Question: No Name Co issues a bond today that will pay a coupon of 8%, twice a year. The yield to maturity for this company

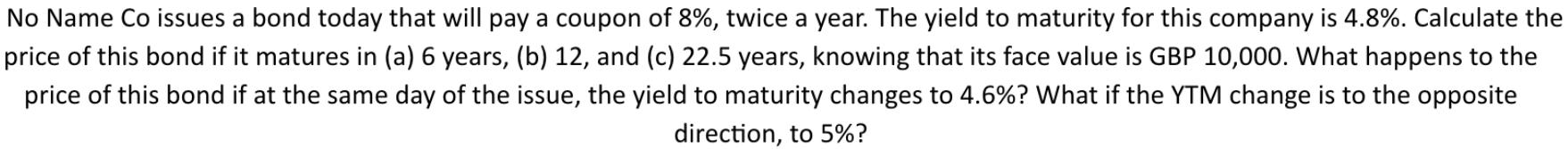

No Name Co issues a bond today that will pay a coupon of 8%, twice a year. The yield to maturity for this company is 4.8%. Calculate the price of this bond if it matures in (a) 6 years, (b) 12, and (c) 22.5 years, knowing that its face value is GBP 10,000. What happens to the price of this bond if at the same day of the issue, the yield to maturity changes to 4.6%? What if the YTM change is to the opposite direction, to 5%?

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts