Question: No SIM 4:47 PM 2. Problem on Operating Exposure Consider a Danish subsidiary (Bansk AS) of a US firm, Graphic Systems. Assume that Bansk AS

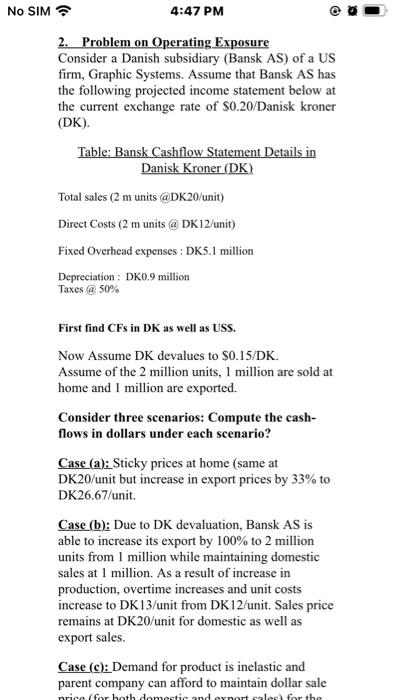

No SIM 4:47 PM 2. Problem on Operating Exposure Consider a Danish subsidiary (Bansk AS) of a US firm, Graphic Systems. Assume that Bansk AS has the following projected income statement below at the current exchange rate of $0.20/Danisk kroner (DK). Table: Bansk Cashflow Statement Details in Danisk Kroner (DK) Total sales (2 munits @DK20/unit) Direct Costs (2 m units @ DK 12/unit) Fixed Overhead expenses : DK5.1 million Depreciation : DK0.9 million Taxes @ 50% First find CFs in DK as well as USS. Now Assume DK devalues to $0.15/DK. Assume of the 2 million units, 1 million are sold at home and 1 million are exported. Consider three scenarios: Compute the cash- flows in dollars under each scenario? Case (a): Sticky prices at home (same at DK20/unit but increase in export prices by 33% to DK26.67/unit Case (b): Due to DK devaluation, Bansk AS is able to increase its export by 100% to 2 million units from 1 million while maintaining domestic sales at 1 million. As a result of increase in production, overtime increases and unit costs increase to DK 13/unit from DK 12/unit. Sales price remains at DK20/unit for domestic as well as export sales. Case (c): Demand for product is inelastic and parent company can afford to maintain dollar sale price for both domestic and eynort cales for the Case (c): Demand for product is inelastic and parent company can afford to maintain dollar sale price (for both domestic and export sales) for the product at US$4/unit pr DK26.67/unit while the unit sales remain at 2 million units, half at home and half domestic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts