Question: NO MISSING DATA. IMMEDIATE ANSWER PLEASE. Compute total income and tax liability of mr.shiva for the A.Y. 2020-21 Mr. Shiva, born in India in the

NO MISSING DATA. IMMEDIATE ANSWER PLEASE.

Compute total income and tax liability of mr.shiva for the A.Y. 2020-21

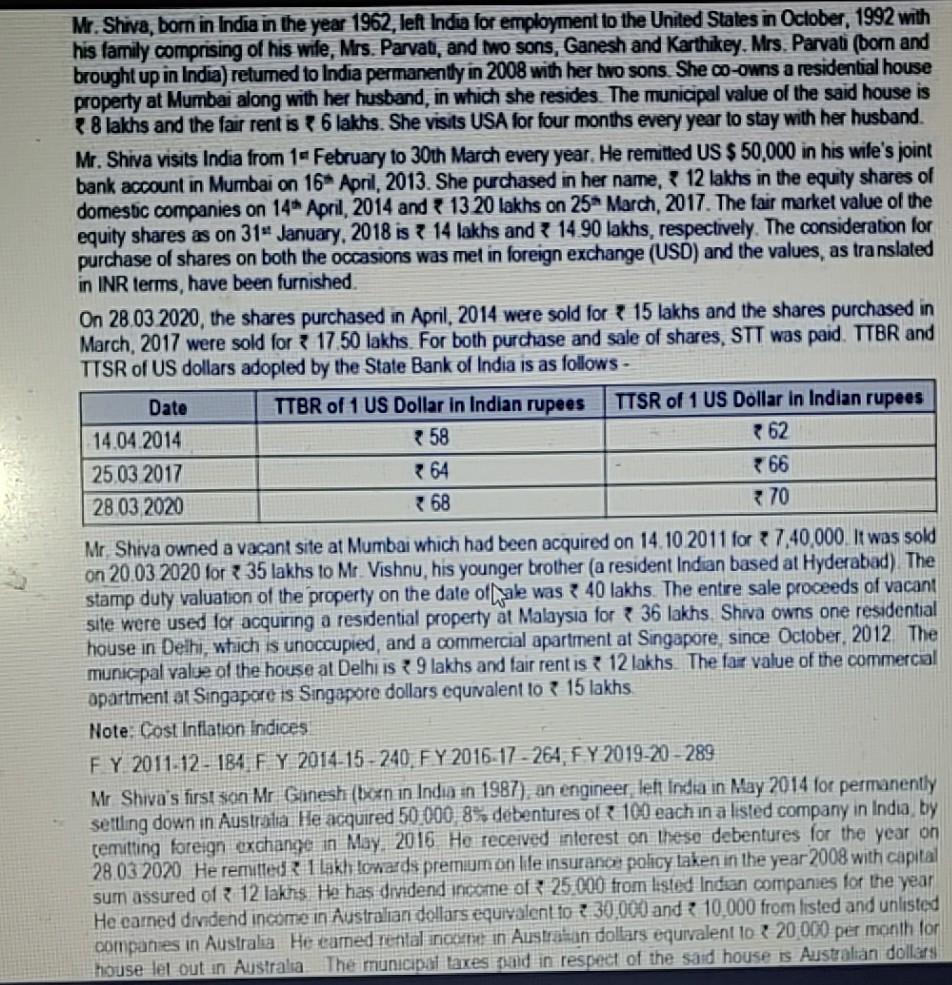

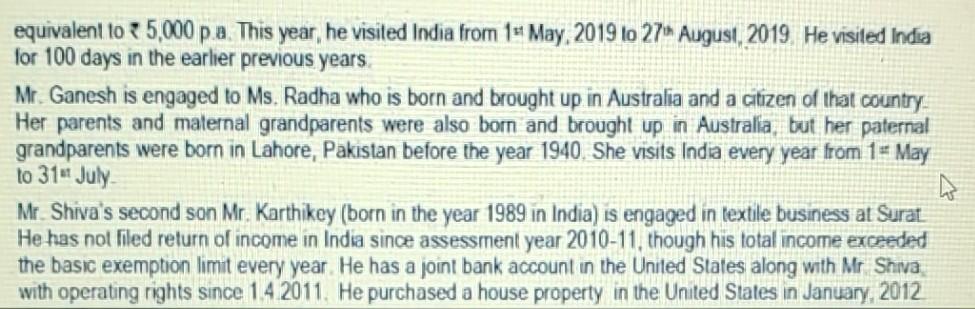

Mr. Shiva, born in India in the year 1962, left India for employment to the United States in October, 1992 with his family comprising of his wife, Mrs. Parvat, and two sons, Ganesh and Karthikey, Mrs. Parvali (born and brought up in India) retumed to India permanently in 2008 with her bwo sons. She co-owns a residential house property at Mumbai along with her husband, in which she resides. The municipal value of the said house is 8 lakhs and the fair rent is 6 lakhs. She visits USA for four months every year to stay with her husband. Mr. Shiva visits India from 1 - February to 30th March every year. He remitted US $ 50,000 in his wife's joint bank account in Mumbai on 16 April, 2013. She purchased in her name, 12 lakhs in the equity shares of domestic companies on 14 April, 2014 and 13 20 lakhs on 25 March, 2017. The fair market value of the equity shares as on 314 January, 2018 is 14 lakhs and 14.90 lakhs, respectively. The consideration for purchase of shares on both the occasions was met in foreign exchange (USD) and the values, as translated in INR terms, have been furnished. On 28.03 2020, the shares purchased in April, 2014 were sold for 15 lakhs and the shares purchased in March 2017 were sold for 3 17.50 lakhs. For both purchase and sale of shares, STT was paid. TTBR and TTSR of US dollars adopted by the State Bank of India is as follows - Date TTBR of 1 US Dollar in Indian rupees TTSR of 1 US Dollar in Indian rupees 14.04.2014 8 58 62 25 03 2017 * 64 66 28.03 2020 68 70 Mr. Shiva owned a vacant site at Mumbai which had been acquired on 14.10 2011 for 7,40,000. It was sold on 20.03 2020 for 35 lakhs to Mr. Vishnu, his younger brother (a resident Indian based at Hyderabad) The stamp duty valuation of the property on the date of Wale was ? 40 lakhs. The entre sale proceeds of vacant site were used for acquiring a residential property at Malaysia for ? 36 lakhs Shiva owns one residential house in Delhi, which is unoccupied, and a commercial apartment at Singapore, since October, 2012 The municpal value of the house at Delhi is 9 lakhs and fair rent is 12 lakhs. The far value of the commercial apartment at Singapore is Singapore dollars equivalent to * 15 lakhs Note: Cost Inflation Indices FY 2011.12 - 184 FY 2014-15 - 240 FY 2016-17 - 264, FY 2019-20 - 289 Mr Shiva's first son Mr Ginesh (born in India in 1987), an engineer left India in May 2014 for permanently settling down in Australia He acquired 50 000 8% debentures of 100 each in a listed company in India by remitting foreign exchange in May 2015 He received interest on these debentures for the year on 28.03.2020 He remuted: 1 lakh towards premium on life insurance policy taken in the year 2008 with capital sum assured of 3 12 lakhs. He has dividend income of 25.000 from listed Indian companies for the year He camed dividend income in Australian dollars equivalent to 30.000 and 2 10,000 from listed and unlisted companies in Australia He camed rental incent in Australian dollars equivalent to 20 000 per month for house let out in Australia The municipat laxes and in respect of the said house is Australian dollars equivalent 10 35,000 p.a. This year, he visited India from 14 May, 2019 to 27 August, 2019 He visited India for 100 days in the earlier previous years Mr. Ganesh is engaged to Ms. Radha who is born and brought up in Australia and a citizen of that country Her parents and maternal grandparents were also born and brought up in Australia, but her paternal grandparents were born in Lahore, Pakistan before the year 1940. She visits India every year from 1= May to 314 July Mr. Shiva's second son Mr. Karthikey (born in the year 1989 in India) is engaged in textile business at Surat He has not filed return of income in India since assessment year 2010-11, though his total income exceeded the basic exemption limit every year. He has a joint bank account in the United States along with Mr Shiva with operating rights since 1.4 2011. He purchased a house property in the United States in January, 2012 Mr. Shiva, born in India in the year 1962, left India for employment to the United States in October, 1992 with his family comprising of his wife, Mrs. Parvat, and two sons, Ganesh and Karthikey, Mrs. Parvali (born and brought up in India) retumed to India permanently in 2008 with her bwo sons. She co-owns a residential house property at Mumbai along with her husband, in which she resides. The municipal value of the said house is 8 lakhs and the fair rent is 6 lakhs. She visits USA for four months every year to stay with her husband. Mr. Shiva visits India from 1 - February to 30th March every year. He remitted US $ 50,000 in his wife's joint bank account in Mumbai on 16 April, 2013. She purchased in her name, 12 lakhs in the equity shares of domestic companies on 14 April, 2014 and 13 20 lakhs on 25 March, 2017. The fair market value of the equity shares as on 314 January, 2018 is 14 lakhs and 14.90 lakhs, respectively. The consideration for purchase of shares on both the occasions was met in foreign exchange (USD) and the values, as translated in INR terms, have been furnished. On 28.03 2020, the shares purchased in April, 2014 were sold for 15 lakhs and the shares purchased in March 2017 were sold for 3 17.50 lakhs. For both purchase and sale of shares, STT was paid. TTBR and TTSR of US dollars adopted by the State Bank of India is as follows - Date TTBR of 1 US Dollar in Indian rupees TTSR of 1 US Dollar in Indian rupees 14.04.2014 8 58 62 25 03 2017 * 64 66 28.03 2020 68 70 Mr. Shiva owned a vacant site at Mumbai which had been acquired on 14.10 2011 for 7,40,000. It was sold on 20.03 2020 for 35 lakhs to Mr. Vishnu, his younger brother (a resident Indian based at Hyderabad) The stamp duty valuation of the property on the date of Wale was ? 40 lakhs. The entre sale proceeds of vacant site were used for acquiring a residential property at Malaysia for ? 36 lakhs Shiva owns one residential house in Delhi, which is unoccupied, and a commercial apartment at Singapore, since October, 2012 The municpal value of the house at Delhi is 9 lakhs and fair rent is 12 lakhs. The far value of the commercial apartment at Singapore is Singapore dollars equivalent to * 15 lakhs Note: Cost Inflation Indices FY 2011.12 - 184 FY 2014-15 - 240 FY 2016-17 - 264, FY 2019-20 - 289 Mr Shiva's first son Mr Ginesh (born in India in 1987), an engineer left India in May 2014 for permanently settling down in Australia He acquired 50 000 8% debentures of 100 each in a listed company in India by remitting foreign exchange in May 2015 He received interest on these debentures for the year on 28.03.2020 He remuted: 1 lakh towards premium on life insurance policy taken in the year 2008 with capital sum assured of 3 12 lakhs. He has dividend income of 25.000 from listed Indian companies for the year He camed dividend income in Australian dollars equivalent to 30.000 and 2 10,000 from listed and unlisted companies in Australia He camed rental incent in Australian dollars equivalent to 20 000 per month for house let out in Australia The municipat laxes and in respect of the said house is Australian dollars equivalent 10 35,000 p.a. This year, he visited India from 14 May, 2019 to 27 August, 2019 He visited India for 100 days in the earlier previous years Mr. Ganesh is engaged to Ms. Radha who is born and brought up in Australia and a citizen of that country Her parents and maternal grandparents were also born and brought up in Australia, but her paternal grandparents were born in Lahore, Pakistan before the year 1940. She visits India every year from 1= May to 314 July Mr. Shiva's second son Mr. Karthikey (born in the year 1989 in India) is engaged in textile business at Surat He has not filed return of income in India since assessment year 2010-11, though his total income exceeded the basic exemption limit every year. He has a joint bank account in the United States along with Mr Shiva with operating rights since 1.4 2011. He purchased a house property in the United States in January, 2012

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts