Question: No additional information should be needed. Specific calculations aren't required only explanations/graphs are needed for these problems. Unless I have not been given enough info

No additional information should be needed. Specific calculations aren't required only explanations/graphs are needed for these problems. Unless I have not been given enough info by the instructor.

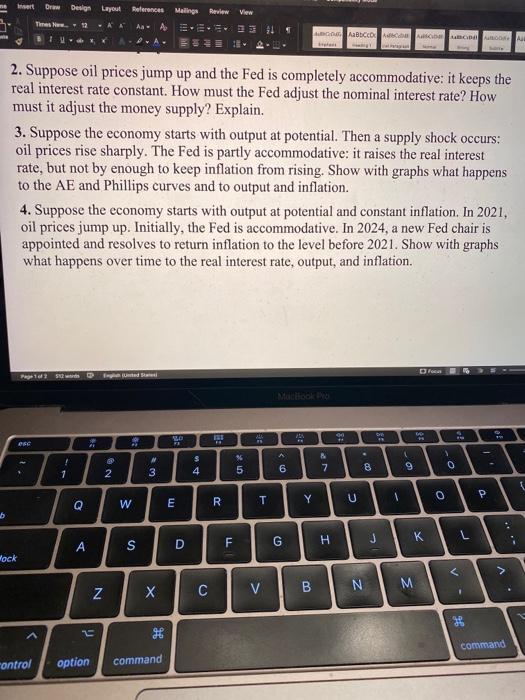

mert Dr Design Layout References Malings Review View There w... 12 AA A A ABECEDA UM MODA 2. Suppose oil prices jump up and the Fed is completely accommodative: it keeps the real interest rate constant. How must the Fed adjust the nominal interest rate? How must it adjust the money supply? Explain. 3. Suppose the economy starts with output at potential. Then a supply shock occurs: oil prices rise sharply. The Fed is partly accommodative: it raises the real interest rate, but not by enough to keep inflation from rising. Show with graphs what happens to the AE and Phillips curves and to output and inflation. 4. Suppose the economy starts with output at potential and constant inflation. In 2021, oil prices jump up. Initially, the Fed is accommodative. In 2024, a new Fed chair is appointed and resolves to return inflation to the level before 2021. Show with graphs what happens over time to the real interest rate, output, and inflation. Da 102 SI LO 1 @ 2 ! 1 : $ 4 % 5 A 6 7 B 0 9 1 Y O T E U Q W R b J L A . G F D S Hock N B C M . V N H command control option command mert Dr Design Layout References Malings Review View There w... 12 AA A A ABECEDA UM MODA 2. Suppose oil prices jump up and the Fed is completely accommodative: it keeps the real interest rate constant. How must the Fed adjust the nominal interest rate? How must it adjust the money supply? Explain. 3. Suppose the economy starts with output at potential. Then a supply shock occurs: oil prices rise sharply. The Fed is partly accommodative: it raises the real interest rate, but not by enough to keep inflation from rising. Show with graphs what happens to the AE and Phillips curves and to output and inflation. 4. Suppose the economy starts with output at potential and constant inflation. In 2021, oil prices jump up. Initially, the Fed is accommodative. In 2024, a new Fed chair is appointed and resolves to return inflation to the level before 2021. Show with graphs what happens over time to the real interest rate, output, and inflation. Da 102 SI LO 1 @ 2 ! 1 : $ 4 % 5 A 6 7 B 0 9 1 Y O T E U Q W R b J L A . G F D S Hock N B C M . V N H command control option command

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts