Question: no excel and do a step by step to how you get to the solution and use formulas! 6. Gigliola Corporation is considering two investment

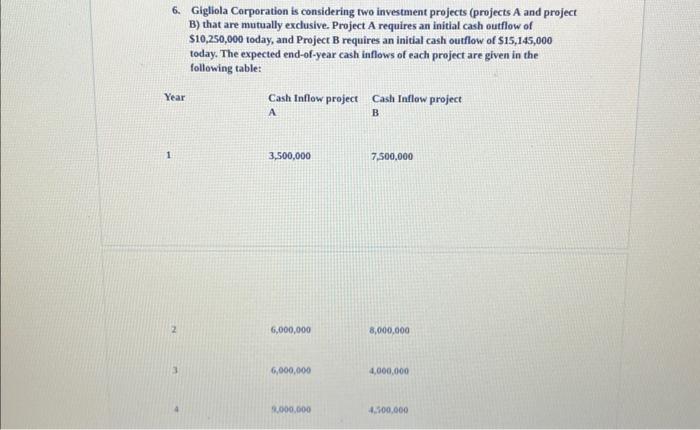

6. Gigliola Corporation is considering two investment projects (projects A and project B) that are mutually exclusive. Project A requires an initial cash outflow of $10,250,000 today, and Project B requires an initial cash outflow of $15,145,000 today. The expected end-of-year cash inflows of each project are given in the following table: The weighted average cost of capital is 11.25% for both projects. a. What is the IRR of each project? b. What is the NPV of each project? c. What is MIRR of each project? d. What is discounted payback of each project? e. Which project should Gigliola Corporation take using NPV approach? Please explain why. 7. CitaVecehia Corporation is evaluating to purchase of new equipment. The price of the equipment, including shipping and installation, is $166,000. The equipment is fully depreciated at the time of purchase. The equipment would be sold after three years for $74,600. The equipment requires a $6,250 increase in net operating working capital. The new equipment would not affect the revenue, but the pretax labor cost would decline by $85,200 per year. The company tax rate is 26 percent, and the WACC is 11.23 percent. What is the NPV of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts