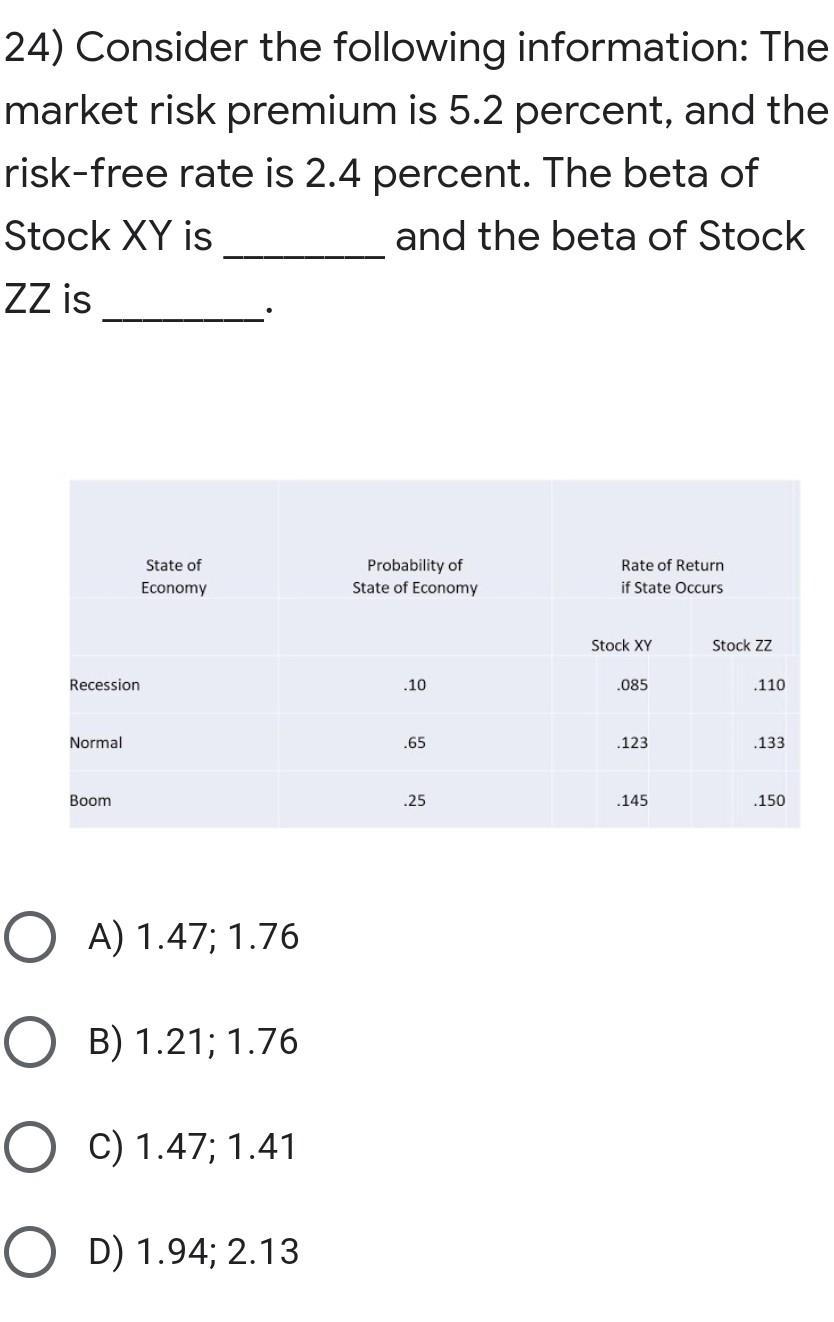

Question: 24) Consider the following information: The market risk premium is 5.2 percent, and the risk-free rate is 2.4 percent. The beta of Stock XY

24) Consider the following information: The market risk premium is 5.2 percent, and the risk-free rate is 2.4 percent. The beta of Stock XY is and the beta of Stock ZZ is Recession Normal Boom State of Economy O A) 1.47; 1.76 OB) 1.21; 1.76 O C) 1.47; 1.41 OD) 1.94; 2.13 Probability of State of Economy .10 .65 .25 Rate of Return if State Occurs Stock XY .085 .123 .145 Stock ZZ .110 .133 .150

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

The market risk premium is 52 percent and the riskfree rate is 24 percent This means that the ... View full answer

Get step-by-step solutions from verified subject matter experts