Question: NO VALUES EXCEL FORMAT ONLY( EXAMPLE =DC+C6) ? X 32 Calculating NPV - Excel FORMULAS DATA REVIEW - Sign In FILE HOME INSERT PAGE LAYOUT

NO VALUES EXCEL FORMAT ONLY( EXAMPLE =DC+C6)

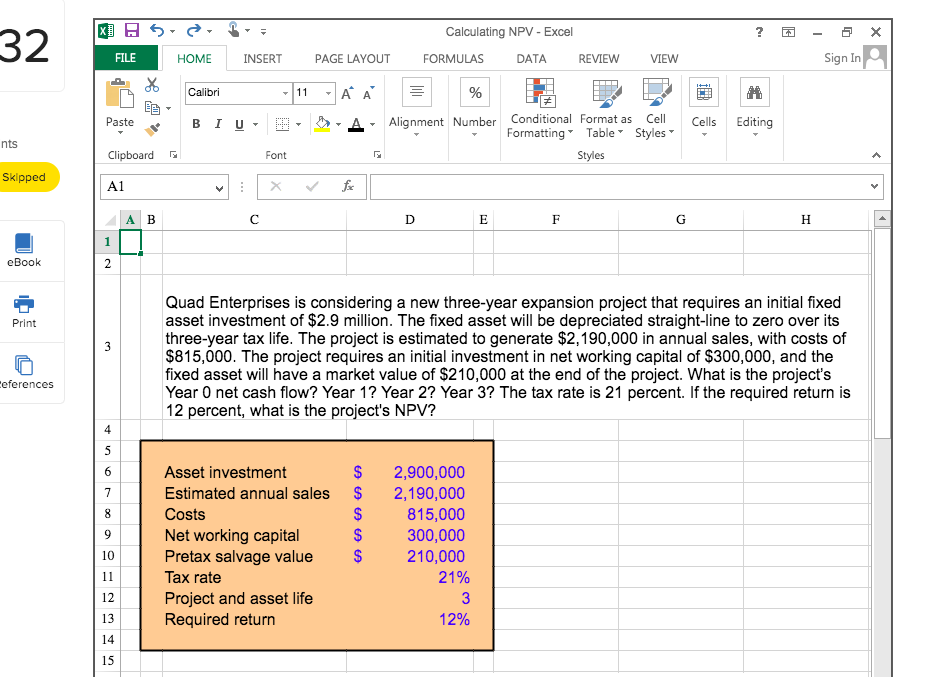

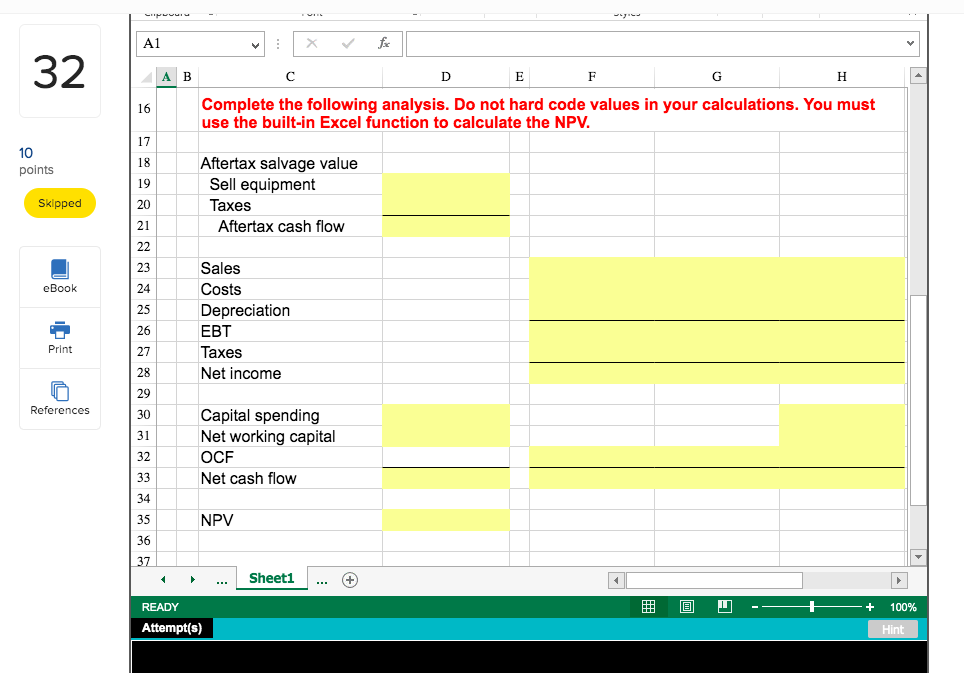

? X 32 Calculating NPV - Excel FORMULAS DATA REVIEW - Sign In FILE HOME INSERT PAGE LAYOUT VIEW * Calibri Calibri -11 - A = % D D B EB B IU 2 - A Alignment Number - Cells - Editing Conditional Format as Cell Formatting Table Styles Styles nts Skipped Clipboard A1 Font x V fic eBook Print Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. The project requires an initial investment in net working capital of $300,000, and the fixed asset will have a market value of $210,000 at the end of the project. What is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? The tax rate is 21 percent. If the required return is 12 percent, what is the project's NPV? Ceferences A A Asset investment Estimated annual sales Costs Net working capital Pretax salvage value Tax rate Project and asset life Required return 2,900,000 2,190,000 815,000 300,000 210,000 21% 3 12% A 41 DEF H Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel function to calculate the NPV. points Aftertax salvage value Sell equipment Taxes Aftertax cash flow Skipped eBook 24 A22R38 2 2 X AARBERRIESE Sales Costs Depreciation EBT Taxes Net income Print References Capital spending Net working capital OCF Net cash flow NPV ... Sheet1 ... + OD -- READY Attempt(s) Hint ? X 32 Calculating NPV - Excel FORMULAS DATA REVIEW - Sign In FILE HOME INSERT PAGE LAYOUT VIEW * Calibri Calibri -11 - A = % D D B EB B IU 2 - A Alignment Number - Cells - Editing Conditional Format as Cell Formatting Table Styles Styles nts Skipped Clipboard A1 Font x V fic eBook Print Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.9 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life. The project is estimated to generate $2,190,000 in annual sales, with costs of $815,000. The project requires an initial investment in net working capital of $300,000, and the fixed asset will have a market value of $210,000 at the end of the project. What is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? The tax rate is 21 percent. If the required return is 12 percent, what is the project's NPV? Ceferences A A Asset investment Estimated annual sales Costs Net working capital Pretax salvage value Tax rate Project and asset life Required return 2,900,000 2,190,000 815,000 300,000 210,000 21% 3 12% A 41 DEF H Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel function to calculate the NPV. points Aftertax salvage value Sell equipment Taxes Aftertax cash flow Skipped eBook 24 A22R38 2 2 X AARBERRIESE Sales Costs Depreciation EBT Taxes Net income Print References Capital spending Net working capital OCF Net cash flow NPV ... Sheet1 ... + OD -- READY Attempt(s) Hint

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts