Question: Next year, Julijuli Sdn Bhd is planning for a major sales increase of 40%. Sales are currently RM30,000,000 and it is forecast that next

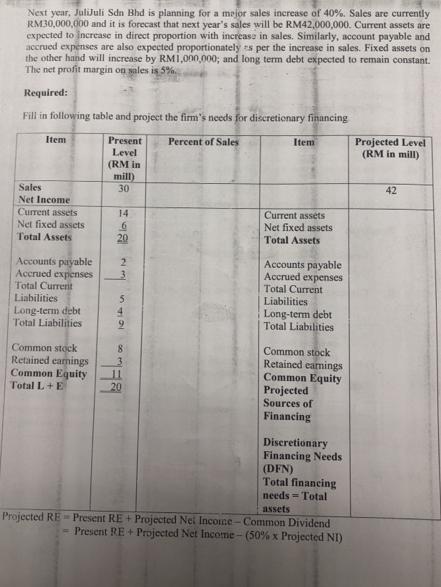

Next year, Julijuli Sdn Bhd is planning for a major sales increase of 40%. Sales are currently RM30,000,000 and it is forecast that next year's sales will be RM42,000,000. Current assets are expected to increase in direct proportion with increase in sales. Similarly, account payable and accrued expenses are also expected proportionately s per the increase in sales. Fixed assets on the other hand will increase by RM1,000,000; and long term debt expected to remain constant. The net profit margin on sales is 5%. Required: Fill in following table and project the firm's needs for discretionary financing Item Present Level (RM in mill) 30 Percent of Sales Projected Level (RM in mill) Item Sales 42 Net Income Current assets Net fixed assets Total Assets 14 Current assts Net fixed assets 20 Total Assets Accounts payable Accrued expienses Total Current Liabilities Long-term debt Total Liabilities 2 Accounts payable Accrued expenses Total Current 5. 4. Liabilities Long-term debt Total Liabilities Common stock Retained earnings Common Equity Total L+E 8. 3. 11 20 Common stock Retained earnings Common Equity Projected Sources of Financing Discretionary Financing Needs (DFN) Total financing needs = Total assets Projected RE- Present RE + Projected Nei Incone- Common Dividend Present RE + Projected Net Income- (50% x Projected NI)

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Item Present LevelRM million Percent of sales Projected LevelRM million Sal... View full answer

Get step-by-step solutions from verified subject matter experts