Question: No handwritten solutions please. Consider the information in Table 2 about an investment opportunity that a hedge fund is considering. Table 2 15 million Expected

No handwritten solutions please.

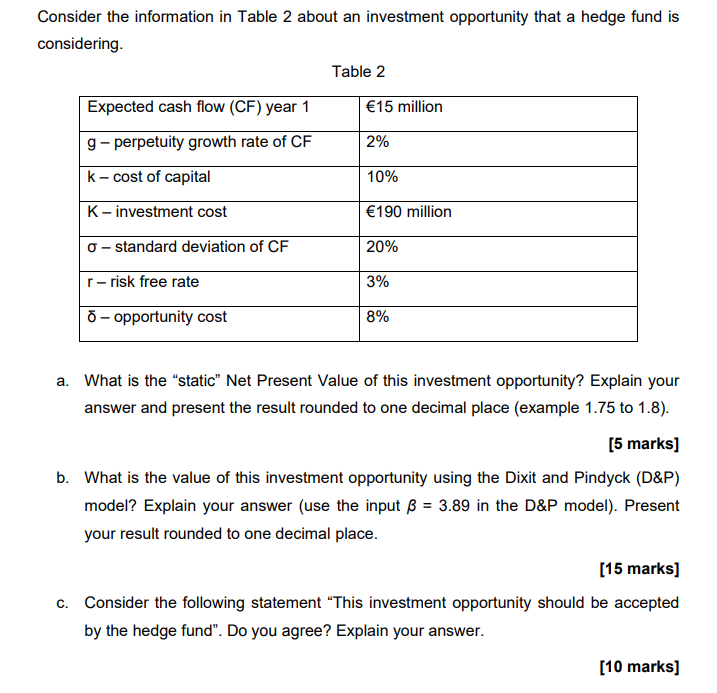

Consider the information in Table 2 about an investment opportunity that a hedge fund is considering. Table 2 15 million Expected cash flow (CF) year 1 g-perpetuity growth rate of CF K-cost of capital 2% 10% 190 million K-investment cost 0 - standard deviation of CF 20% r-risk free rate 3% o - opportunity cost 8% a. What is the "static" Net Present Value of this investment opportunity? Explain your answer and present the result rounded to one decimal place (example 1.75 to 1.8). [5 marks] b. What is the value of this investment opportunity using the Dixit and Pindyck (D&P) model? Explain your answer (use the input B = 3.89 in the D&P model). Present your result rounded to one decimal place. [15 marks] C. Consider the following statement This investment opportunity should be accepted by the hedge fund. Do you agree? Explain your ans answer. [10 marks] Consider the information in Table 2 about an investment opportunity that a hedge fund is considering. Table 2 15 million Expected cash flow (CF) year 1 g-perpetuity growth rate of CF K-cost of capital 2% 10% 190 million K-investment cost 0 - standard deviation of CF 20% r-risk free rate 3% o - opportunity cost 8% a. What is the "static" Net Present Value of this investment opportunity? Explain your answer and present the result rounded to one decimal place (example 1.75 to 1.8). [5 marks] b. What is the value of this investment opportunity using the Dixit and Pindyck (D&P) model? Explain your answer (use the input B = 3.89 in the D&P model). Present your result rounded to one decimal place. [15 marks] C. Consider the following statement This investment opportunity should be accepted by the hedge fund. Do you agree? Explain your ans answer. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts