Question: NO CONTRACT SIZE IS GIVEN! This is for a Ag Finance Class. PROBLEM 6 (50 points) Suppose that you know today that you will be

NO CONTRACT SIZE IS GIVEN! This is for a Ag Finance Class.

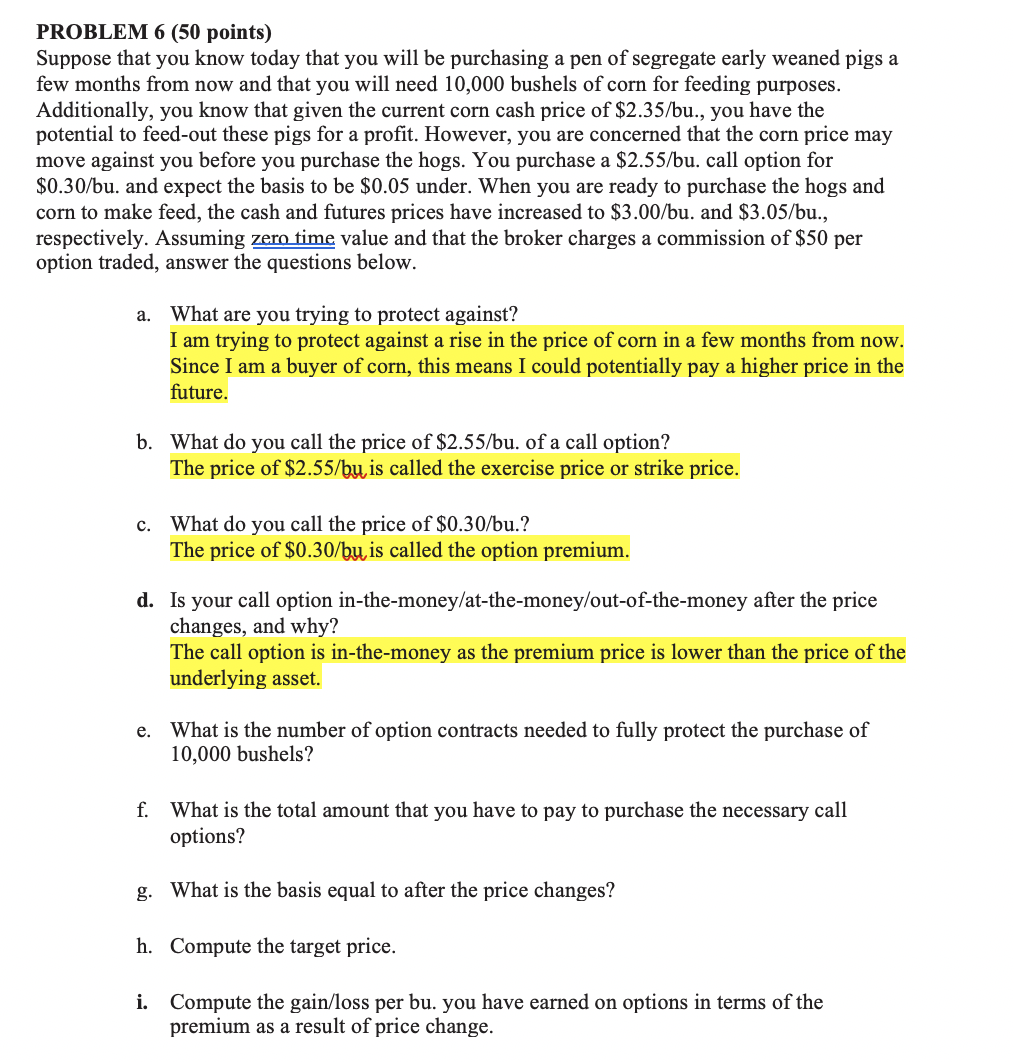

PROBLEM 6 (50 points) Suppose that you know today that you will be purchasing a pen of segregate early weaned pigs a few months from now and that you will need 10,000 bushels of corn for feeding purposes. Additionally, you know that given the current corn cash price of $2.35/bu., you have the potential to feed-out these pigs for a profit. However, you are concerned that the corn price may move against you before you purchase the hogs. You purchase a $2.55/bu. call option for $0.30/bu. and expect the basis to be $0.05 under. When you are ready to purchase the hogs and corn to make feed, the cash and futures prices have increased to $3.00/bu. and $3.05/bu., respectively. Assuming zero time value and that the broker charges a commission of $50 per option traded, answer the questions below. a. What are you trying to protect against? I am trying to protect against a rise in the price of corn in a few months from now. Since I am a buyer of corn, this means I could potentially pay a higher price in the future. b. What do you call the price of $2.55/bu. of a call option? The price of $2.55/bu is called the exercise price or strike price. c. What do you call the price of $0.30/bu.? The price of $0.30/bu is called the option premium. d. Is your call option in-the-money/at-the-money/out-of-the-money after the price changes, and why? The call option is in-the-money as the premium price is lower than the price of the underlying asset. e. What is the number of option contracts needed to fully protect the purchase of 10,000 bushels? f. What is the total amount that you have to pay to purchase the necessary call options? g. What is the basis equal to after the price changes? h. Compute the target price. i. Compute the gain/loss per bu. you have earned on options in terms of the premium as a result of price change. PROBLEM 6 (50 points) Suppose that you know today that you will be purchasing a pen of segregate early weaned pigs a few months from now and that you will need 10,000 bushels of corn for feeding purposes. Additionally, you know that given the current corn cash price of $2.35/bu., you have the potential to feed-out these pigs for a profit. However, you are concerned that the corn price may move against you before you purchase the hogs. You purchase a $2.55/bu. call option for $0.30/bu. and expect the basis to be $0.05 under. When you are ready to purchase the hogs and corn to make feed, the cash and futures prices have increased to $3.00/bu. and $3.05/bu., respectively. Assuming zero time value and that the broker charges a commission of $50 per option traded, answer the questions below. a. What are you trying to protect against? I am trying to protect against a rise in the price of corn in a few months from now. Since I am a buyer of corn, this means I could potentially pay a higher price in the future. b. What do you call the price of $2.55/bu. of a call option? The price of $2.55/bu is called the exercise price or strike price. c. What do you call the price of $0.30/bu.? The price of $0.30/bu is called the option premium. d. Is your call option in-the-money/at-the-money/out-of-the-money after the price changes, and why? The call option is in-the-money as the premium price is lower than the price of the underlying asset. e. What is the number of option contracts needed to fully protect the purchase of 10,000 bushels? f. What is the total amount that you have to pay to purchase the necessary call options? g. What is the basis equal to after the price changes? h. Compute the target price. i. Compute the gain/loss per bu. you have earned on options in terms of the premium as a result of price change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts