Debt Betas by Rating and Maturity By rating A and above BBB BB B CCC Average beta 15 Yr Average beta 0.01 0.06 0.07 0.14 Source: S. Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage." Stanford GSB working paper, 2009. Print Done Next Gestion Consider the beginntry data from 2009 Uw he wants to the two teach from the stars are Estebet for each um . What the very best Market Bet Debt Beta as the state omare the debutat each innen relevage are The bota do reach Rund to three decontact Total Enterprise Capitalisation Company Name mo Deta Ares (DAL 4058 17.030+ Southwest 48705 26 JA BLU 12400 3.255 Continental Arts CALI 1407 4.2013 Estimate the strachom The best of the forcond to com Toral Maria Value Company Name Capitalization 3 milion 15 min Date ALDAL $7,0391 SAM 925 A BLU 12490 38255 Equity Bata 2004 095 1911 1921 38 ABO CCC Acer Equity 2008 951 1991 Debt Bata 0.179 0.07 Submit quite Next question Consider the funge data 2001 Usmas edebt betaler mv matplating the form What is the other on the Beta Ratings BB 15 min 4. 48705 12499 1.14 millow 17.01 0.020 30055 Company Name Duta Arins (DAL Sos. Un Jei Airways Continent ICAL Estimate betreach tom The bel of company is und dem Equity Bata 20 0.50 1.971 1902 ASS OC Aset be Euty Bee Total Enterprise Value mi 17.00 1020 25 43019 Maret Company Name Capitation Derne (DAL) 4.9521 South Artin Luv 4. Anes 1241 Contral ACAL . What is the better then the There Round to Dett Det 170 OOTS 025 200 0961 9 1 Data table ating BB BBB /CCC B B (Click on the following icon in order to copy its contents into a spreadsheet.) Market Total Capitalization Enterprise Company Name ($ million) Value ($ million) Equity Beta Delta Air Lines (DAL) 4,958.1 17,039.1 2.056 Southwest Airlines (LUV) 4,879.5 6,392.6 0.951 JetBlue Airways (JBLU) 1,249.9 3,825.5 1.911 Continental Airlines (CAL) 1,140.7 4,391.9 1.927 Debt Ratings BB A/BBB B/CCC B to ti Debt Beta D. 170 Print Done D.075 285 - - X Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Average Debt Betas by Rating and Maturity By rating A and above BBB BB B CCC Average beta 15 YT Average beta 0.01 0.06 0.07 0.14 Source: S. Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage," Stanford GSB working paper, 2009 Print Done Consider the following airlino Industry data from mid-2009 a. Use the estimates in table to estimate the debt beta for each firm (uso an average If multiple ratings are listed) b. Estimate the asset beta for each firm. c. What is the average asset bota for the industry, based on those firma? Atte Du Debt Beta Dul a. Use the estimates in table to estimate the debt bata for each firm (uso an average if multiple ratings are listed) The beta of the debt for each company is: (Round to three decimal places) Qui Market Total Enterprise Capitalization Value Company Name ($ million) (5 million) Equity Beta QUE Delta Air Lines (DAL) 4,9778 16,9723 1 908 Southwest Airlines (LUV) 4,905,6 6,3224 0.984 JetBlue Airways (JBLU) 1,2283 3,8849 1.904 Qui Continental Airlines (CAL) 1,101.6 4,388.1 2.051 b. Estimate the asset beta for each firm Que The beta of the asset for each company lo: (Round to three decimal places) Total Enterprise Market Value QUE Company Name Capitalization (5 million) (5 million) Equity Beta AirlinA Debt Ratings BB ABBB B/CCC B 1 Debt Beta Asset Beta 1 incor ON Consider the following airline industry data from mid-2009 a. Use the estimates in table to estimate the debt beta for each firm (use an average it multiple ratings are listed) b. Estimate the asset beta for each firm, c. What is the average asset bota for the industry, based on these firms? Ruiz 0.984 1.904 A/BBB B/CCC B 2.051 Southwest Airlines (LUV) 4,905.6 6,3224 put JetBlue Airways (JBLU) 1,2283 3,884.9 Continental Airlines (CAL 1,1016 4,388.1 but b. Estimate the asset bota for each firm The beta of the asset for each company is: (Round to threo decimal places) Qui Total Enterprise Market Value Company Name Capitalization (5 million) ($ million) Delta Air Lines (DAL) 4,9778 Que 16.9723 Southwest Airlines (LUV) 4,9056 6,3224 JetBlue Airways (JBLU) 1,2283 3,884,9 Qui Continental Airlines (CAL) 1.101.6 4,388.1 c. What is the average asset beta for the industry, based on these firms? QUE The average asset beta for the Industry is (Round to three decimal places.) Asset Beta Equity Beta 1,906 0.984 1.904 2.051 Debt Beta 0.170 0.075 0.285 0.260 inc ne a av Data table Erlind ays Airlin (Click on the following icon in order to copy its contents into a spreadsheet.) Market Total Capitalization Enterprise Company Name ($ million) Value (s million) Equity Beta Delta Air Lines (DAL) 4,977.8 16,9723 1.906 Southwest Airlines (LUV) 4,905.6 6,322.4 0.984 JetBlue Airways (JBLU) 1,228.3 3,884.9 1.904 Continental Airlines (CAL) 1,101.6 4,388.1 2.051 The & Debt Ratings BB A/BBB B/CCC B the a Ass Bet Jamd os Mirlind Vays Airlid Print Done 1 Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Average Debt Betas by Rating and Maturity By rating A and above BBB BB B CCC Average beta 15 Yr Average beta 0.01 0.06 0.07 0.14 Source: S. Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage." Stanford GSB working paper, 2009. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts