Question: Next Page Question 3 (1 point) You are valuing a company using the WACC approach and have estimated that the free cash flows from the

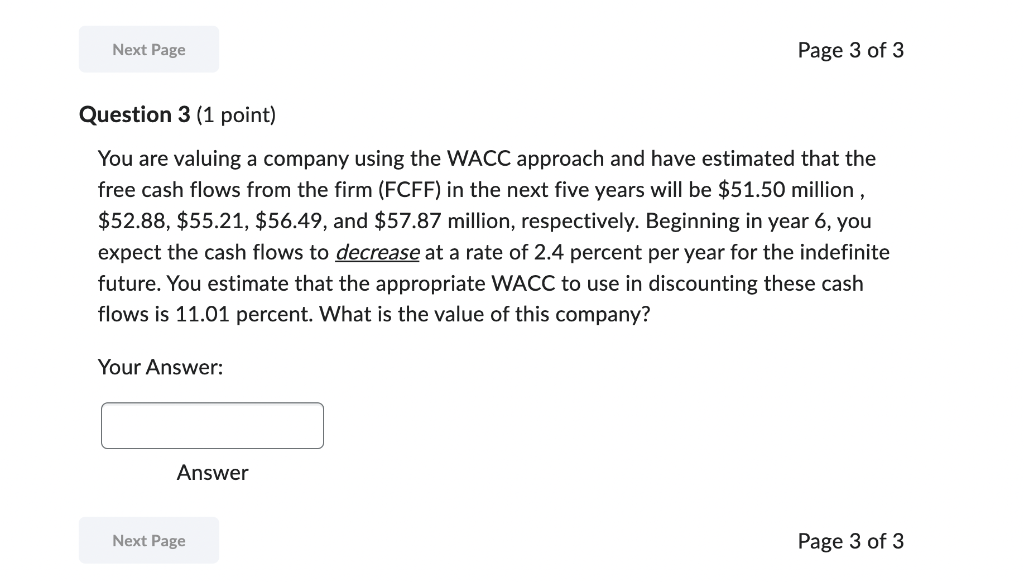

Next Page Question 3 (1 point) You are valuing a company using the WACC approach and have estimated that the free cash flows from the firm (FCFF) in the next five years will be $51.50 million, $52.88, $55.21, $56.49, and $57.87 million, respectively. Beginning in year 6, you expect the cash flows to decrease at a rate of 2.4 percent per year for the indefinite future. You estimate that the appropriate WACC to use in discounting these cash flows is 11.01 percent. What is the value of this company? Your Answer: Answer Page 3 of 3 Next Page Page 3 of 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts