Question: No plagiarism please!! Final Exercise - Please answer the following questions: 1. Hempstead Electric buys its wiring materials in bulk directly from Hamilton Wire and

No plagiarism please!!

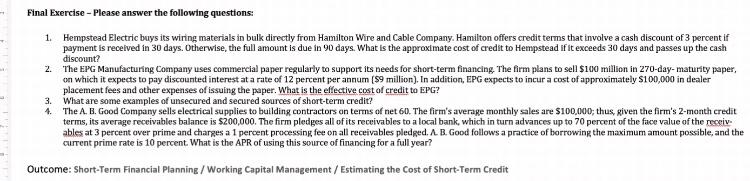

Final Exercise - Please answer the following questions: 1. Hempstead Electric buys its wiring materials in bulk directly from Hamilton Wire and Cable Company. Hamilton offers credit terms that involve a cash discount of 3 percent if payment is received in 30 days. Otherwise, the full amount is due in 90 days. What is the approximate cost of credit to Hempstead if it exceeds 30 days and passes up the cash discount? 2. The EPG Manufacturing Company uses commercial paper regularly to support its needs for short-term financing. The firm plans to sell $100 million in 270-day-maturity paper, on which it expects to pay discounted interest at a rate of 12 percent per annum ($9 million). In addition, EPG expects to incur a cost of approximately $100,000 in dealer placement fees and other expenses of issuing the paper. What is the effective cost of credit to EPG? 3. What are some examples of unsecured and secured sources of short-term credit? 4. The A. B. Good Company sells electrical supplies to building contractors en terms of net 60. The firm's average monthly sales are $100,000; thus, Riven the firm's 2-month credit terms, its average receivables balance is $200,000. The firm pledges all of its receivables to a local bank, which in turn advances up to 70 percent of the face value of the receive ables at 3 percent over prime and charges a 1 percent processing fee on all receivables pledged. A. B. Good follows a practice of borrowing the maximum amount possible, and the current prime rate is 10 percent. What is the APR of using this source of financing for a full year? Outcome: Short-Term Financial Planning / Working Capital Management / Estimating the Cost of Short-Term Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts