Question: No additional data was given for the question. 6. A stock pays a dividend of D at the end of each year for the next

No additional data was given for the question.

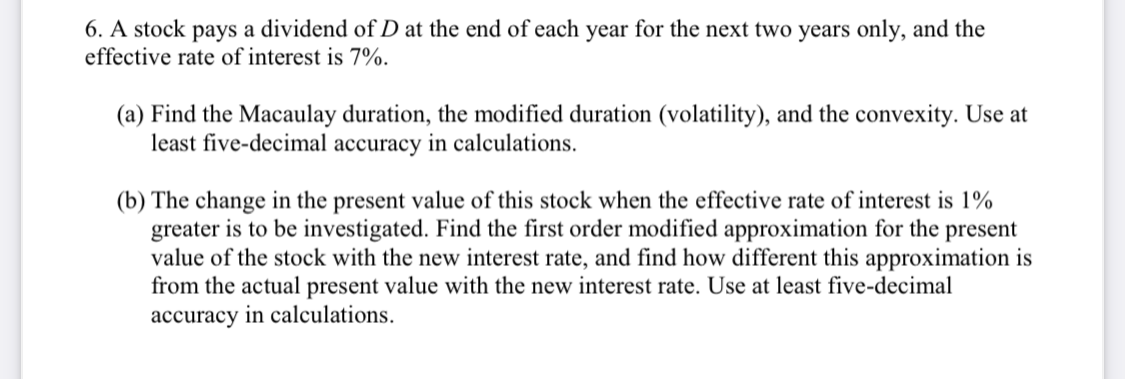

6. A stock pays a dividend of D at the end of each year for the next two years only, and the effective rate of interest is 7%. (a) Find the Macaulay duration, the modified duration (volatility), and the convexity. Use at least five-decimal accuracy in calculations. (b) The change in the present value of this stock when the effective rate of interest is 1% greater is to be investigated. Find the first order modified approximation for the present value of the stock with the new interest rate, and find how different this approximation is from the actual present value with the new interest rate. Use at least five-decimal accuracy in calculations. 6. A stock pays a dividend of D at the end of each year for the next two years only, and the effective rate of interest is 7%. (a) Find the Macaulay duration, the modified duration (volatility), and the convexity. Use at least five-decimal accuracy in calculations. (b) The change in the present value of this stock when the effective rate of interest is 1% greater is to be investigated. Find the first order modified approximation for the present value of the stock with the new interest rate, and find how different this approximation is from the actual present value with the new interest rate. Use at least five-decimal accuracy in calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts