Question: There is no contract size given! This is for the Ag Finance class. PROBLEM 6 (50 points) Suppose that you know today that you will

There is no contract size given! This is for the Ag Finance class.

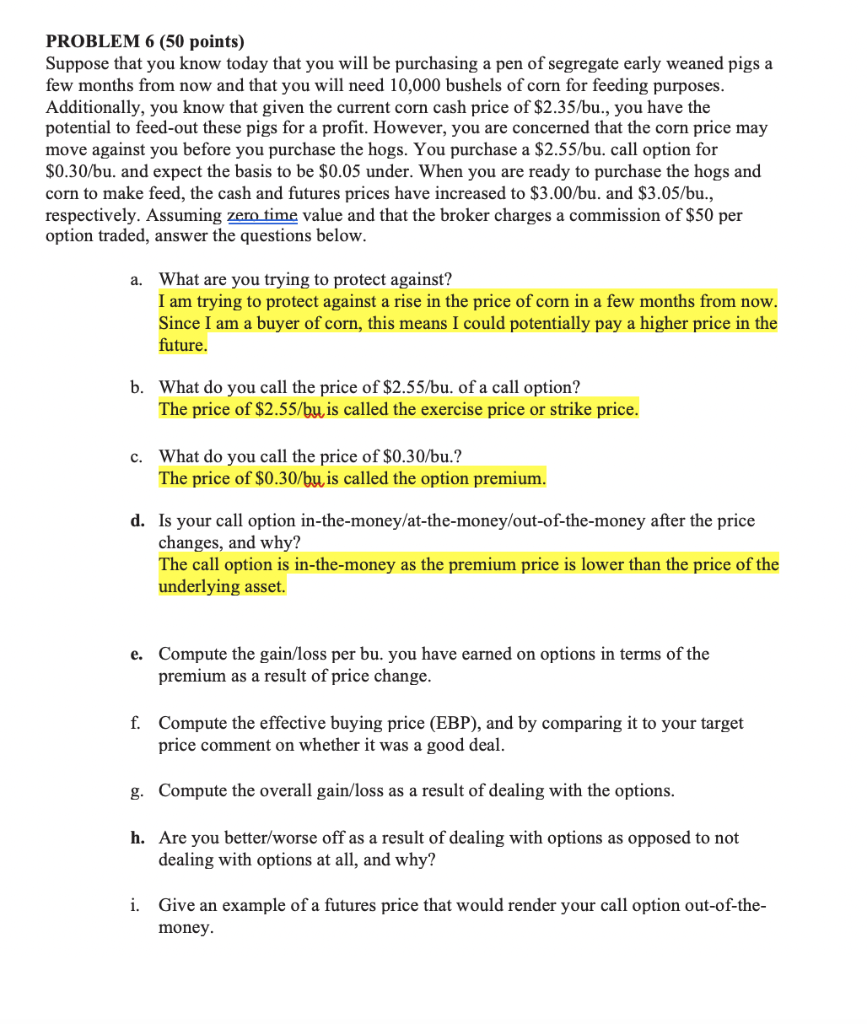

PROBLEM 6 (50 points) Suppose that you know today that you will be purchasing a pen of segregate early weaned pigs a few months from now and that you will need 10,000 bushels of corn for feeding purposes. Additionally, you know that given the current corn cash price of $2.35/bu., you have the potential to feed-out these pigs for a profit. However, you are concerned that the corn price may move against you before you purchase the hogs. You purchase a $2.55/bu. call option for $0.30/bu. and expect the basis to be $0.05 under. When you are ready to purchase the hogs and corn to make feed, the cash and futures prices have increased to $3.00/bu. and $3.05/bu.. respectively. Assuming zero time value and that the broker charges a commission of $50 per option traded, answer the questions below. a. What are you trying to protect against? I am trying to protect against a rise in the price of corn in a few months from now. Since I am a buyer of corn, this means I could potentially pay a higher price in the future. b. What do you call the price of $2.55/bu. of a call option? The price of $2.55/bu, is called the exercise price or strike price. c. What do you call the price of $0.30/bu.? The price of $0.30/bu is called the option premium. d. Is your call option in-the-money/at-the-money/out-of-the-money after the price changes, and why? The call option is in-the-money as the premium price is lower than the price of the underlying asset. e. Compute the gain/loss per bu. you have earned on options in terms of the premium as a result of price change. f. Compute the effective buying price (EBP), and by comparing it to your target price comment on whether it was a good deal. g. Compute the overall gain/loss as a result of dealing with the options. h. Are you better/worse off as a result of dealing with options as opposed to not dealing with options at all, and why? i. Give an example of a futures price that would render your call option out-of-the- money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts