Question: no need explanation answers only 1 Mark A potential impact of increasing the capital adequacy ratio (CAR) to 9.5% is --------------------- 13 of 15 O

no need explanation

answers only

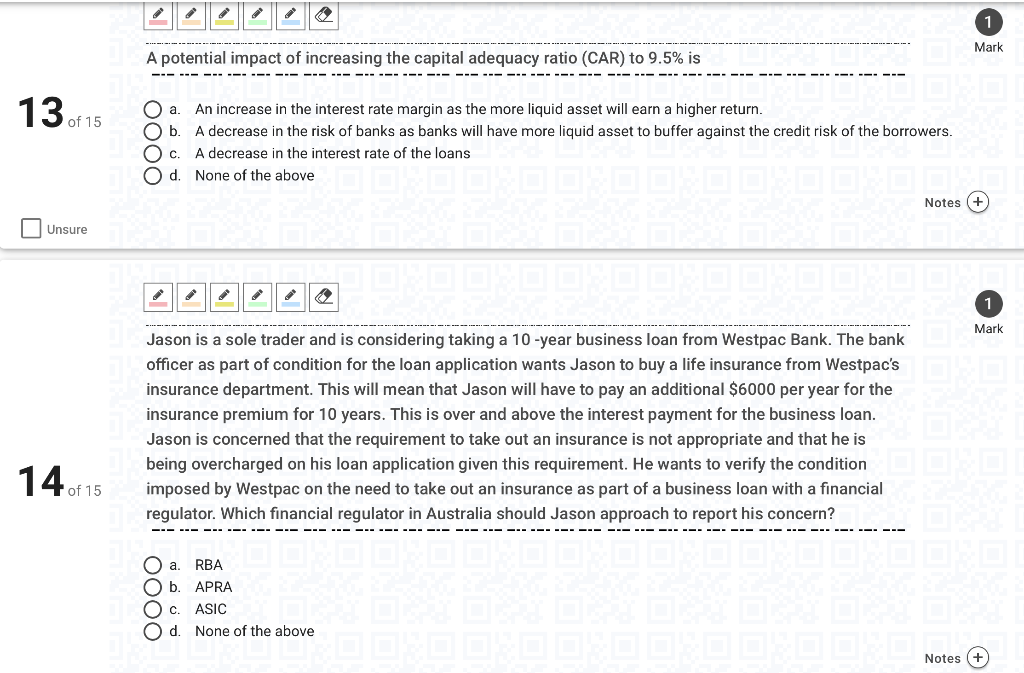

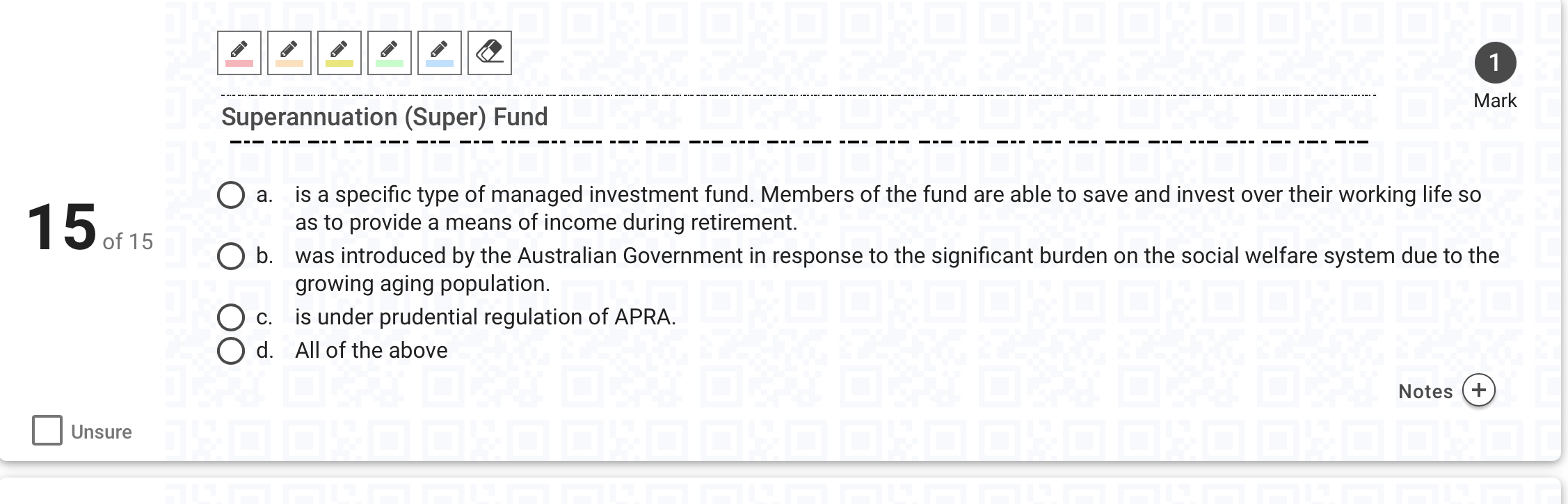

1 Mark A potential impact of increasing the capital adequacy ratio (CAR) to 9.5% is --------------------- 13 of 15 O a. b. An increase in the interest rate margin as the more liquid asset will earn a higher return. A decrease in the risk of banks as banks will have more liquid asset to buffer against the credit risk of the borrowers. A decrease in the interest rate of the loans None of the above O c. d. Notes + Unsure 1 Mark Jason is a sole trader and is considering taking a 10-year business loan from Westpac Bank. The bank officer as part of condition for the loan application wants Jason to buy a life insurance from Westpac's insurance department. This will mean that Jason will have to pay an additional $6000 per year for the insurance premium for 10 years. This is over and above the interest payment for the business loan. Jason is concerned that the requirement to take out an insurance is not appropriate and that he is being overcharged on his loan application given this requirement. He wants to verify the condition imposed by Westpac on the need to take out an insurance as part of a business loan with a financial regulator. Which financial regulator in Australia should Jason approach to report his concern? 14.15 --------- --------------------------------------------------- OOOO O a. RBA b. APRA c. ASIC Od None of the above Notes 1 Mark Superannuation (Super) Fund 15.15 O a. is a specific type of managed investment fund. Members of the fund are able to save and invest over their working life so as to provide a means of income during retirement. O b. was introduced by the Australian Government in response to the significant burden on the social welfare system due to the growing aging population. is under prudential regulation of APRA. d. All of the above C. Notes + Unsure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts