Question: No excel please and can you please show your work? I cannot figure out how to find N(d2) Question 30 (1 point) A hedge fund

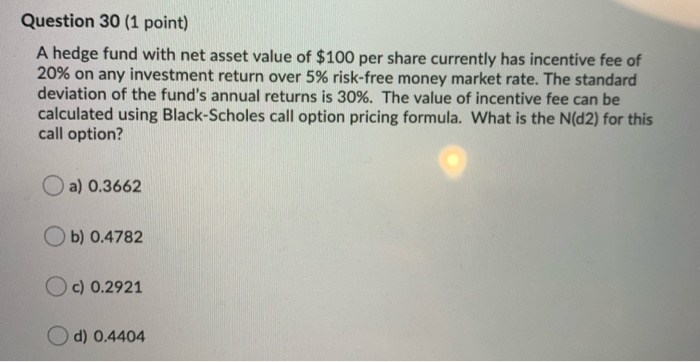

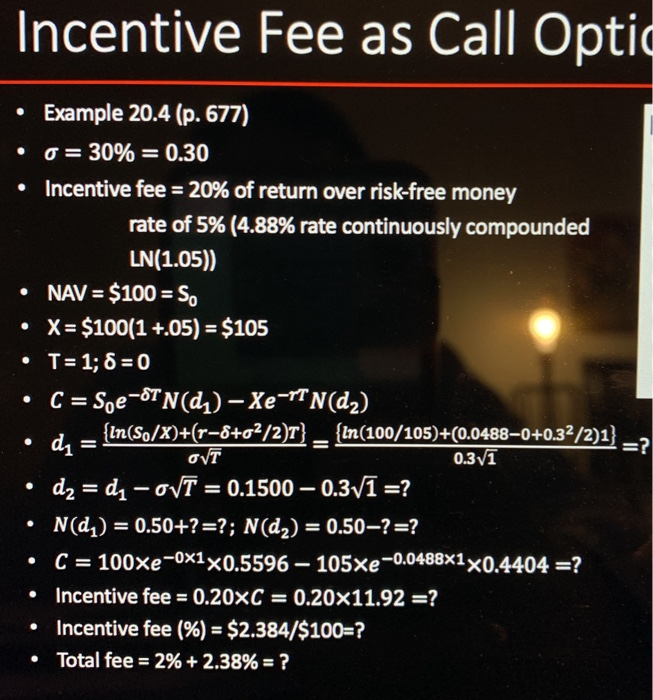

Question 30 (1 point) A hedge fund with net asset value of $100 per share currently has incentive fee of 20% on any investment return over 5% risk-free money market rate. The standard deviation of the fund's annual returns is 30%. The value of incentive fee can be calculated using Black-Scholes call option pricing formula. What is the N(D2) for this call option? a) 0.3662 Ob) 0.4782 Oc) 0.2921 d) 0.4404 Incentive Fee as Call Optic Example 20.4 (p. 677) o = 30% = 0.30 Incentive fee = 20% of return over risk-free money rate of 5% (4.88% rate continuously compounded LN(1.05)) NAV = $100 = S. X = $100(1 +.05) = $105 T= 1; 8 = 0 C = Spe-8TN(04)-Xe-TN(d)) d -{In(So/X)+(r-8+02/2)T} _{In(100/105)+(0.0488-0+0.32/2)1} 0.3V1 d2 = d7 - Ovt = 0.1500 0.3V1 =? Nd) = 0.50+?=?; Ndx) = 0.50?=? C = 100xe-0x1x0.5596 - 105xe-0.0488x1x0.4404 =? Incentive fee = 0.20XC = 0.20x11.92 =? Incentive fee (%) = $2.384/$100=? Total fee = 2% + 2.38% = ? OVT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts