Question: Next year Baldwin plans to include an additional performance bonus of 0.5% in its compensation plan. This incentive will be provided in addition to the

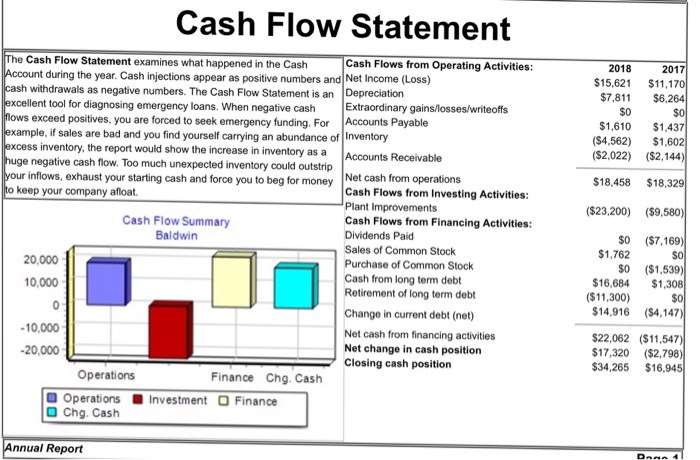

Cash Flow Statement Cash Flows from Operating Activities: 2018 201 $15,621 $11,17 he Cash Flow Statement examines what happened in the Cash during the year. Cash injections appear as positive numbers and Net Income (Loss) withdrawals as negative numbers. The Cash Flow Statement is an Depreciation nt tool for diagnosing emergency loans. When negative cash Extraordinary gains/losses/writeoffs exceed positives, you $7,811 $0 $1,610 $1,437 ($4,562) $1 ($2,022) ($2,144) are forced to seek emergency funding. For Accounts Payable e, if sales are bad and you find yourself carrying an abundance of Inventory xcess inventory, the report would show the increase in inventory as aAccounts Receivable e negative cash flow. Too much unexpected inventory could outstrip inflows, exhaust your starting cash and force you to beg for money $18,458 $18,3 Net cash from operations Cash Flows from Investing Activities: Plant Improvements Cash Flows from Financing Activities: Dividends Paid Sales of Common Stock Purchase of Common Stock Cash from long term debt Retirement of long term debt keep your company afloat ($23,200) ($9,580) $0 ($7,169 $0 ($1,539) Cash Flow Summary Baldwin $1,762 16,684 $1 14,916 ($4.147) 20,000 10,000 ($11,300) Change in current debt (net) Net cash from financing activities Net change in cash position Closing cash position $22,062 ($11,547 $17,320 ($2,798 $34,265 $16,945 10,000 -20,000 Operations Finance Chg. Cash Operations Investment O Finance O Chg. Cash nnual Report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts