Question: Please show calculations. Problem 2 on Operating Exposure Consider a Danish subsidiary (Bansk AS) of a US firm, Graphic Systems. Assume that Bansk AS has

Please show calculations.

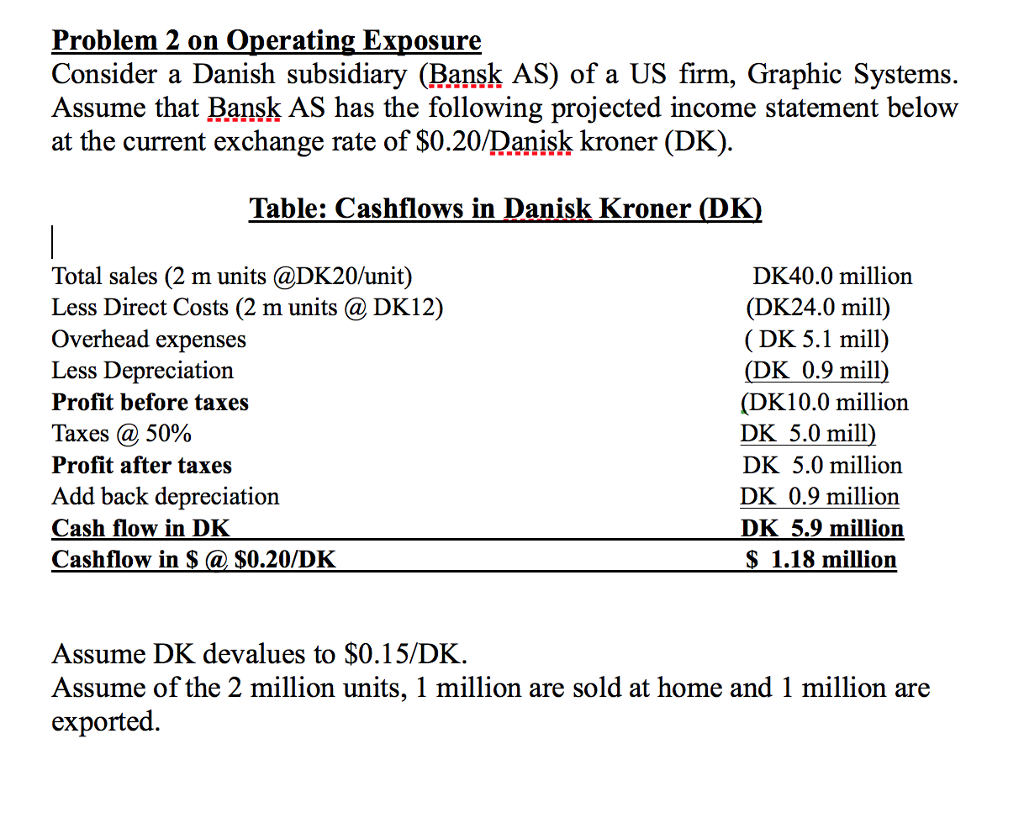

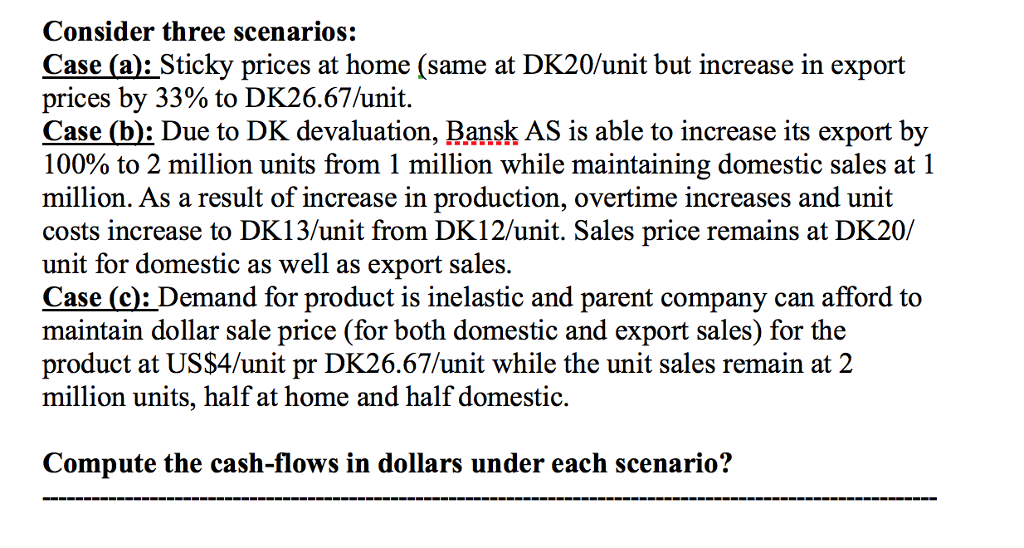

Problem 2 on Operating Exposure Consider a Danish subsidiary (Bansk AS) of a US firm, Graphic Systems. Assume that Bansk AS has the following projected income statement below at the current exchange rate of $0.20/Danisk kroner (DK) Table: Cashflows in Danisk Kroner Total sales (2 m units @DK20/unit) Less Direct Costs (2 m units @ D Overhead expenses Less Depreciation Profit before taxes Taxes @ 50% Profit after taxes Add back depreciation Cash flow in DK Cashflow in S $0.20/DK DK40.0 million (DK24.0 mill) (DK 5.1 mill) DK 0.9 mill) (DK10.0 million DK 5.0 mill DK 5.0 million DK 0.9 million DK 5.9 million $1.18 million K12) Assume DK devalues to $0.15/DK Assume of the 2 million units, 1 million are sold at home and 1 million are exported. Problem 2 on Operating Exposure Consider a Danish subsidiary (Bansk AS) of a US firm, Graphic Systems. Assume that Bansk AS has the following projected income statement below at the current exchange rate of $0.20/Danisk kroner (DK) Table: Cashflows in Danisk Kroner Total sales (2 m units @DK20/unit) Less Direct Costs (2 m units @ D Overhead expenses Less Depreciation Profit before taxes Taxes @ 50% Profit after taxes Add back depreciation Cash flow in DK Cashflow in S $0.20/DK DK40.0 million (DK24.0 mill) (DK 5.1 mill) DK 0.9 mill) (DK10.0 million DK 5.0 mill DK 5.0 million DK 0.9 million DK 5.9 million $1.18 million K12) Assume DK devalues to $0.15/DK Assume of the 2 million units, 1 million are sold at home and 1 million are exported

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts