Question: No images plz, except excel output. Plz do only Q. 4 & 5 only ABC Manufacture Pty Ltd has two products, Product A and Product

No images plz, except excel output. Plz do only Q. 4 & 5 only

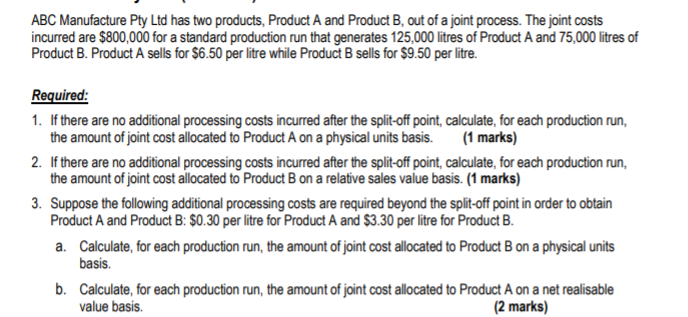

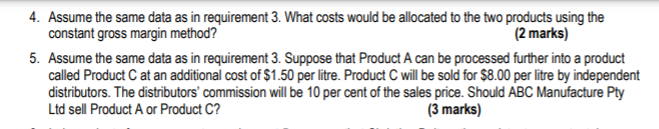

ABC Manufacture Pty Ltd has two products, Product A and Product B, out of a joint process. The joint costs incurred are $800,000 for a standard production run that generates 125,000 litres of Product A and 75,000 litres of Product B. Product A sells for $6.50 per litre while Product B sells for $9.50 per litre. Required: 1. If there are no additional processing costs incurred after the split-off point, calculate, for each production run, the amount of joint cost allocated to Product A on a physical units basis. (1 marks) 2. If there are no additional processing costs incurred after the split-off point, calculate, for each production run, the amount of joint cost allocated to Product B on a relative sales value basis. (1 marks) 3. Suppose the following additional processing costs are required beyond the split-off point in order to obtain Product A and Product B: $0.30 per litre for Product A and $3.30 per litre for Product B. a. Calculate, for each production run, the amount of joint cost allocated to Product B on a physical units basis. b. Calculate, for each production run, the amount of joint cost allocated to Product A on a net realisable value basis. (2 marks) 4. Assume the same data as in requirement 3. What costs would be allocated to the two products using the constant gross margin method? (2 marks) 5. Assume the same data as in requirement 3. Suppose that Product A can be processed further into a product called Product Cat an additional cost of $1.50 per litre. Product C will be sold for $8.00 per litre by independent distributors. The distributors' commission will be 10 per cent of the sales price. Should ABC Manufacture Pty Ltd sell Product A or Product C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts