Question: NO EXPLANATION NECESSARY, just the final answer for 4 MC questions, it would help me tremendously! (thumbs up) 167 Use the following information about the

NO EXPLANATION NECESSARY, just the final answer for 4 MC questions, it would help me tremendously! (thumbs up)

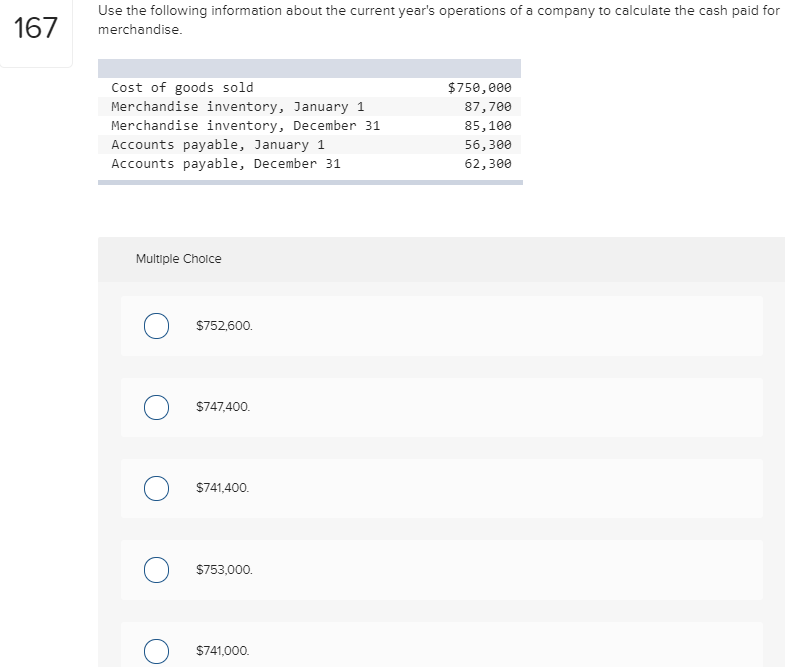

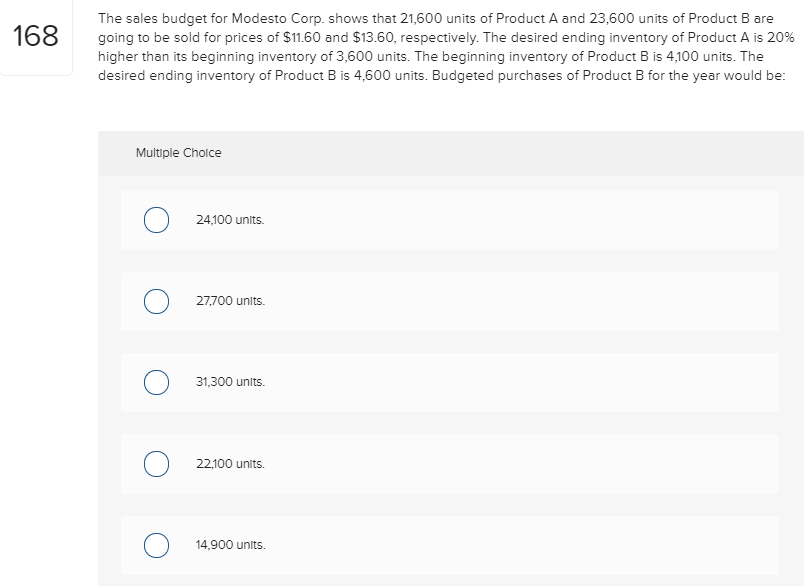

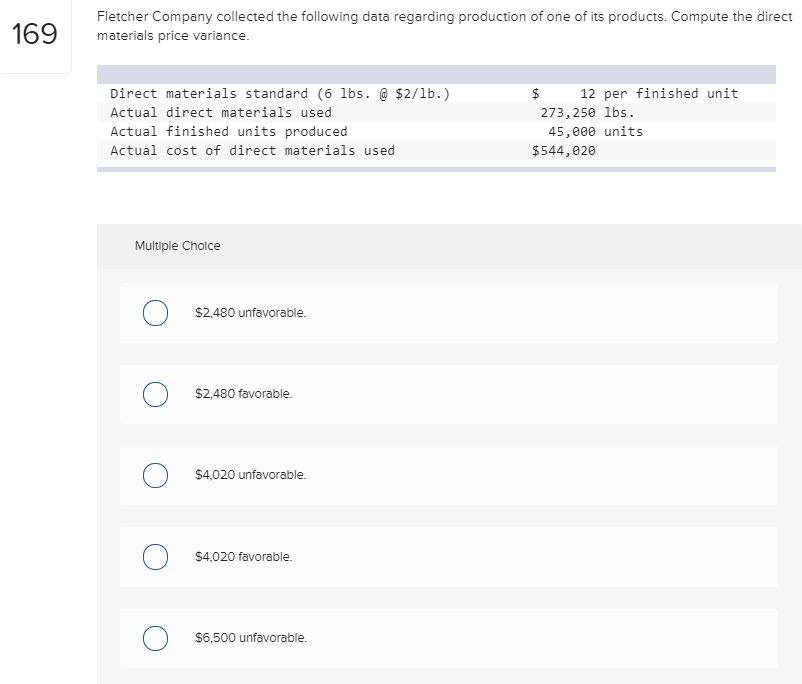

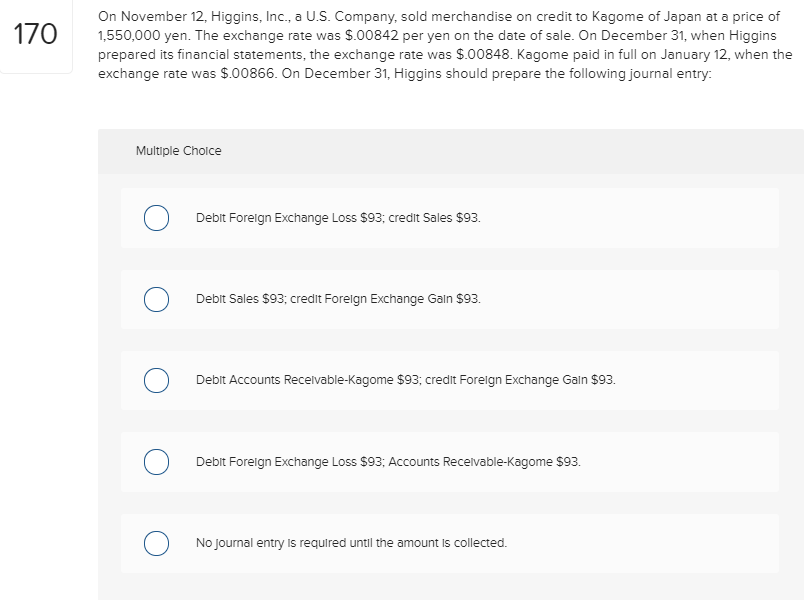

167 Use the following information about the current year's operations of a company to calculate the cash paid for merchandise. Cost of goods sold Merchandise inventory, January 1 Merchandise inventory, December 31 Accounts payable, January 1 Accounts payable, December 31 $750,000 87,700 85,100 56,300 62,300 Multiple Choice 0 $752,600 O $747,400 O $741,400 0 $753,000. 0 $741,000. 168 The sales budget for Modesto Corp. shows that 21,600 units of Product A and 23,600 units of Product B are going to be sold for prices of $11.60 and $13.60, respectively. The desired ending inventory of Product A is 20% higher than its beginning inventory of 3,600 units. The beginning inventory of Product B is 4,100 units. The desired ending inventory of Product B is 4,600 units. Budgeted purchases of Product B for the year would be: Multiple Choice 24100 units. 27,700 units. 31,300 units. 22100 units. 14,900 units. 169 Fletcher Company collected the following data regarding production of one of its products. Compute the direct materials price variance. Direct materials standard (6 lbs. @ $2/lb.) Actual direct materials used Actual finished units produced Actual cost of direct materials used $ 12 per finished unit 273, 250 lbs. 45,000 units $544,620 Multiple Choice O $2,480 unfavorable. ) $2,480 favorable. 0 $4,020 unfavorable. O $4,020 favorable. O $6,500 unfavorable. 170 On November 12, Higgins, Inc., a U.S. Company, sold merchandise on credit to Kagome of Japan at a price of 1,550,000 yen. The exchange rate was $.00842 per yen on the date of sale. On December 31, when Higgins prepared its financial statements, the exchange rate was $.00848. Kagome paid in full on January 12, when the exchange rate was $.00866. On December 31, Higgins should prepare the following journal entry: Multiple Choice O Debit Foreign Exchange Loss $93; credit Sales $93. Debit Sales $93; credit Forelgn Exchange Gain $93. O Debit Accounts Receivable-Kagome $93; credit Foreign Exchange Gain $93. 0 Debit Foreign Exchange Loss $93; Accounts Receivable-Kagome $93. 0 No journal entry is required until the amount is collected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts