Question: Roxxon Inc. is considering a project that will require an initial investment of $450,000. The company's CFO wants to know how long it will take

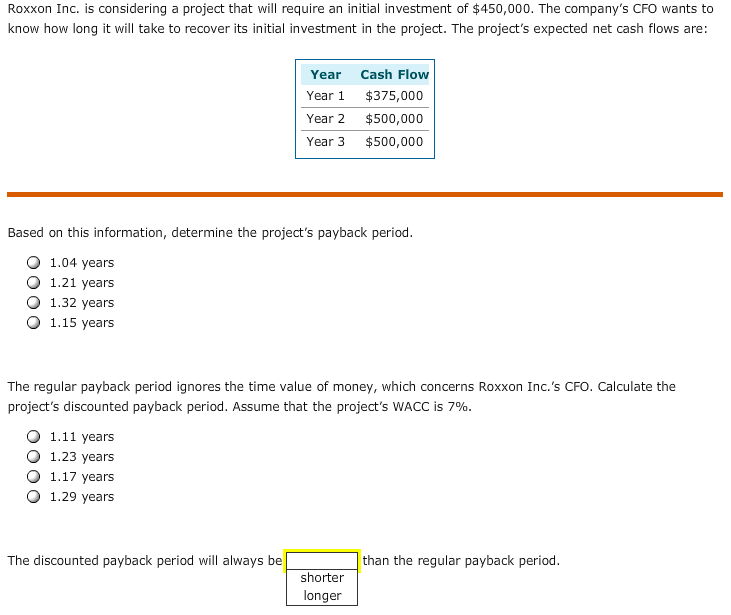

Roxxon Inc. is considering a project that will require an initial investment of $450,000. The company's CFO wants to know how long it will take to recover its initial investment in the project. The project's expected net cash flows are: Year Cash Flow Year 1 $375,000 Year 2 $500,000 Year 3 $500,000 Based on this information, determine the project's payback period 1.04 years O 1.21 years O 1.32 years 1.15 years The regular payback period ignores the time value of money, which concerns Roxxon Inc.'s CFO. Calculate the project's discounted payback period. Assume that the project's WACC is 7% O 1.11 years O 1.23 years O 1.17 years O 1.29 years The discounted payback period will always be than the regular payback period shorter longer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts