Question: no need to do held to maturity, please just do the second Dude, Inc, purchases 3-year bonds from Bunny, Inc on 1/1/2022. The bonds have

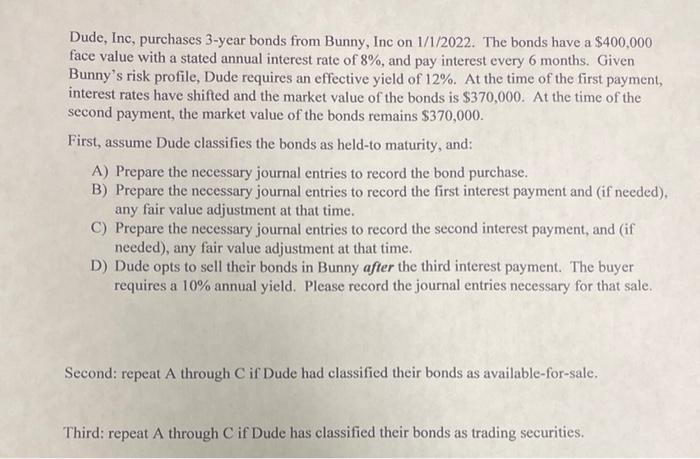

Dude, Inc, purchases 3-year bonds from Bunny, Inc on 1/1/2022. The bonds have a $400,000 face value with a stated annual interest rate of 8%, and pay interest every 6 months. Given Bunny's risk profile, Dude requires an effective yield of 12%. At the time of the first payment, interest rates have shifted and the market value of the bonds is $370,000. At the time of the second payment, the market value of the bonds remains $370,000. First, assume Dude classifies the bonds as held-to maturity, and: A) Prepare the necessary journal entries to record the bond purchase. B) Prepare the necessary journal entries to record the first interest payment and (if needed), any fair value adjustment at that time. C) Prepare the necessary journal entries to record the second interest payment, and (if needed), any fair value adjustment at that time. D) Dude opts to sell their bonds in Bunny after the third interest payment. The buyer requires a 10% annual yield. Please record the journal entries necessary for that sale. Second: repeat A through C if Dude had classified their bonds as available-for-sale, Third: repeat A through C if Dude has classified their bonds as trading securities. Dude, Inc, purchases 3-year bonds from Bunny, Inc on 1/1/2022. The bonds have a $400,000 face value with a stated annual interest rate of 8%, and pay interest every 6 months. Given Bunny's risk profile, Dude requires an effective yield of 12%. At the time of the first payment, interest rates have shifted and the market value of the bonds is $370,000. At the time of the second payment, the market value of the bonds remains $370,000. First, assume Dude classifies the bonds as held-to maturity, and: A) Prepare the necessary journal entries to record the bond purchase. B) Prepare the necessary journal entries to record the first interest payment and (if needed), any fair value adjustment at that time. C) Prepare the necessary journal entries to record the second interest payment, and (if needed), any fair value adjustment at that time. D) Dude opts to sell their bonds in Bunny after the third interest payment. The buyer requires a 10% annual yield. Please record the journal entries necessary for that sale. Second: repeat A through C if Dude had classified their bonds as available-for-sale, Third: repeat A through C if Dude has classified their bonds as trading securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts