Question: No Excel I need to know how to do it for a test. Thank you Bixby Inc. is evaluating expansion into a new market. The

No Excel I need to know how to do it for a test. Thank you

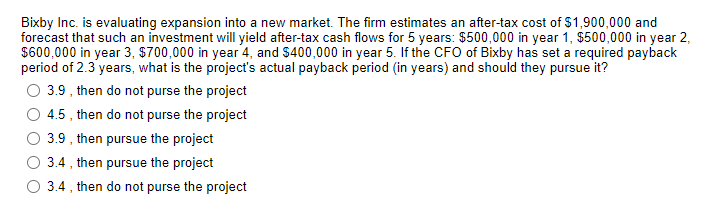

Bixby Inc. is evaluating expansion into a new market. The firm estimates an after-tax cost of $1,900,000 and forecast that such an investment will yield after-tax cash flows for 5 years: $500,000 in year 1, $500,000 in year 2, $600,000 in year 3, $700,000 in year 4, and $400,000 in year 5. If the CFO of Bixby has set a required payback period of 2.3 years, what is the project's actual payback period in years) and should they pursue it? 3.9, then do not purse the project 4.5, then do not purse the project 3.9, then pursue the project 3.4, then pursue the project 3.4, then do not purse the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts