Question: No additional information was provided. Question 2 (10 points) XYZ purchased an office building for $550,000 in 2010. On October 15, 2019, XYZ building was

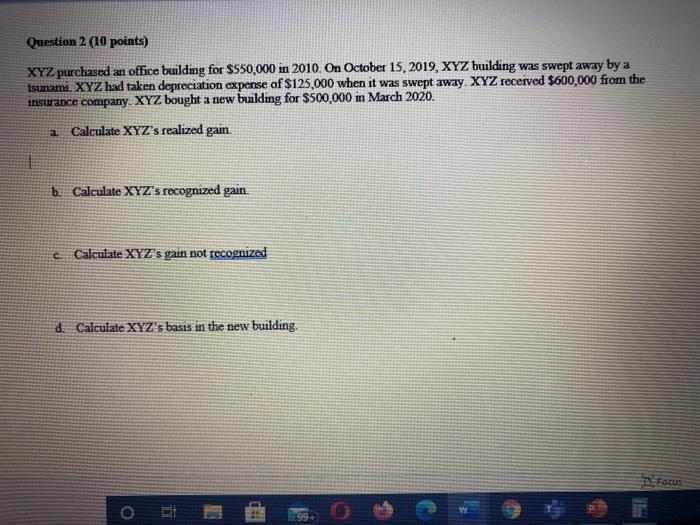

Question 2 (10 points) XYZ purchased an office building for $550,000 in 2010. On October 15, 2019, XYZ building was swept away by a tsunami. XYZ had taken depreciation expense of $125,000 when it was swept away. XYZ received $600,000 from the insurance company. XYZ bought a new building for $500,000 in March 2020. a Calculate XYZ's realized gam. 1 b. Calculate XYZ's recognized gain c. Calculate XYZ's gain not recognized d. Calculate XYZ's basis in the new building, 99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts