Question: Nick has just finished plotting the relationship between the NPV of two independent projects (MiniHospital and Super Hospital) for different discount rates. He finds that

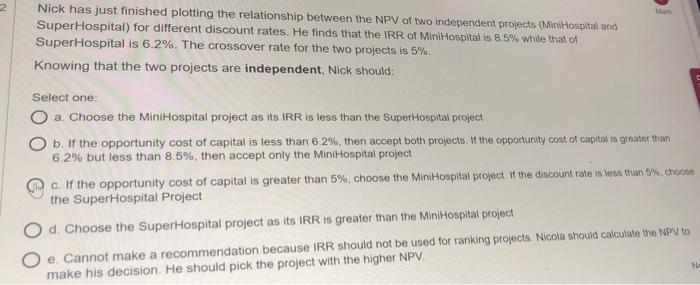

Nick has just finished plotting the relationship between the NPV of two independent projects (MiniHospital and Super Hospital) for different discount rates. He finds that the IRR of Mini Hospital is 8.5% while that of SuperHospital is 6.2%. The crossover rate for the two projects is 5%. Knowing that the two projects are independent, Nick should: Select one a. Choose the MiniHospital project as its IRR is less than the SuperHospital project O b. If the opportunity cost of capital is less than 62%, then accept both projects. It the opportunity cost of capital is greater than 6.2% but less than 8.5%, then accept only the MiniHospital project c. If the opportunity cost of capital is greater than 5%, choose the MiniHospital project of the discount rate is less than 5% choose the SuperHospital Project O d. Choose the SuperHospital project as its IRR is greater than the Mini Hospital project O e Cannot make a recommendation because IRR should not be used for ranking projects Nicola should calculate the NPV 10 make his decision. He should pick the project with the higher NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts