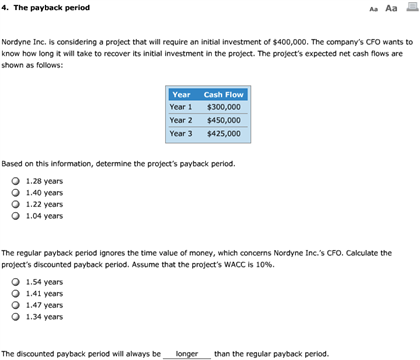

Question: Nordyne Inc, is considering a project that will require an initial investment of $400,000. The company's CFO wants to know how long it will take

Nordyne Inc, is considering a project that will require an initial investment of $400,000. The company's CFO wants to know how long it will take to recover its initial investment in the project. The project's expected net cash flows are shown as follows: Based on this information, determine the project's payback period. The regular payback period ignore the time value of money, which concern Nordyne Inc.'s CFO. Calculate the project's discounted payback period. Assume that the project WACC is 10% .The discounted payback period will always be longer than the regular payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts