Question: NO EXPLANATION NECESSARY, just the final answer for 4 MC questions, it would help me tremendously! (thumbs up) 69 Masterson Company's budgeted production calls for

NO EXPLANATION NECESSARY, just the final answer for 4 MC questions, it would help me tremendously! (thumbs up)

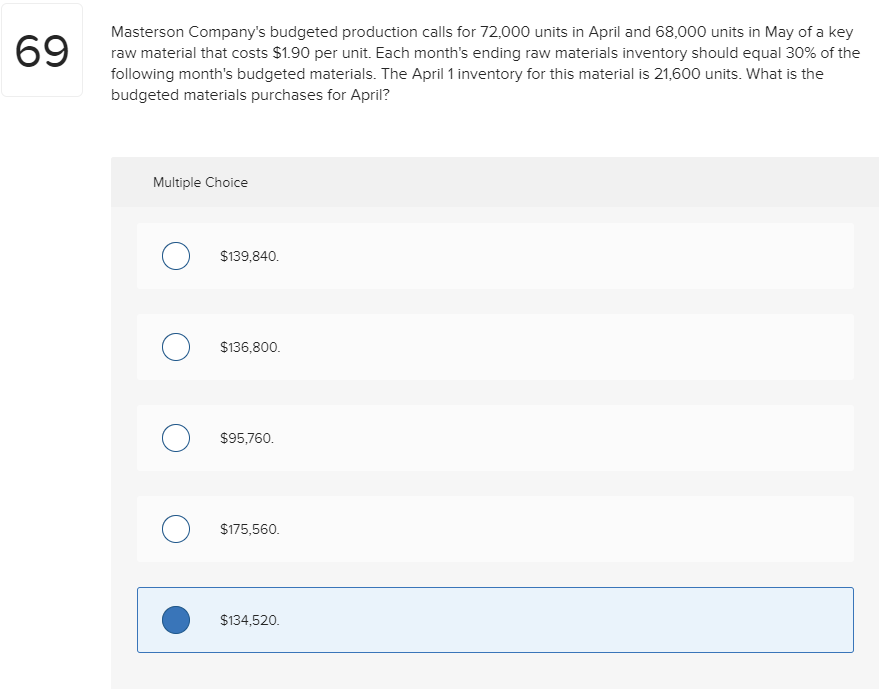

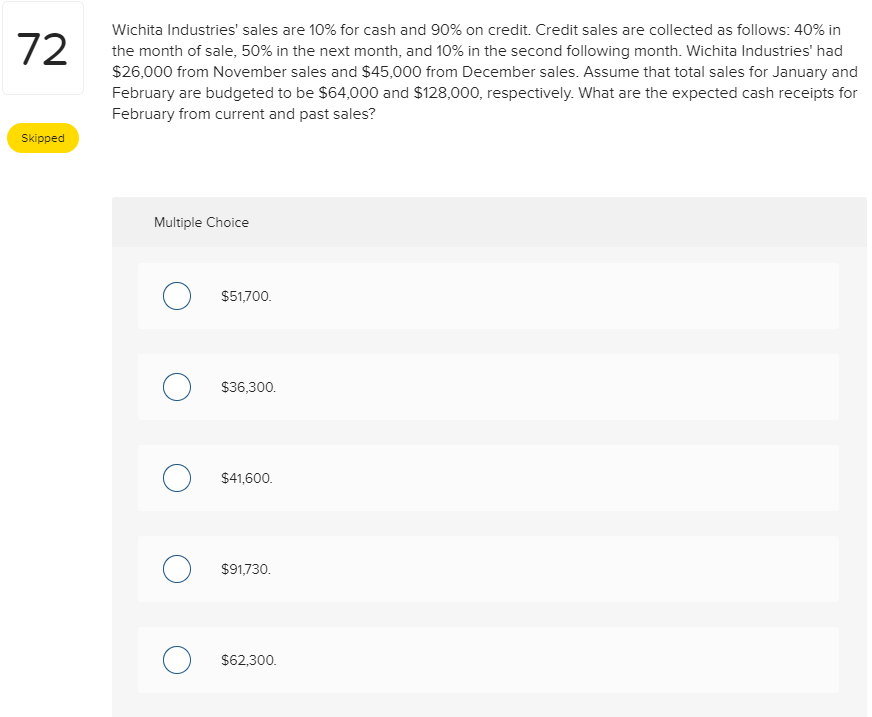

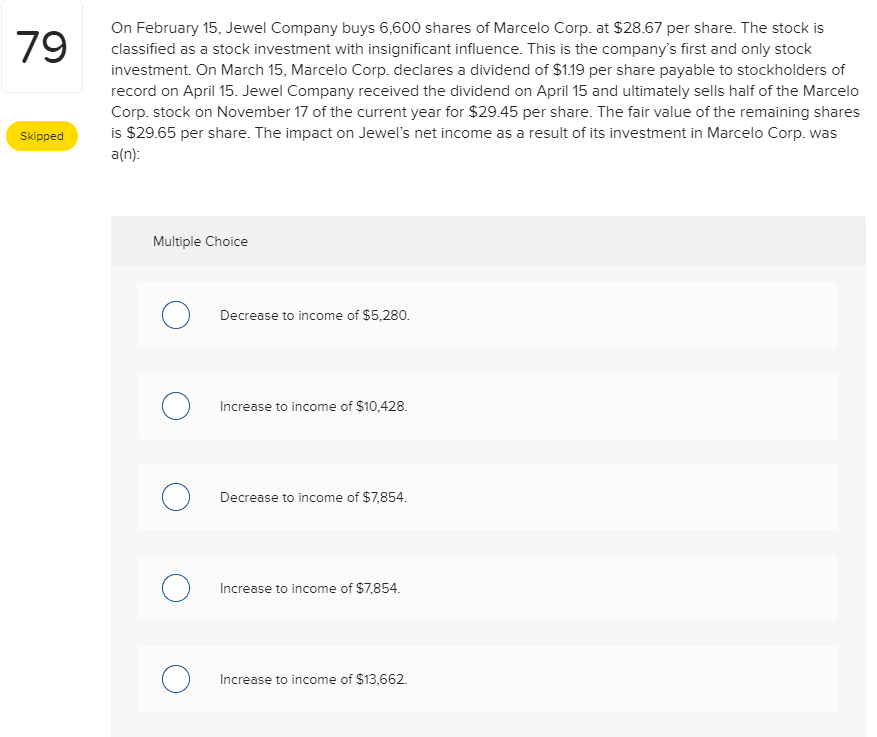

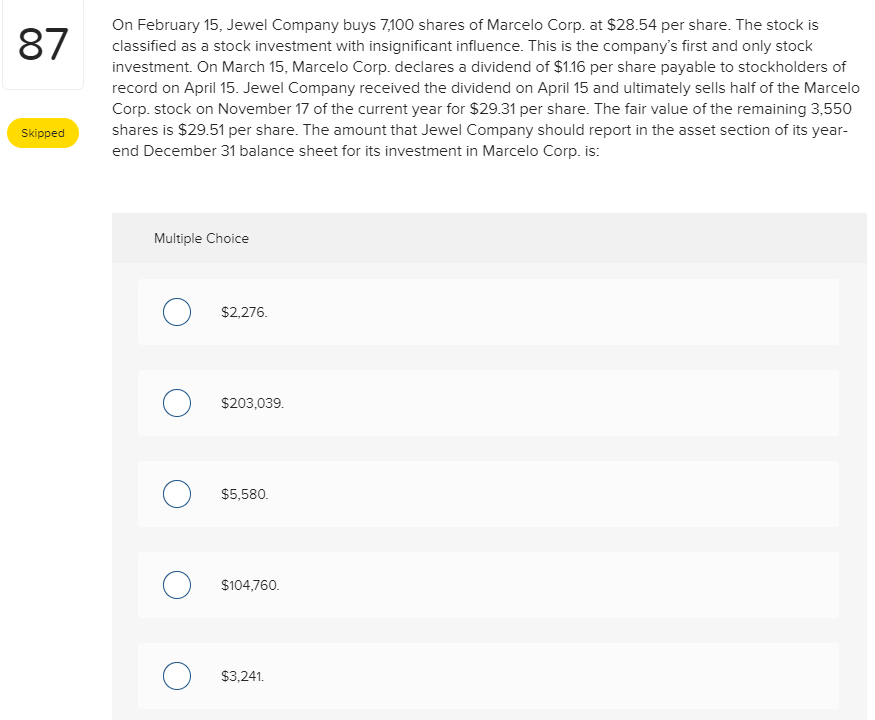

69 Masterson Company's budgeted production calls for 72,000 units in April and 68,000 units in May of a key raw material that costs $1.90 per unit. Each month's ending raw materials inventory should equal 30% of the following month's budgeted materials. The April 1 inventory for this material is 21,600 units. What is the budgeted materials purchases for April? Multiple Choice $139,840. O $136,800 $95,760 $175,560. $134,520 Wichita Industries' sales are 10% for cash and 90% on credit. Credit sales are collected as follows: 40% in the month of sale, 50% in the next month, and 10% in the second following month. Wichita Industries' had $26.000 from November sales and $45,000 from December sales. Assume that total sales for January and February are budgeted to be $64,000 and $128,000, respectively. What are the expected cash receipts for February from current and past sales? Skipped Multiple Choice 0 $51,700 O $36,300. O $41,600. 0 $91,730 O $62,300 70 On February 15, Jewel Company buys 6,600 shares of Marcelo Corp. at $28.67 per share. The stock is classified as a stock investment with insignificant influence. This is the company's first and only stock investment. On March 15, Marcelo Corp. declares a dividend of $1.19 per share payable to stockholders of record on April 15. Jewel Company received the dividend on April 15 and ultimately sells half of the Marcelo Corp. stock on November 17 of the current year for $29.45 per share. The fair value of the remaining shares is $29.65 per share. The impact on Jewel's net income as a result of its investment in Marcelo Corp. was an): Skipped Multiple Choice O Decrease to income of $5,280. O Increase to income of $10,428. O Decrease to income of $7,854. O Increase to income of $7,854. O Increase to income of $13,662 On February 15, Jewel Company buys 7,100 shares of Marcelo Corp. at $28.54 per share. The stock is classified as a stock investment with insignificant influence. This is the company's first and only stock investment. On March 15, Marcelo Corp. declares a dividend of $1.16 per share payable to stockholders of record on April 15. Jewel Company received the dividend on April 15 and ultimately sells half of the Marcelo Corp. stock on November 17 of the current year for $29.31 per share. The fair value of the remaining 3,550 shares is $29.51 per share. The amount that Jewel Company should report in the asset section of its year- end December 31 balance sheet for its investment in Marcelo Corp. is: Skipped Multiple Choice 0 $2,276. 0 $203,039. 0 $5,580. 0 $104,760. 0 $3,241

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts