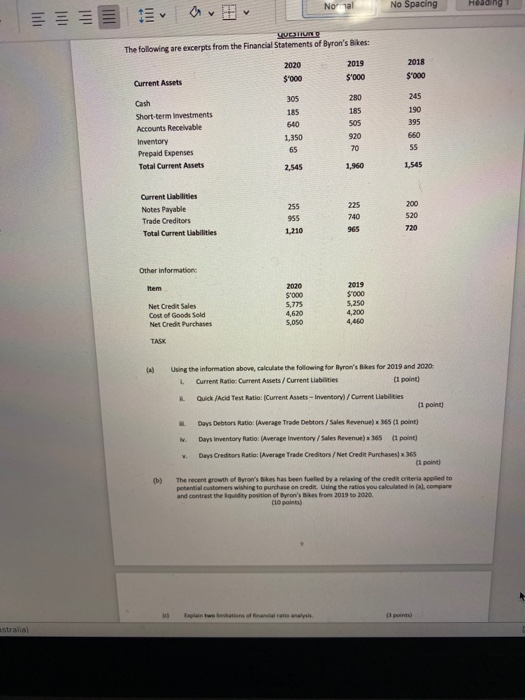

Question: No al No Spacing Heading v WIRD The following are excerpts from the Financial Statements of Byron's Bikes: 2020 $ 000 2019 $'000 2018 S'000

No al No Spacing Heading v WIRD The following are excerpts from the Financial Statements of Byron's Bikes: 2020 $ 000 2019 $'000 2018 S'000 Current Assets Cash Short-term Investments Accounts Receivable Inventory Prepaid Expenses Total Current Assets 305 185 640 1,350 65 280 185 SOS 920 70 245 190 395 660 55 2,545 1,960 1,545 Current Liabilities Notes Payable Trade Creditors Total Current abilities 255 955 1,210 225 740 965 200 520 720 Other information: Item Net Credit Sales Cost of Goods Sold Net Credit Purchases 2020 $000 5,775 4,620 5,050 2019 S'000 5,250 4,200 4,460 TASK Using the information above, calculate the following for Byron's Bikes for 2019 and 2020: Current Ratio: Current Assets / Current Liabilities (1 point) Quick /Acid Test Ratio: Current Assets - Inventory/Current Liabilities (1 point) Days Debtors Ratio: Average Trade Debtors / Sales Revenue 365 (1 point) Days Inventory Ratio: (Average Inventory/Sales Revenue) x 365 (1 point) Days Creditors Ratio: Average Trade Creditors/Net Credit Purchases) x 36 ci point The recent growth of Byron's bikes has been fuelled by a relaxing of the credit criteris applied to potential customers willing to purchase on credit. Using the ratios you calculated in al.compare and contract the quidity position of Byron's Bikes from 2019 to 2020. Clopoint (b) points) stralia

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts